|

|

|

|

|||||

|

|

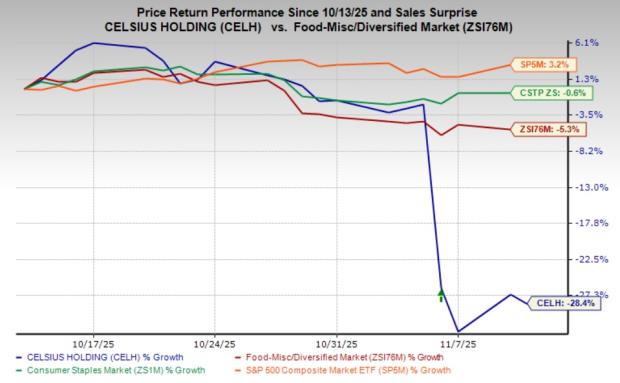

Celsius Holdings, Inc. (CELH) shares have fallen about 27% since the company reported its third-quarter fiscal 2025 results on Nov. 6. Despite solid quarterly results, investors reacted cautiously amid near-term business transitions, integration costs and concerns about the stock’s rich valuation.

Due to this pullback, CELH has underperformed the industry, broader Zacks Consumer Staples sector, as well as the S&P 500 in the past month. In the said time frame, Celsius Holdings’ shares have tumbled 28.4% compared with the industry and sector’s respective declines of 5.3% and 0.6%. Meanwhile, the S&P 500 grew 3.2%.

Celsius Holdings delivered another quarter of impressive growth in the third quarter of 2025. Net sales surged 173% year over year to $725.1 million, supported by strong performance from the CELSIUS brand and added contributions from Alani Nu and Rockstar, which were acquired earlier in the year. The combined portfolio now holds roughly 21% of the U.S. energy drink market, highlighting CELH’s growing scale and brand relevance.

Profitability also remained strong. The company delivered adjusted earnings per share of 42 cents, up from 30 cents reported in the year-ago period, while adjusted EBITDA climbed to $205.6 million, reflecting ongoing margin expansion and operational efficiency. These results show that Celsius Holdings continues to execute well despite absorbing multiple acquisitions and distribution changes during the quarter.

Even with strong adjusted results, management warned that the fourth quarter will be “noisy.” The company is in the middle of transitioning parts of the Alani Nu business into PepsiCo’s (PEP) direct-store-delivery (DSD) system while integrating Rockstar into its operations. These transitions are expected to cause temporary fluctuations in sales and margins as inventory levels normalize and logistics are restructured.

Celsius Holdings also noted potential headwinds from freight, scrap and tariff-related costs, along with short-term promotional timing shifts that could affect quarterly comparisons. While none of these issues appear structural, they create uncertainty around near-term performance and may take a few quarters to smooth out.

Despite the short-term turbulence, Celsius Holdings’ underlying momentum remains strong. Retail takeaway data showed CELSIUS brand sales increased 13% year over year, while Alani Nu maintained its strong growth trajectory, supported by new flavor launches and limited-time offerings. The company’s strategic partnership with PepsiCo continues to be a major growth driver, expanding Celsius’ reach across key channels and increasing shelf presence nationwide.

Celsius also strengthened its balance sheet after the quarter ended, reducing debt by $200 million to lower interest expenses and improve financial flexibility heading into 2026. Management highlighted that PepsiCo’s continued support reinforces confidence in Celsius Holdings’ long-term potential and positions the combined portfolio for sustained market share gains.

Analysts’ earnings estimates for Celsius Holdings have moved higher following the results, suggesting that they see the current challenges as temporary and expect the company to sustain strong growth into 2026. The Zacks Consensus Estimate for 2025 and 2026 EPS has moved higher in the past seven days.

While Celsius Holdings’ fundamentals remain solid, valuation continues to be a concern. The stock’s forward 12-month P/E of 29.67X stands well above the industry average of 14.48X. Its Value Score of D further suggests limited room for multiple expansion in the near term. In comparison, other beverage leaders such as PepsiCo, Keurig Dr Pepper (KDP) and Coca-Cola (KO) all trade at more moderate valuations of 17.07X, 12.42X and 22.46X, respectively.

CELH’s premium reflects its faster growth trajectory, but it also means the stock could remain volatile if margins or volumes underperform expectations.

Celsius Holdings delivered another quarter of strong growth, expanding its top line and adjusted profitability while continuing to integrate its recent acquisitions. The stock’s sharp post-earnings decline seems driven more by short-term transition noise than by weakness in the underlying business. With earnings estimates trending upward and demand for energy drinks holding steady, CELH remains a compelling growth story in the beverage space. However, given the ongoing integration work and elevated valuation, investors may prefer to wait for clearer signs of margin stability before considering new positions.

Celsius Holdings currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 5 hours | |

| 9 hours | |

| 9 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 17 hours |

Nvidia Earnings, Inflation Data, State of the Union Address: What to Watch This Week

KDP

The Wall Street Journal

|

| 18 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite