|

|

|

|

|||||

|

|

Despite the rise of crypto, a raging bull equity market, and years of stagnation, precious metals have regained their shine over the past two years. In particular, gold and the SPDR Gold Shares ETF (GLD) illustrate how years of frustrating basing action can eventually lead to a massive breakout. Gold prices peaked in late 2011 and would fail to make new highs again until August 2020. In the 2020 instance, GLD printed a brief all-time high before retracing. Finally, GLD broke out for real in March 2024 and never looked back. Additionally, it provided gold bugs with one of the smoothest and stress-free investments over the past two years, nearly doubling since.

Gold once again proves the old Wall Street adage that “The longer the base, the higher in space.” Meanwhile, gold’s sister, silver, was even more frustrating to hold than gold (until recently). The iShares Silver ETF (SLV) topped in April 2011 and has yet to break out.

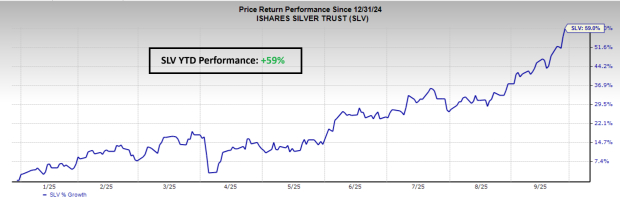

Unsurprisingly, gold and silver are correlated assets. Investors often treat precious metals as a safe-haven asset, using them to fight against inflation, rising interest rates, falling dollar prices, global instability, and global central banks that have run amok. While correlated, silver is the fastest-moving between the two precious metals. Though gold breached all-time highs and broke out first, silver has played catchup and is now outperforming gold year-to-date, with a rise of ~58% versus gold’s ~44% gains.

Silver and gold each have numerous commercial uses. For instance, gold is used in aerospace, electronics, and dentistry, to name a few examples. However, silver has far more industrial use than gold, with roughly half of silver’s supply used in industrial applications (compared to ~12% for gold). In fact, silver is critical for two of Wall Street’s hottest industries – AI data centers and renewable energy applications such as solar panels.

Silver has experienced a tremendous run, gaining 37% over the past six months. However, with silver working on its seventh consecutive weekly gain, investors may be wondering whether it is time to go short. The short answer is “definitely not.”

Three invaluable investor quotes come to mind when I see a raging uptrend like we are witnessing in precious metals:

“It is one of the great paradoxes of the stock market that what seems too high usually goes higher and what seems too low usually goes lower.” ~ William O’Neil

“The market can remain irrational longer than you can remain solvent.” ~ John Maynard Keynes

“The trend is your friend until the end, when it bends.” ~ Ed Seykota

In addition to not fighting the powerful uptrend, investors need to understand today’s trend in the context of silver’s rich history of wild short squeezes, booms, and busts.

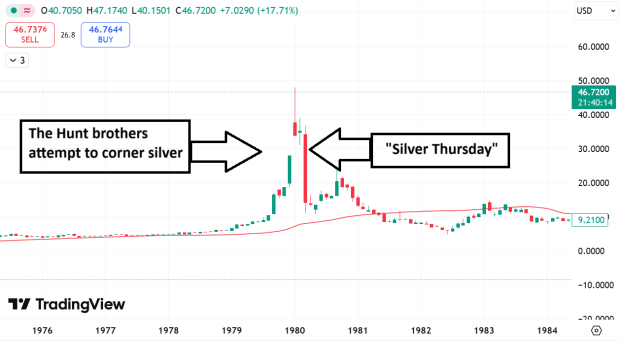

Before there were modern-day meme stocks like GameStop (GME), Tilray (TLRY), and AMC (AMC), there was silver. In the late 1970s, three brothers, known as the Hunt brothers, did the unthinkable and attempted to corner the silver market, believing that silver was a suitable hedge against the rampant inflation that plagued Americans during the 1970s. Being that the Hunt brothers were the sons of legendary oil tycoon H.L Hunt, they had the necessary funds to make a valiant attempt. Using leverage, the Hunt brothers began aggressively accumulating silver, causing silver prices to skyrocket from $6 an ounce to $50 per ounce!

However, regulators began to be express concern about unsustainable silver prices, market stability, and the excessive use of leverage. Unfortunately for the Hunt brothers, regulators restricted margin purchasing for commodities while the Federal Reserve simultaneously clamped down on reckless lending practices. The result was a brutal crash. On what was later dubbed “Silver Thursday,” silver prices plummeted from $20 an ounce to $11 in a single day. The Hunt brothers would lose $1.7 billion on silver, leading to their bankruptcy and making them the largest individual debtors in history.

The Hunt brothers’ silver saga is a sage reminder that investors should avoid fighting trends in both directions at all costs (especially in the silver market!).

Back to present-day markets. Silver is at a critical juncture chart-wise. Silver futures are a hair away from their 2011 all-time high of $49.83. $50 should prove to be a critical price level. Legendary investor Jesse Livermore discussed the importance of “round numbers” in markets, teaching that once a round number is breached, it can lead to intense momentum bursts. Meanwhile, if silver can recapture all-time highs, the floodgates may open as no more “overhead supply” volume exists. Though silver has rallied strongly already, the Fibonacci extensions suggest that silver could reach $55 if a breakout is successful.

Bottom Line

With the $50 level and its 2011 all-time high in sight, the historical context of silver’s dramatic booms and busts serves as a powerful reminder: the key to navigating this surging market isn’t fighting the trend – it’s respecting momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| 14 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite