|

|

|

|

|||||

|

|

Bank of America BAC, the second-largest bank in the United States, has laid out an ambitious medium-term plan centered on sustainable growth, digital scale, cost discipline and capital efficiency.

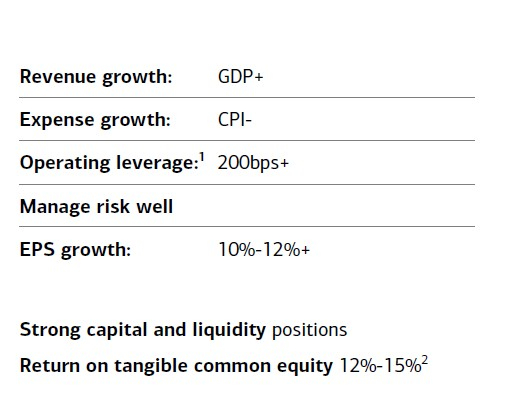

During the Investor Day conference on Nov. 5, BAC unveiled a plan that focuses on organic expansion, technological leadership and capital optimization. Over the next three to five years, the bank aims to deliver 5-7% annual growth in net interest income (NII), more than 12% of earnings growth and a return on tangible common equity (ROTCE) between 16% and 18%, while maintaining a Common Equity Tier 1 ratio of 10.5% (50 basis points [bps] above regulatory minimum).

Notably, the company’s medium-term ROTCE target compares with 17% over the cycle for JPMorgan JPM and 10%-11% for Citigroup C.

Based on the medium-term targets, does Bank of America stock deserve a spot in your portfolio? Let’s find out.

Bank of America’s plan centers on responsible growth, balancing risk discipline with investment in technology, capital and talent to scale efficiently across businesses. The bank continues to invest more than $4 billion annually in new technology, expanding artificial intelligence (AI), automation, cybersecurity and digital engagement to deepen client relationships and enhance productivity.

By deploying data-driven insights and AI across lending, risk and advisory functions, BAC aims to boost efficiency and client primacy. Growth will be led by high-return operations such as middle market, global banking and wealth management, complemented by international expansion and holistic capital solutions to drive long-term returns.

As such, Bank of America targets to achieve an efficiency ratio of 55-59%, reflecting ongoing expense control and operating leverage improvements. Further, loans and deposits are expected to witness a CAGR of 5% and 4%, respectively.

These targets are ambitious but grounded in existing momentum. BAC has a strong track record of disciplined cost control, diversified earnings streams and steady digital adoption (nearly 80% of households are digitally active). Its multi-year technology investments and integrated platform already provide operating leverage and cross-segment synergies that support these goals.

However, achieving these targets will depend on macroeconomic stability, credit quality and interest rate trends. Slower loan demand or persistent margin pressure could temper revenue growth, while rising regulatory and technology costs may challenge efficiency gains. Still, given its scale, robust capital base and proven ability to deliver organic growth, Bank of America’s medium-term roadmap looks achievable.

Historical Shareholder Model: 2015-2024

Rate Cuts & NII: The Federal Reserve cut rates twice this year to 3.75%-4.00%, following a 100-bp cut in 2024. Being one of the most interest rate-sensitive U.S. banks, BAC’s NII is expected to face pressure as interest rates come down. However, fixed-rate asset repricing, higher loan and deposit balances and a gradual fall in funding costs are expected to offset the adverse impact of lower rates.

As rates come down, it will boost lending activity. Also, easing regulatory capital requirements will help channel excess capital into loan growth, particularly within resilient commercial and consumer segments. Hence, Bank of America will likely witness a decent demand for loans, which will support NII expansion.

Bank of America projects a 5-7% year-over-year increase in net interest income (NII) for 2026, after similar growth this year. Likewise, JPMorgan and Citigroup are likely to demonstrate resilience and steady growth in NII.

For 2025, Citigroup expects NII (excluding Markets) to grow 5.5%. JPMorgan anticipates 2025 NII to be $95.8 billion, up more than 3% year over year. Nonetheless, as interest rates decline, both are likely to face some headwinds into next year.

Network Expansion & Digital Reach: Bank of America is highly focused on its financial centers as a core part of its growth strategy, combining digital and physical convenience for clients. The company operates 3,650 financial centers in the country and is actively expanding its footprint, especially in growth markets. Since 2019, it has opened 300 new financial centers and renovated more than 100.

BAC has entered 18 new markets since 2014 and plans to open financial centers in six additional markets through 2028. This expansion has already added 170 new financial centers and $18 billion in incremental deposits in those markets. The bank sees the physical network as critical to driving core deposit and account growth, even in a heavily digital era, thanks to client preference for local, trusted in-person advice and expanded relationship opportunities.

The bank's strategic investment in new financial centers and expansion into new markets reflects a broader industry shift toward optimizing branch networks to deepen customer relationships and tap into new business opportunities. In this competitive environment, the ability to blend digital convenience with in-person expertise is expected to give Bank of America long-term leverage in the evolving banking landscape.

The company plans to continue strengthening its technology initiatives and spend heavily on these. These efforts help it attract and retain customers and boost cross-selling opportunities.

Fortress Balance Sheet & Solid Liquidity: Bank of America’s liquidity profile remains solid. As of Sept. 30, 2025, average global liquidity sources totaled $961 billion. The company’s investment-grade long-term credit ratings of A1, A- and AA- from Moody’s, S&P Global Ratings and Fitch Ratings, respectively, and a stable outlook facilitate easy access to the debt market.

BAC continues to reward shareholders handsomely. The company cleared this year’s stress test conducted by the Fed and raised the dividend by 8% to 28 cents per share. In the past five years, it has raised dividends five times, with an annualized growth rate of 8.83%.

Similarly, JPMorgan and Citigroup cleared their stress tests and announced higher quarterly dividends. JPMorgan declared a quarterly dividend of $1.50 per share, representing a rise of 7% from the prior payout. Citigroup announced an increase in its quarterly dividend by 7% to 60 cents per share.

Additionally, Bank of America has announced a new share repurchase plan under which it is authorized to buy back $40 billion worth of shares.

Investment Banking (IB) Business Set to Perform Well: As global deal-making came to a grinding halt at the beginning of 2022, it weighed heavily on Bank of America’s IB business. Though the company’s total IB fees plunged in 2022 and 2023, the trend reversed in 2024. This year has had its share of hiccups. It began on an optimistic note, although the market sentiment cooled after the launch of Trump’s tariff policies on 'Liberation Day.'

However, after the initial setback, deal-making activities have regained momentum. Many deals that were put on hold are resuming as there is more clarity about the direction of the economy and tariff plans, with capital remaining available. Thus, BAC’s IB business performance was decent in the first nine months of 2025.

Bank of America targets mid-single-digit CAGR in IB fees and a 50 to 100-bp market share gain over the medium term, building on its 136-bp gain as of the third quarter of 2025. Management plans to deepen integration between corporate and IB, expand middle-market coverage and pursue more large deals. Growth will be driven by AI-enabled insights, senior talent and holistic capital solutions, including private credit and alternative investments, while leveraging its global client reach across 87 jurisdictions.

Asset Quality: Bank of America’s asset quality has been weakening. While the company recorded negative provisions in 2021, a substantial jump in provisions occurred in the following years due to a worsening macroeconomic outlook. The metric surged 115.4% in 2022, 72.8% in 2023 and 32.5% in 2024. Similarly, net charge-offs grew 74.9% in 2023 and 58.8% in 2024. The uptrend for both continued in the first nine months of 2025.

As interest rates are less likely to decline substantially in the near term, it is expected to hurt the borrowers’ credit profile. The company remains vigilant about the effects of continuous high rates on its loan portfolio. The impact of tariffs on inflation is now clearly visible, with numbers trending higher. Hence, the company’s asset quality is expected to remain subdued.

Bank of America’s shares have gained 21.2% this year, underperforming the broader market and trailing key peers, Citigroup and JPMorgan.

YTD Price Performance

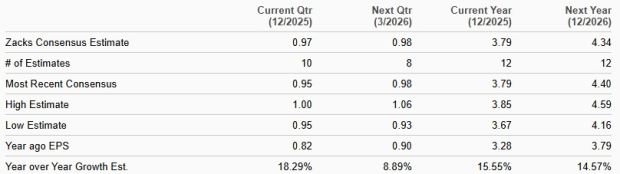

Over the past week, the Zacks Consensus Estimate for 2025 and 2026 earnings per share has been revised upward to $3.79 and $4.34, respectively. The consensus estimate for earnings indicates 15.6% and 14.6% growth for 2025 and 2026, respectively.

Bank of America Earnings Estimates

Bank of America stock is currently trading at a 12-month trailing price-to-tangible book (P/TB) of 1.94X, which is below the industry’s 3.19X. This shows the stock is trading at a discount.

Price-to-Tangible Book Ratio (TTM)

BAC stock is inexpensive compared with JPMorgan, which has a P/TB of 3.15X. On the other hand, it is trading at a premium compared with Citigroup’s P/TB of 1.10X.

Bank of America’s medium-term roadmap demonstrates a solid long-term strategy anchored in technology, disciplined growth and strong capital management. However, despite its compelling fundamentals and attractive valuation, the stock may not be a buy right now. With interest rates declining, NII growth could moderate, while rising regulatory and technology costs may constrain near-term efficiency gains. Asset quality pressures and subdued loan growth also pose headwinds.

Still, the bank’s diversified model, fortress balance sheet and expanding digital ecosystem provide a solid foundation for sustainable value creation. For investors with a long-term horizon, holding BAC shares makes sense as the near-term risk-reward remains balanced, and patience could be rewarded as its multi-year strategy delivers steady compounding returns.

At present, Bank of America carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite