|

|

|

|

|||||

|

|

AngioDynamics, Inc. ANGO reported a pro-forma adjusted loss per share of 10 cents for first-quarter fiscal 2026, marking an improvement from the year-ago quarter’s adjusted loss of 11 cents. The Zacks Consensus Estimate for the metric was pegged at a loss of 14 cents.

Pro-forma basis excludes the divested Dialysis and BioSentry businesses, the divested PICC and Midline product portfolios and the discontinued Radiofrequency and Syntrax products.

On a pro-forma basis, the fiscal first-quarter GAAP loss per share was 26 cents, reflecting an improvement from the year-ago quarter’s loss of 32 cents.

Pro-forma revenues in the fiscal first quarter totaled $75.7 million, up 12.2% year over year on a reported basis. The top line outpaced the Zacks Consensus Estimate by 4.8%.

The company continued to see strong contributions from its Med Tech (which includes the Auryon peripheral atherectomy platform, the thrombus management platform and the NanoKnife irreversible electroporation platform) and Med Device businesses during the quarter.

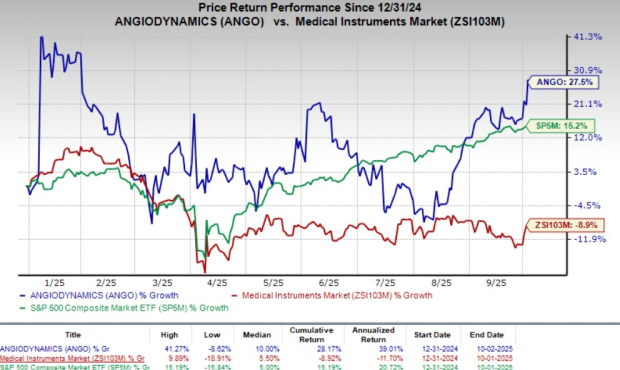

Shares of this company gained nearly 6% in yesterday’s trading. Share of ANGO have gained 27.5% so far this year against the industry's decline of 8.7%. The S&P 500 Index was up 15.2% in the same time period

In the quarter under review, U.S. net revenues totaled $66.5 million, up 11.7% year over year. Our estimate for the metric was $62.3 million.

Pro-forma International revenues totaled $9.3 million, up 15.6% from the year-ago quarter’s level on a reported basis. Our projection for the metric was $10.2 million.

AngioDynamics derives revenues from two businesses — Med Tech and Med Device.

The Med Tech business’ pro-forma net sales in the fiscal first quarter were $35.3 million, reflecting an uptick of 26.1% year over year. Our projection for the metric was $32.7 million.

The rise was primarily driven by increased net sales of Auryon, which amounted to $16.5 million (up 20.1% year over year), and Mechanical Thrombectomy revenues (including AngioVac and AlphaVac) of $11.3 million (up 41.2% year over year). AngioVac revenues totaled $8 million (up 37.1% year over year) and AlphaVac revenues amounted to $3.3 million (up 52.3% year over year). Total NanoKnife revenues were $6.4 million, up 26.7% year over year.

Pro-forma Med Device revenues totaled $40.5 million, up 2.3% from the year-ago period’s level. This figure compares to our projection of $39.9 million.

In the quarter under review, AngioDynamics’ pro forma gross profit rose 14% to $41.9 million. The pro forma gross margin expanded 90 basis points to 55.3%. We had projected a pro forma gross margin of 54.2% for the quarter.

Sales and marketing expenses on a pro forma basis increased 9.9% year over year to $28.1 million. Research and development expenses on a pro forma basis increased 2.1% to $6.4 million, while general and administrative expenses rose 14.4% to $12.6 million. On a pro forma basis, adjusted operating expenses of $47.102 million increased 9.9% year over year.

The adjusted operating loss on a pro forma basis totaled $5.2 million compared with the prior-year quarter’s loss of $6.1 million.

AngioDynamics exited the first quarter of fiscal 2026 with cash and cash equivalents of $38.8 million compared with $55.9 million at the end of fiscal 2025.

The company ended the quarter with no debt on its balance sheet.

Cumulative net cash used in operating activities was $15.9 million compared with $18.3 million a year ago.

AngioDynamics has updated its guidance for fiscal 2026.

The company expects net sales to be in the range of $308-$313 million, up from the previous guidance of $305-$310 million. The Zacks Consensus Estimate is currently pegged at $306.3 million.

AngioDynamics now expects its Med Tech revenue growth to be in the range of 14-16% (previously 12-15%), while Med Device revenue growth is projected to remain flat over the comparable fiscal 2025 period.

Management expects the tariffs to have a $4-$6 million impact on its overall top-line and segmental performance.

The adjusted loss per share is projected to be between 33 cents and 23 cents, including the tariff impacts (narrower than earlier guidance of a loss of 35 cents to 25 cents). The Zacks Consensus Estimate is currently pegged at a loss of 30 cents per share.

AngioDynamics, Inc. price-consensus-eps-surprise-chart | AngioDynamics, Inc. Quote

AngioDynamics (ANGO) delivered a solid start to fiscal 2026, with first-quarter revenues rising 12.2% year over year, led by continued strength in its Med Tech segment, which grew 26% and now represents nearly half of total sales. The company also reported a narrower-than-expected adjusted loss, supported by gross margin expansion despite the impact of tariff headwinds.

Key growth drivers going forward include the Auryon platform as adoption expands in hospitals and internationally following CE mark approval. Mechanical Thrombectomy, comprising AngioVac and AlphaVac, delivered continued growth fueled by new hospital approvals, strong physician uptake, and a dedicated sales force expansion to 50 reps.

NanoKnife continued to show momentum with probe sales tied largely to prostate procedures. The expanded prostate indication, rising physician interest, and a direct-to-patient AARP campaign are boosting adoption, while the upcoming CPT I reimbursement code, effective Jan. 1, 2026, is expected to further accelerate utilization.

With a favorable revenue mix, pricing actions, and operating efficiencies driving margin gains, AngioDynamics raised its FY26 revenue outlook, signaling confidence in sustained growth and profitability improvement.

ANGO currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Masimo MASI, Phibro Animal Health PAHC and CorMedix CRMD, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Masimo shares have jumped 5.3% in the past year. Estimates for the company’s 2025 earnings per share have increased 1.3% to $5.30 in the past 30 days. MASI’s earnings beat estimates in each of the trailing four quarters, the average surprise being 13.8%. In the last reported quarter, it posted an earnings surprise of 8.1%.

Estimates for Phibro Animal Health’s fiscal 2026 earnings per share have increased 6.5% to $2.45 in the past 30 days. Shares of the company have surged 83.3% in the past year compared with the industry’s 0.7% growth. PAHC’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 27.9%. In the last reported quarter, it delivered an earnings surprise of 9.6%.

Estimates for CorMedix’s 2025 earnings per share have increased 50% to $1.83 in the past 30 days. Shares of the company have rallied 24.2% in the past year against the industry’s 5.1% decline. Its earnings yield of 16.6% also outpaces the industry’s -20.5% yield. CRMD’s earnings topped estimates in each of the trailing four quarters, the average surprise being 34.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 31 min | |

| 2 hours | |

| 5 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow, Nasdaq Eke Out Gains; Gold, Silver Names Slide (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Nasdaq, Dow Climb; Airline Name Flies Higher (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow Weakens As Nasdaq Lags; Biotech Name Hits Record (Live Coverage)

MASI +34.22%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite