|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Taiwan Semiconductor Manufacturing may quietly be the industry’s most important player.

Although competitors are trying to take a bite out of TSMC’s massive market share, its lead is just too wide.

A high-profile industry insider (as well as a major customer) just gave a wildly bullish endorsement of this technology company’s stock.

Let's face it -- it's easy to say a particular investment is a lifetime holding when you know you can sell it if the company's circumstances change. A true "forever" trade is a relatively rare thing.

There are some publicly traded companies, however, that are not only built to last, but built to thrive indefinitely. Their stocks are not only lifetime investments, but potentially life-changing. Taiwan Semiconductor Manufacturing (NYSE: TSM) is one of these names. Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

On the off chance you've never heard of it, just as the name suggests, Taiwan Semiconductor Manufacturing, better known as TSMC, makes computer chips. There's a good chance you're a regular user of one of its products, in fact. See, it doesn't make its own branded designs. TSMC is instead a contracted manufacturer of other chip companies' silicon. Apple, Nvidia (NASDAQ: NVDA), and Qualcomm are just some of its customers. Indeed, this company manufactures about two-thirds of the world's total semiconductors, and reportedly makes nine out of every 10 of the planet's most advanced high-performance chips.

Almost needless to say, without TSMC, the world's microchip landscape would look considerably different.

Yes, this manufacturing concentration is something of a problem for the semiconductor industry, which doesn't want to be beholden to a single supplier/service provider -- a liability that came to a head during and because of the COVID-19 pandemic. When supply chains to and from Taiwan broke down, most technology companies were effectively dead in the water. Some of them have attempted to build their own chip foundries in the meantime. Intel (NASDAQ: INTC), for example, budgeted an initial investment of $28 billion to erect a brand-new production facility in Ohio, plus another $32 billion to build a chip plant in Arizona. Another 33 billion euros were earmarked for investment in a semiconductor R&D facility in Europe back in 2022.

There's a reason, however, that much of this intended spending has since been scaled back, delayed, or outright canceled. That is, building new computer chipmaking infrastructure is as expensive as it is complicated, making it tough to penetrate the business.

This dynamic, of course, bodes well for TSMC's continued dominance of the business.

None of this is to suggest TSMC is impervious to the chip industry's usual slings and arrows. Case in point: The company's top line fell more than 4% in 2023 -- when the entire semiconductor business ran into a post-pandemic headwind -- dragging profits 18% lower year over year.

Competition is still creeping in, too. For example, although Intel is dramatically scaling back its plans to become a major semiconductor foundry, credible rumors that TSMC customer Advanced Micro Devices is mulling a production relationship with Intel have been circulating, while Microsoft is a confirmed Intel foundry customer. That's not a major revenue win, but it is a high-profile one.

Image source: Getty Images.

Nevertheless, demand for new and better chips is not only still growing, but accelerating. Intel and other would-be manufacturers can't build foundries fast enough, forcing the industry to continue relying on TSMC, which has the production capacity the business needs right now. The company managed to make approximately 17 million 12-inch (or equivalent) wafers last year, for perspective, or $90 billion worth of silicon. That's up 34% year over year in an industry that the Semiconductor Industry Association says only grew by 19% in 2024.

Give credit to the rise of artificial intelligence, of course, which is creating massive demand for computing processors and related microchips.

The thing is, this is just a taste of what to expect for the near and distant future now that AI is making it easy and advantageous to digitize, well, everything. Deloitte believes the global semiconductor market is poised to grow from just a little less than $700 billion this year to $1 trillion by 2030, en route to $2 trillion by 2040.

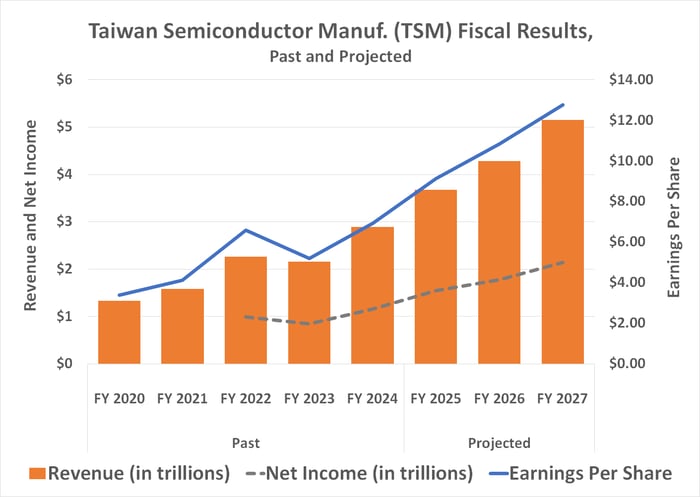

Data source: CNBC, MarketWatch, StockAnalysis, Simply Wall St. Chart by author. Revenue and net income are in New Taiwanese Dollars. Per-share earnings are in U.S. dollars, reflecting their relative, currency-adjusted levels to the ADR of TSMC.

TSMC will, of course, feature prominently in that growth. It has to.

So, yes -- buying TSMC stock today could set you up for life, even if it's not going to do so overnight. It's likely to be life-changing in the same way that Apple and Amazon were, dishing out market-beating gains for a long, long time.

With all of that being said, perhaps the best argument for owning a long-term stake in Taiwan Semiconductor Manufacturing isn't a quantitative one, but a qualitative, anecdotal one. In August, Nvidia CEO Jensen Huang commented, "I think TSMC is one of the greatest companies in the history of humanity, and anybody who wants to buy TSMC stock is a very smart person." Then he doubled down on that bullishness last month, exclaiming, "You can't overstate the magic that is TSMC."

That's strong praise, and from an industry insider who would know.

Just don't tarry if you're interested. Although TSMC shares recently reached yet another record high, they're still reasonably priced at less than 30 times this year's expected per-share earnings of $9.85. You're not going to find a much lower valuation from a growth company like this one, which is poised to grow at a solid double-digit pace for many, many more years.

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $621,976!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,150,085!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 29, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Intel, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.

| 38 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

CoreWeave Stock Falls Amid Blue Owl Doubts, Data Center Debt Financing Report

NVDA

Investor's Business Daily

|

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite