|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Quantum computing pure plays have huge upside, but are incredibly risky.

Legacy companies like Alphabet and Nvidia have massive resources to invest in this tech.

Quantum computing investing is not an easy field to pick stocks in. There's a lot of complex knowledge needed to understand the technology, making it hard for investors to discern which company is currently leading the way. Furthermore, the space is rapidly shifting, with new announcements occurring every week that change the landscape.

This makes it difficult to be a quantum computing investor, but I think there is a way to spread out the risk a bit and still have exposure to this important and emerging space. By taking a basket approach and picking a few stocks, investors can increase their odds of success by sacrificing maximum return for a better chance of success. I think this is the best way to approach quantum computing, and I've got five picks that help make up a quantum computing basket.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

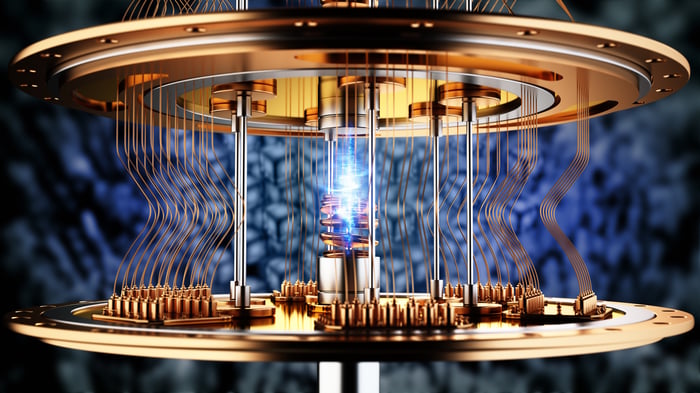

Image source: Getty Images.

First, let's look at some pure plays in this space. These companies are the most exciting, as they're relatively small but have the chance to turn into giant tech companies if their technology is successful.

First is IonQ (NYSE: IONQ). It was the first quantum computing pure play company to go public, and has seen tremendous success over the past year. It's taking a unique approach to the quantum computing realm, utilizing a trapped-ion technology versus the more popular superconducting option.

A trapped-ion quantum computer is inherently more accurate, but trades off processing speed. Still, with quantum computing accuracy being the biggest problem surrounding widespread commercial adoption, investing in a company whose technology is a leader in solving this problem is a wise idea.

Next is Rigetti Computing (NASDAQ: RGTI). Rigetti is deploying the superconducting quantum computing approach and has seen some recent successes with it. On Sept. 30, Rigetti announced the sale of two quantum computing systems that totaled $5.7 million.

While that's not the billion-dollar enterprise many investors picture this technology having, it's a start. Furthermore, because these customers likely explored other quantum computing options available, it's a big deal that they decided to pick Rigetti over some others.

Last on the pure play list is D-Wave Quantum (NYSE: QBTS). D-Wave Quantum is taking a completely different approach to quantum computing than IonQ or Rigetti. It's developing a quantum annealing computer, which can't be used for general-purpose computing like the other two options. Instead, quantum annealing focuses on solving optimization problems, which is incredibly useful for weather patterns, logistics networks, and artificial intelligence (AI) training.

If D-Wave can develop a winning option with this approach, it could dominate the fields that are recognized as having the most value for quantum computing.

Next are some legacy tech players competing in the quantum computing space. While these options don't have nearly the upside of the pure plays, they're also less risky. If IonQ, D-Wave, or Rigetti fail to produce a commercially viable product, it's likely that their stock will go to zero. For Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Nvidia (NASDAQ: NVDA), they have other primary businesses that will ensure their viability for years to come.

Alphabet is seen as a leader in quantum computing from the big tech standpoint. It's developing quantum computing for internal use, but also to be rented out via its cloud computing service, Google Cloud. If Alphabet can develop its own quantum computer in-house, it can increase its margins in this area, as it won't have to pay for other companies' profits, as it does when it buys Nvidia's graphics processing units (GPUs) now. Alphabet has resources that the pure play companies can only dream about, and in a trend that needs heavy capital influx to develop the product, Alphabet could be a huge winner.

Last is Nvidia. Nvidia currently produces the most powerful classical computing units available, and has no plans to develop a quantum computing option. However, Nvidia sees that the real value in quantum computing will be a hybrid approach that uses its GPUs alongside a quantum computing unit. To ensure its hardware is used in this hybrid approach, Nvidia is evolving its leading software, CUDA, for quantum computing, renaming it CUDA-Q.

CUDA software is a primary reason why Nvidia has been so successful in the AI arms race so far, and by offering a quantum computing alternative, it will ensure that its computing products will be used for years to come, even if quantum computing takes the world by storm.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $655,428!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,103,559!*

Now, it’s worth noting Stock Advisor’s total average return is 1,060% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 13, 2025

Keithen Drury has positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

| 4 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite