|

|

|

|

|||||

|

|

In the ever-evolving world of payments, Mastercard Incorporated MA and American Express Company AXP stand as two of the industry’s most recognizable giants. Both have long histories, global footprints and strong brand strength. Yet, beneath their shared reputation lies a fundamental difference: Mastercard serves as a network connecting consumers, merchants, and banks, while American Express operates a vertically integrated model, directly issuing cards and managing lending risk.

With interest rates, travel demand, tariff wars and consumer spending trends shaping the financial landscape, payment stocks are regaining investor attention as dependable long-term plays. Both Mastercard and American Express have demonstrated resilience, but one appears better positioned to capitalize on global growth and digital payment tailwinds.

So, which payments king offers more room to run in this environment? Let’s take a closer look at the fundamentals and crown the stronger contender.

American Express has carved out a powerful niche among premium consumers, leveraging its closed-loop model to control both sides of the transaction, issuing cards and acquiring merchants. This structure gives it deep insight into spending behavior and enables strong brand loyalty, especially among affluent users.

In the last reported quarter, total revenues net of interest expense rose 11% year over year to $18.4 billion, fueled by steady card member spending, higher revolving loan balances, and continued momentum in card fee income. Total network volumes advanced 9%, reflecting resilient demand across travel, entertainment and dining, categories where AmEx traditionally excels. Its premium positioning continues to attract Millennials and Gen Z users, who tend to spend more than their older counterparts.

American Express Company price-consensus-eps-surprise-chart | American Express Company Quote

However, AmEx’s strengths also expose it to greater cyclicality. Its heavy reliance on high-income U.S. consumers exposes it to economic fluctuations and potential pullbacks in discretionary spending. Rising credit delinquencies are another concern, as American Express holds lending exposure directly on its balance sheet. Provisions for credit losses mounted to $3.8 billion in the first nine months of 2025, underscoring growing stress in its loan portfolio.

Additionally, the company’s total debt-to-EBITDA ratio stands at 3.38, well above Mastercard’s 0.92. While its rewards and lending-driven model can amplify growth during expansionary periods, it also heightens risk in downturns, a structural limitation compared with Mastercard’s asset-light, transaction-based approach.

Mastercard’s business model offers a cleaner, more scalable way to capitalize on global payment growth. Unlike American Express, it does not lend directly; it simply connects banks, merchants and consumers through its network. This “toll collector” model ensures Mastercard earns a fee on every transaction without taking credit risk, making its earnings more resilient in volatile economic cycles.

In the last reported quarter, Mastercard reported 16.8% year-over-year revenue growth to $8.1 billion, with adjusted operating income rising 18% to $4.9 billion. Cross-border volume, a key profit driver, jumped 15% as international travel spending remained strong. The company’s adjusted operating margin stood at an impressive 59.9%, showcasing operational efficiency and pricing power.

Mastercard Incorporated price-consensus-eps-surprise-chart | Mastercard Incorporated Quote

Mastercard’s global diversification remains one of its biggest advantages. The company operates in more than 210 countries, with a strong foothold in emerging markets, regions where digital payments are still gaining traction. These markets offer significant untapped potential, positioning Mastercard for sustained growth over the long term. Its return on capital stands at a stellar 55.5%, far outpacing AmEx’s 11.9%.

Strategically, Mastercard has also been faster to integrate into new technologies shaping the future of payments. Its investments in real-time payments, open banking, AI-driven fraud prevention, tokenization and stablecoins bolster its ecosystem for both consumers and businesses. The company’s partnerships with fintechs and central banks highlight its adaptability, a critical edge in an era where innovation defines market leadership.

The Zacks Consensus Estimate projects Mastercard’s 2025 sales and EPS to grow 15.2% and 11.9% year over year, respectively. For 2026, EPS is expected to climb another 16.4%. Meanwhile, AmEx’s 2025 sales and EPS estimates point to 8.8% and 14.6% year-over-year increases, followed by a 14.3% EPS rise in 2026. Notably, both companies have seen multiple upward estimate revisions in the past week.

At first glance, Mastercard may seem expensive with a forward P/E of 30.64X compared to American Express’s 20.56X. But that premium tells a story: one of greater earnings visibility, geographic breadth and lower balance-sheet risk. Mastercard’s business model, free from lending exposure, deserves a higher multiple given its consistent cash generation and global scale.

Moreover, Mastercard’s beta stands at 0.97, versus AmEx’s 1.29, highlighting its steadier performance during market volatility. AmEx’s reliance on consumer credit cycles makes it inherently more sensitive to macroeconomic changes. For investors prioritizing risk-adjusted returns, Mastercard’s valuation premium is justified by its predictable growth profile.

Currently, Mastercard trades below its average analyst price target of $651.64, implying roughly 15.1% upside potential. Conversely, AmEx’s share price sits above its average target of $338.60, suggesting a 3.1% downside risk from current levels.

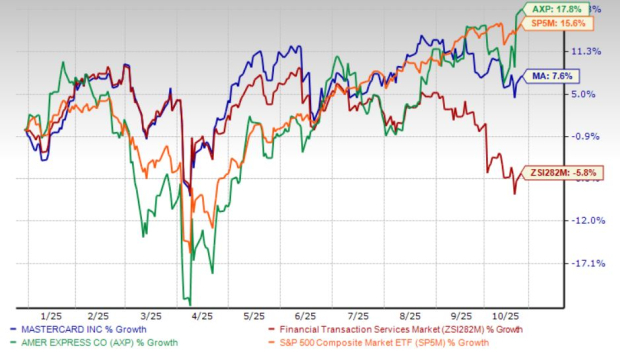

Year to date, Mastercard shares gained a steady 7.6%, while AmEx shares jumped 17.8%. The S&P 500 grew 15.6% during this time.

Both Mastercard and American Express are pillars of the payments industry, but their business models tell two very different stories. AmEx shines with brand loyalty and a premium customer base, yet its lending exposure and cyclical sensitivity add risks during economic pressure periods.

Mastercard, by contrast, operates an asset-light, globally diversified model with strong margins and fast cross-border growth. Its deep investment in innovation and partnerships keeps it aligned with the future of digital payments. In this duel of payment titans, Mastercard emerges as the smarter choice with greater return on capital and meaningful upside to the target price.

While MA trades at a higher valuation, that premium reflects its superior growth prospects and resilience in turbulent periods. Overall, Mastercard holds the stronger position today, even as both it and American Express remain rated Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 11 hours | |

| 11 hours | |

| 14 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite