|

|

|

|

|||||

|

|

AI adoption is driving strong demand for computer chips and cloud computing services.

As the largest chipmaker worldwide, Taiwan Semiconductor Manufacturing is well positioned to deliver superior returns for investors.

Oracle's growth is accelerating, driven by demand for its cloud infrastructure business.

AI is accelerating demand for chips and cloud computing services. The AI chip market is expected to grow 29% per year through 2030, according to Grand View Research, while the cloud computing market is expected to increase at an annualized rate of 20%.

For investors looking for quality growth stocks to cash in on this opportunity, here are two no-brainer choices.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

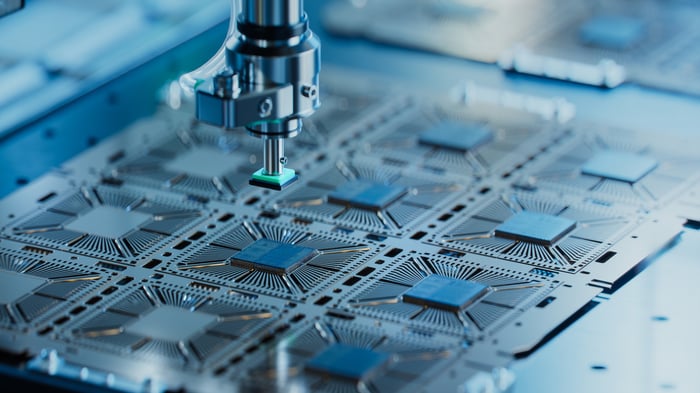

Image source: Getty Images.

Demand for AI chips is driving robust growth for the leading chipmaker, Taiwan Semiconductor Manufacturing (NYSE: TSM). TSMC, as it's also known, makes chips for other designers, including Nvidia, Apple, and Advanced Micro Devices. It controls more than 65% of the global foundry market, according to tech market researcher Counterpoint.

TSMC has invested for decades building expertise in cutting-edge chipmaking processes, which allows its clients to focus on what they do best, which is designing the most powerful chips in the world. The relationship TSMC built with its clients over the years is a competitive advantage. Its moat is so wide that even Intel has not been able to make headway against TSMC despite recent investments to build its own foundry business.

Demand for AI semiconductors and other high-performance chips pushed TSMC's revenue up 44% year over year in the second quarter. Its competitive lead allows it to earn a high net margin of over 42%.

As more investment goes into building more advanced AI, the company should continue to report stellar financial results. Developing smarter AI requires growing amounts of computational power, which is a catalyst for TSMC. The company is investing to expand manufacturing capacity in the U.S. and elsewhere to mitigate the risks of higher costs from tariffs and to be able to meet growing demand.

Despite its commanding lead in the foundry market, the stock looks undervalued, trading at a forward price-to-earnings ratio (P/E) of 28. Analysts expect earnings to rise at an annualized rate of 21% in the coming years. Assuming the stock continues to trade at the same valuation, that is enough growth to double the share price within the next four years.

AI is a major catalyst for growth in the cloud computing market, since businesses can use AI in the cloud to get better insights from their data. Oracle (NYSE: ORCL) might be the best cloud stock to buy based on its leadership in enterprise database services and its extensive data center infrastructure that is optimized for AI.

Oracle's total revenue grew 12% year over year last quarter, but that doesn't tell investors about the real momentum happening in the business. The stock is soaring on the accelerating growth in its cloud infrastructure business, where the company is signing deals with major tech companies. In the second quarter, its remaining performance obligations (contracted revenue not yet realized) surged 359% year over year.

This impressive growth shows Oracle is becoming the preferred choice for AI workloads in the cloud. It can bundle its industry-leading database services with top AI models.

It also benefits from offering cloud customers integrated services across other cloud platforms like Amazon, Alphabet's Google, and Microsoft. This is clearly attractive to its customers -- Oracle's multi-cloud revenue jumped 1,529% last quarter.

Management expects the momentum to continue, as more workloads shift from AI training to inferencing, where models learn to make forecasts from new data. Its cloud infrastructure revenue is expected to grow 77% for the full year.

The stock is soaring because the robust demand in cloud infrastructure will grow its total revenue by 16% in fiscal 2026 on a constant-currency basis, indicating accelerating growth. This justifies the stock's high P/E multiple. AI is creating a more sticky relationship with Oracle's cloud database customers, setting up excellent return prospects for investors.

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $621,976!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,150,085!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 29, 2025

John Ballard has positions in Advanced Micro Devices and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Intel, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.

| 32 min | |

| 2 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite