|

|

|

|

|||||

|

|

Colgate-Palmolive Company CL is expected to register a bottom-line decline when it reports third-quarter 2025 results on Oct. 31, before the opening bell. The Zacks Consensus Estimate for third-quarter revenues is pegged at $5.1 billion, indicating growth of 2% from the year-ago quarter’s reported figure.

The consensus estimate for CL’s earnings is pegged at 89 cents per share and is expected to decline 2.2% year over year. The Zacks Consensus Estimate for earnings for the quarter has moved down by a penny in the past seven days.

In the last reported quarter, the company's earnings beat the consensus estimate by 3.4%. It has delivered an earnings surprise of 3.7%, on average, in the trailing four quarters.

Colgate-Palmolive Company price-eps-surprise | Colgate-Palmolive Company Quote

Our proven model does not conclusively predict an earnings beat for Colgate this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Colgate currently has an Earnings ESP of -0.61% and a Zacks Rank of 4 (Sell).

Colgate’s third-quarter performance is expected to have benefited from solid business momentum, supported by pricing, funding-the-growth initiative and other productivity initiatives. The company’s idea of delivering balanced organic sales growth, driven by improvements in all categories and divisions, and volume and pricing gains, has been driving its performance. CL’s brand strength, coupled with its focus on innovation, premiumization and digital transformation, is expected to have driven its performance in the to-be-reported quarter.

Colgate’s focus on science-based, value-added innovation — exemplified by the relaunch of Colgate Total, Colgate Miracle Repair serum and Hill’s therapeutic lines — is supporting category growth and brand penetration.

Our model predicts sales growth of 2.9% for third-quarter 2025, with organic sales growth of 2.1%. We expect the volume decline of 0.1% to be largely offset by pricing gains of 2.2% for the third quarter. Our model predicts a 1.5% rise in sales in Latin America, 8% growth in Europe, a 1% increase in Asia Pacific, an 8.5% increase in Africa/Eurasia and a 4.2% rise in Pet Nutrition. This is expected to be partly offset by a 1.1% decline in North America.

The company has been delivering a sequential rise in the gross margin for the past few quarters, driven by continued strong pricing, benefits from revenue growth management initiatives, strength in the funding-the-growth program and other productivity initiatives. Continued gains from these initiatives are expected to have led to a gross margin expansion in the to-be-reported quarter. Our model predicts sequential gross margin growth of 60 bps to 60.7% for the third quarter of 2025.

However, Colgate’s third-quarter 2025 performance is likely to have encountered continued headwinds from a combination of inflationary pressures, foreign currency fluctuations and soft performance across key regions. Markets like Latin America, which previously experienced significant pressure from currency devaluation despite growth in pricing and volume, have been vulnerable. These foreign exchange headwinds are expected to have continued eroding sales on a reported basis in the quarter under review.

On the last reported quarter’s earnings call, management anticipated the uncertainty and volatility across the global markets and the impacts of tariffs to remain challenging in the quarters ahead. In addition, consumer uncertainty and a slowdown in category pricing remain headwinds.

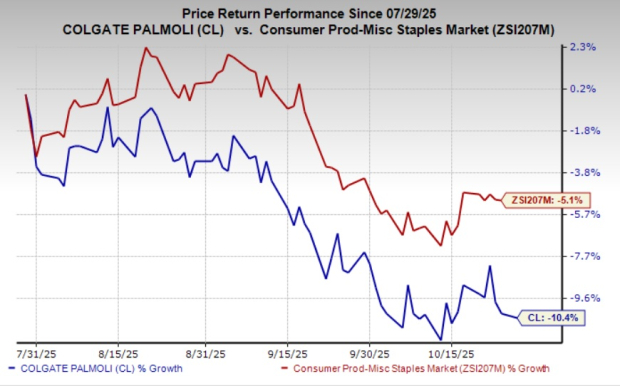

The recent market movements show that Colgate’s shares have lost 10.4% in the past three months compared with the industry's 5.1% decline.

From the valuation standpoint, CL trades at a forward 12-month P/E multiple of 20.18X, exceeding the industry average of 19.05X and below the S&P 500’s average of 23.69X. Its valuation appears quite pricey.

Here are some companies that, according to our model, have the right combination of elements to beat on earnings this reporting cycle.

Vital Farms VITL currently has an Earnings ESP of +8.84% and flaunts a Zacks Rank of 1. VITL is anticipated to register increases in its top and bottom lines when it reports third-quarter 2025 results. The Zacks Consensus Estimate for Vital Farms’ quarterly revenues is pegged at $191 million, indicating growth of 31.7% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Vital Farms’ bottom line has been unchanged in the past 30 days at 29 cents per share. This implies a surge of 81.3% from the year-ago quarter’s reported figure. VITL delivered an earnings beat of 35.8%, on average, in the trailing four quarters.

The Estee Lauder Companies EL has an Earnings ESP of +15.65% and a Zacks Rank of 3 at present. EL is likely to register growth in its top and bottom lines when it releases first-quarter fiscal 2026 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.4 billion, which implies growth of 0.6% from the figure in the prior-year quarter.

The consensus estimate for Estee Lauder’s bottom line has moved up by a penny to 16 cents per share in the past seven days. The estimate indicates 14.3% growth from the year-ago quarter’s actual. EL delivered an earnings surprise of 71.5%, on average, in the trailing four quarters.

Monster Beverage MNST currently has an Earnings ESP of +0.82% and a Zacks Rank of 3. The company is likely to register increases in the top and bottom lines when it reports third-quarter 2025 numbers. The Zacks Consensus Estimate for quarterly earnings per share is pegged at 48 cents, suggesting a 20% growth from the year-ago period’s reported number. The consensus mark has been unchanged in the past 30 days.

The consensus estimate for Monster Beverage’s quarterly revenues is pegged at $2.1 billion, which indicates growth of 11.9% from the prior-year quarter’s actual. MNST has a trailing four-quarter earnings surprise of 0.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 12 hours | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite