|

|

|

|

|||||

|

|

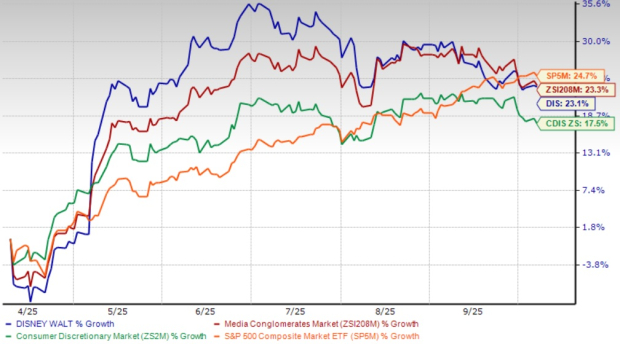

Disney DIS has experienced a remarkable 23.1% surge over the past six months, outperforming the Zacks Consumer Discretionary sector and rewarding shareholders who maintained conviction through the company's strategic transformation. However, despite this impressive momentum, prudent investors should consider holding their positions rather than adding exposure at current levels while awaiting clearer catalysts and more favorable entry points in 2025.

Disney's theatrical and streaming content pipeline demonstrates the company's commitment to franchises that have historically driven both box office success and subscriber engagement. The fall 2025 slate includes significant releases across multiple studio banners, positioning the company to capitalize on diverse audience segments. The IMAX and 3D re-release of Avatar: The Way of Water serves as an appetizer for Avatar: Fire and Ash, scheduled for Dec. 19, which is expected to drive substantial box office revenues during the critical holiday season.

The company's live-action division continues building momentum with TRON: Ares arriving Oct. 10. Additionally, 20th Century Studios releases, including Springsteen: Deliver Me From Nowhere and the franchise continuation Predator: Badlands, demonstrate Disney's ability to leverage acquired intellectual property while maintaining creative differentiation across its studio portfolio. Walt Disney Animation Studios returns with Zootopia 2 on Nov. 26, capitalizing on a beloved franchise during the Thanksgiving corridor.

Disney's recent acquisition of rights to Katherine Rundell's Impossible Creatures book series represents a strategic investment in franchise development for the coming years. The expansive deal includes theatrical film rights and a first-look relationship with Rundell's production company, positioning Disney to develop another potential multi-film franchise beginning in 2026 and beyond.

Management provided comprehensive fiscal 2025 guidance projecting adjusted earnings per share of $5.85, representing an 18% increase over fiscal 2024. This guidance demonstrates confidence in the company's operational execution across multiple business segments. The Direct-to-Consumer division expects operating income of $1.3 billion with double-digit percentage segment operating income growth, validating the company's streaming transformation strategy.

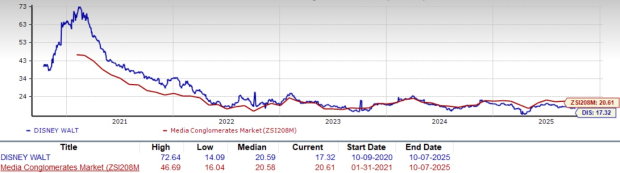

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $94.87 billion, indicating 3.84% year-over-year growth, with earnings expected to increase 17.91% to $5.86 per share. These projections suggest steady growth ahead.

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

However, investors should note specific headwinds embedded within this guidance. Disney projects approximately $185 million in cruise line pre-opening expenses for fiscal 2025, with roughly $50 million expected in the fourth quarter. Additionally, the company anticipates an equity loss of approximately $200 million from its India joint venture, primarily driven by purchase accounting amortization related to the joint venture formation completed in November 2024. These operational investments, while strategically sound, pressure near-term margins and earnings quality.

The Experiences segment projects 8% segment operating income growth, representing a deceleration compared to historical performance. This moderation reflects normalized post-pandemic demand patterns and increased operational expenses from capacity expansions. While theme park operations remain Disney's most profitable division, the growth trajectory appears more measured than previous periods, suggesting limited near-term upside surprises.

For the fourth quarter of fiscal 2025, Disney expects total Disney+ and Hulu subscriptions to increase more than 10 million compared to the third quarter, with the majority coming from Hulu due to an expanded Charter deal. However, Disney+ subscribers specifically are expected to see only modest increases, indicating potential saturation in core markets and intensifying competition for streaming subscribers.

The media and entertainment landscape remains intensely competitive, with formidable rivals challenging Disney across multiple fronts. Warner Bros. Discovery WBD maintains significant theatrical and streaming operations through its studio legacy and Max platform. Warner Bros. Discovery recently restructured its business to emphasize profitable growth, potentially creating more disciplined competition. The company's vast content library spanning DC Comics properties, HBO programming, and Discovery's unscripted content provides Warner Bros. Discovery with diversified revenue streams. Warner Bros. Discovery's leaner cost structure following recent reorganizations may enable more aggressive content spending or pricing strategies that pressure Disney's margins.

Netflix NFLX continues dominating the streaming landscape with more than 280 million global subscribers, substantially exceeding Disney's combined Disney+ and Hulu subscriber base. Netflix's operating leverage from its massive scale enables substantial content investments while maintaining profitability, creating a formidable competitive moat. The company's international expansion and advertising tier introduction have opened new growth vectors, with Netflix demonstrating a consistent ability to raise prices without significant subscriber churn. Netflix's first-mover advantage and algorithm-driven content discovery create switching costs that make subscriber acquisition increasingly expensive for Disney.

Amazon AMZN leverages its Prime Video service as part of a broader ecosystem strategy, using content to drive Prime membership retention rather than standalone profitability. Amazon's vast financial resources enable aggressive content spending without immediate return requirements, exemplified by big-budget productions and sports rights acquisitions. The company's integration of shopping features within Prime Video and its advertising capabilities creates unique monetization opportunities unavailable to Disney. Amazon's willingness to sustain losses in pursuit of market share makes it an unpredictable and potentially disruptive competitor.

While Disney trades below its historical average valuation multiples, the stock's premium relative to certain competitors and the broader market warrants caution. The recent 23.1% surge has compressed the valuation discount, reducing the margin of safety for new investors. Disney's forward P/E of 17.32x, though below historical norms and and the Zacks Media Conglomerates industry average, still reflects optimistic expectations for earnings growth and successful execution across streaming profitability, theatrical performance, and experiences revenues. Any disappointments in subscriber growth, theatrical releases, or theme park attendance could trigger multiple compressions, creating better entry opportunities.

Current shareholders should maintain positions given Disney's strategic assets and improving financial trajectory, but awaiting a more attractive entry point appears prudent for those considering new investments. The combination of intensifying competition from Warner Bros. Discovery, Netflix, and Amazon, alongside execution risks in streaming and experiences, suggests patience may be rewarded with better valuations ahead. Disney currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 11 min |

OpenAI Raises $110 Billion From Amazon, Nvidia, SoftBank. OpenAI And AWS Expand Partnership.

AMZN

Investor's Business Daily

|

| 12 min | |

| 20 min | |

| 23 min |

How The AI Bubble Could Burst. Lessons From The Dot-Com Stock Market Crash.

AMZN

Investor's Business Daily

|

| 23 min | |

| 25 min | |

| 31 min | |

| 35 min | |

| 42 min | |

| 51 min | |

| 55 min | |

| 56 min | |

| 57 min | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite