|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

PepsiCo Inc. PEP shares rose 3.7% following a stronger-than-expected third-quarter 2025 earnings report on Oct. 9, as solid pricing gains and resilient demand fueled investor optimism. However, the question now is whether the rally reflects lasting fundamentals or short-term exuberance. In third-quarter 2025, the company’s earnings and revenues beat the Zacks Consensus Estimate.

PepsiCo delivered a strong third-quarter performance, supported by steady momentum in its North America beverage business and resilient growth across international markets. The company benefited from improving trends in its global convenient foods segment and better profitability within PepsiCo Foods North America. Continued innovation, cost optimization and portfolio reshaping helped drive solid results despite ongoing supply-chain and inflationary pressures.

In the past three months, PepsiCo’s shares have rallied 10.7% against the broader industry’s decline of 1.7%. The company has also outperformed the Zacks Consumer Staples sector’s decline of 4.5% and the S&P 500’s rise of 5.9%.

PEP’s performance is notably stronger than that of its competitors, The Coca-Cola Company KO and Keurig Dr Pepper Inc. KDP, which have declined 3.5% and 22.3%, respectively, in the past three months. However, PEP shares have underperformed Monster Beverage Corporation’s MNST rally of 16.7% in the same period.

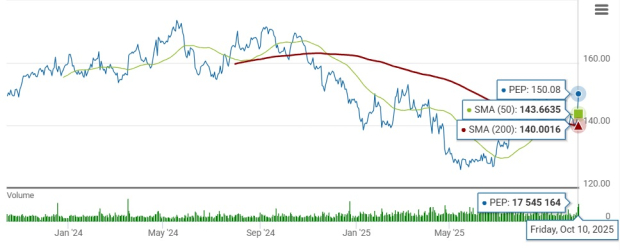

PEP’s current share price of $150.08 is 15.4% below its recent 52-week high mark of $177.50. Also, the stock trades 17.6% above its 52-week low of $127.60. PepsiCo trades above its 50 and 200-day simple moving averages, indicating a bullish sentiment.

PEP’s post-earnings rally reflects investor confidence in the company’s solid third-quarter performance, driven by balanced growth across beverages, snacks and international markets. Net revenues rose 3%, marking an acceleration from the prior quarter. Strong volume and pricing gains within Trademark Pepsi and the continued outperformance of Pepsi Zero Sugar, Mountain Dew and modern soda brand poppi underscored PepsiCo’s ability to capture evolving consumer preferences. Meanwhile, its international segment delivered an impressive 18th consecutive quarter of mid-single-digit organic revenue growth, led by strength in markets such as Brazil, the U.K., Türkiye and China.

In North America, PepsiCo’s beverage business saw improved margins despite elevated input costs, supported by cost optimization, innovation in permissible offerings and expanding away-from-home channels. The Frito-Lay and Quaker segment also made progress through portfolio transformation and renewed emphasis on affordable, functional snacks. Across categories, PepsiCo’s focus on price-pack architecture, AI-driven productivity and portfolio reshaping through acquisitions like Poppi and Siete provided further tailwinds.

Looking ahead, management expressed optimism about sustaining growth momentum. PepsiCo expects its international business to remain resilient and North American operations to show improving profitability as cost-saving actions take hold.

For fiscal 2025, the company reaffirmed its guidance for low-single-digit organic revenue growth and flat year-over-year core constant-currency EPS. The company has $8.6 billion in total shareholder returns planned. Management emphasized that PepsiCo is prioritizing faster organic growth, stronger margins and continued investment in innovation to accelerate portfolio transformation and enhance shareholder value.

The Zacks Consensus Estimate for PepsiCo’s 2025 and 2026 EPS moved up 0.6% and 0.4%, respectively, in the last 30 days. The upward revision in earnings estimates indicates that analysts are gaining confidence in the company’s growth potential.

The Zacks Consensus Estimate for PEP’s 2025 sales suggests year-over-year growth of 1.5% and that for EPS indicates a decline of 1%. For 2026, the Zacks Consensus Estimate for PepsiCo’s sales and EPS implies 3.1% and 5.5% year-over-year growth, respectively.

PEP is currently trading at a forward 12-month P/E multiple of 17.79X, slightly above the industry average of 17.73X and below the S&P 500’s average of 22.93X.

At 17.79X P/E, PEP is trading at a valuation much lower than its competitors, such as Coca-Cola and Monster Beverage, which are delivering solid growth and trade at higher multiples. Coca-Cola and Monster Beverage have forward 12-month P/E ratios of 21.21X and 33.29X, both significantly higher than PepsiCo. However, the stock’s current valuation is above Keurig Dr Pepper’s 12.04X multiple.

PepsiCo’s third-quarter performance underscores the company’s fundamental strength and sustained earnings momentum. Its diversified portfolio, expanding international footprint, and continued focus on innovation and cost efficiency have positioned it to outperform peers and navigate macro challenges effectively. The consistent upward revision in earnings estimates further reflects analysts’ confidence in PepsiCo’s growth trajectory and operational resilience.

Despite the recent rally, PEP’s valuation remains attractive relative to key beverage competitors, suggesting that the market has yet to fully price in its improving growth profile and margin potential. With solid earnings visibility, disciplined execution and strong brand equity, PepsiCo appears well-positioned to extend its momentum in the quarters ahead.

Given its combination of steady fundamentals, favorable estimate trends and reasonable valuation, the current setup presents an appealing opportunity for investors to buy into PepsiCo’s ongoing strength and potential upside. PEP currently has a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite