|

|

|

|

|||||

|

|

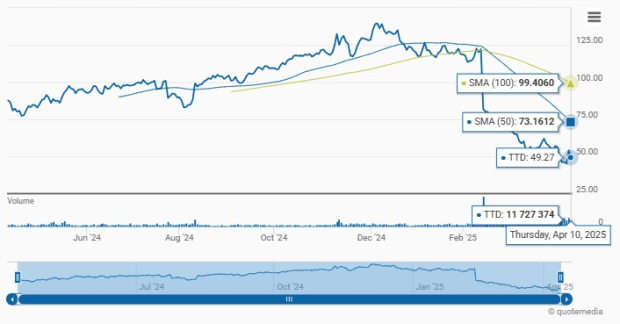

The Trade Desk TTD shares have lost 18.2% over the past month amid broader market volatility. The indices have been affected by the escalating tariff and trade tensions between the United States and other countries, especially China. Expectations of supply chain disruptions and associated inflationary pressure and a possible global recession are keeping investors on edge, leading to a broader market sell-off. Though President Trump’s announcement of a 90-day pause on reciprocal tariffs led to strong gains, but again indices fell the next day.

Apart from that, company-specific factors have also been weighing on the stock’s performance. Weaker-than-expected fourth-quarter 2024 results, as well as slower adoption of its next-generation platform, Kokai, have kept investors cautious.

The stock has also underperformed the Zacks Computer & Technology sector and the Zacks Internet Services industry’s decline of 8.4% and 8.3%, respectively.

The company has underperformed its digital advertising peers, including Alphabet GOOGL and Amazon AMZN. Alphabet and Amazon shares have plunged 8.4% and 8.9%, respectively, in the same time frame.

Its recent volatility raises questions about its future trajectory. Let’s discuss the stock’s pros and cons and explore whether this dip signals caution or opportunity for investors.

TTD is benefiting from a significant increase in digital spending in key areas, such as Connected TV (CTV) and retail media. In the fourth quarter of 2024, The Trade Desk reported a record-breaking spend of more than $12 billion on its platform, signaling continued growth in advertiser demand.

In the fourth quarter of 2024, The Trade Desk further advanced support for UID2, a privacy-centric identity solution designed to replace third-party cookies and improve the relevance of digital advertising while prioritizing user control and privacy.

Major streaming platforms — Disney, Netflix, Paramount, Peacock, Fox, and Max — are investing heavily in programmatic advertising and many of them have adopted UID2, boosting addressability and precision targeting for advertisers. TTD highlighted that this will aid in the expansion of CTV advertising around the world.

UID2 is also live across major platforms like Spotify Technology SPOT, SiriusXM/Pandora, and iHeartMedia, in addition to most streaming giants. Spotify, through its extended partnership with TTD, is piloting integrations with OpenPath and UID2 through the Spotify Ad Exchange. This collaboration aims to improve addressability and provide deeper insights into Spotify’s premium ad inventory, which is likely to boost TTD’s service adoption and revenue growth.

The Trade Desk also introduced its Ventura Operating System for CTV, designed to drive greater efficiency and transparency in CTV advertising. This operating system enables better data management, allowing TTD to enhance its targeting capabilities, which are crucial as the CTV market expands.

In January 2025, The Trade Desk entered into a definitive agreement to acquire Sincera, a leading digital advertising data company, to enhance its programmatic advertising platform by integrating Sincera’s actionable insights on data quality. This integration enables more accurate ad valuation and improves both publisher data signals and campaign optimization for advertisers.

The Trade Desk is actively simplifying its platform to be more intuitive without compromising sophistication, which should improve client onboarding and retention. At the same time, the company is aggressively integrating AI across all its operations to cater to the evolving needs of its clients amid the AI boom.

While Kokai is expected to replace Solimar entirely by the end of 2025, TTD currently maintains two platforms, leading to operational difficulties.

Any delays in Kokai adoption could impact performance and reduce upsell opportunities.

Increasing macroeconomic uncertainty and escalating trade tensions do not augur well for TTD, as these could squeeze ad budgets. The intensely competitive nature of the digital advertising industry, dominated by industry giants like Google and Amazon, continues to put pressure on TTD’s market positioning.

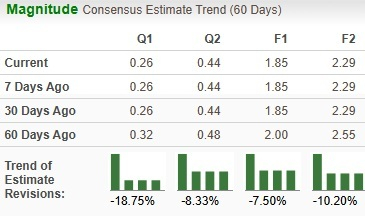

Given the myriad challenges, analysts appear to be bearish on the stock as reflected in a significant downward revision for earnings estimates.

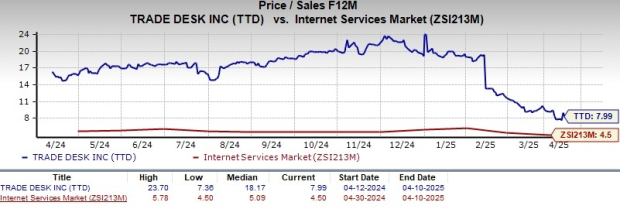

From a valuation perspective, TTD is quite expensive. TTD stock is trading at a premium with a forward 12-month Price/Sales of 7.99X compared with the industry’s 4.5X.

The Trade Desk is also trading below its 50 and 100-day moving averages, indicating bearish sentiment among investors.

The Trade Desk’s strong portfolio and expanding partner base serve as key strengths. However, macroeconomic uncertainty remains an overhang.

The intensely competitive nature of the digital advertising industry, dominated by industry giants like Google and Amazon, continues to put pressure on TTD’s market positioning. Stretched valuation also remains a concern.

The Trade Desk carries a Zacks Rank #3 (Hold), which implies investors should wait for a more favorable entry point to accumulate the stock.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 10 hours | |

| 10 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours | |

| 15 hours | |

| 16 hours | |

| 18 hours | |

| 19 hours | |

| 20 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite