|

|

|

|

|||||

|

|

Rigetti Computing RGTI reported third-quarter 2025 adjusted loss per share of 3 cents, narrower than the loss per share of 8 cents in the prior-year quarter. The metric also surpassed the Zacks Consensus Estimate of earnings by 40%.

GAAP loss per share in the reported quarter was 62 cents compared with the loss per share of 8 cents in the prior-year quarter.

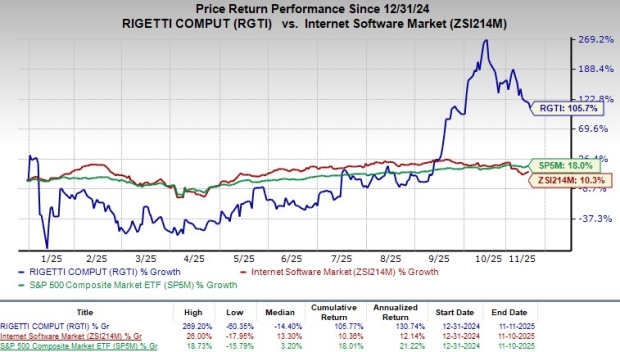

Shares of this company lost nearly 5.1% at yesterday’s market closing. The company’s shares have surged 105.7% in the year-to-date period compared with the industry’s growth of 10.3%. The broader S&P 500 Index has increased 18% in the same time frame.

The company reported total revenues of $1.9 million, down 18.1% year over year. The top line missed the Zacks Consensus Estimate by 18.5%.

Per management, on a year-over-year basis, quarterly revenue was impacted by the expiration of the U.S. National Quantum Initiative (NQI) and its pending reauthorization in Congress, which slowed government-driven contract activity and sales. While recent Novera system orders and the AFRL contract provide future revenue visibility, these contributions were not recognized in the third quarter, weighing on reported results.

In the quarter under review, RGTI’s gross profit declined 66.5% year over year to $0.4 million. The gross margin significantly contracted 2990 basis points to 20.7%. Per management, the year-over-year decline in gross margin was impacted by revenue mix and pricing variability in development contracts, including those with the U.K.’s National Quantum Computing Centre for Quantum Systems, which carry lower margins compared to most other revenue streams.

Selling, general and administrative expenses increased 2.3% year over year to $5.9 million. Research and development expenses increased 17.8% year over year to $15 million. Total operating expenses of $20.9 million increased 12.9% year over year.

Operating loss for the quarter under review totaled $20.5 million compared with $17.3 million in the prior-year quarter.

RGTI exited the third quarter of 2025 with cash, cash equivalents and short-term available-for-sale investments of $446.9 million compared with $425.7 million at the end of the second quarter.

The company ended the quarter with no debts on its balance sheet.

Cumulative net cash used in operating activities at the end of the third quarter was $43.6 million compared with $42.1 million a year ago.

Rigetti Computing, Inc. price-consensus-eps-surprise-chart | Rigetti Computing, Inc. Quote

RGTI exited third-quarter 2025 results on a mixed note, where its earnings surpassed the Zacks Consensus Estimate while revenues missed the same. Continued decline in revenues and gross margin does not bode well for the stock. Increased operating loss also seems a matter of concern.

Rigetti highlighted strong momentum this quarter, driven by continued progress on its modular chiplet-based quantum architecture. Management noted growing interest in its 9-qubit Novera systems, which are designed as on-premise, upgradable platforms to help customers build foundational quantum expertise. The company is also expanding collaborations across the ecosystem, including partnerships with C-DAC in India and Montana State University, where Rigetti’s Novera hardware will support advanced research.

Importantly, Rigetti is working with QphoX and the U.S. Air Force Research Laboratory to advance microwave-to-optical conversion, a critical step toward quantum networking. The company also joined NVIDIA’s new NVQLink initiative, which aims to seamlessly connect quantum processing units with leading AI supercomputing platforms, further validating Rigetti’s hybrid computing vision.

Management refreshed its technology roadmap with higher confidence in scaling superconducting gate-based systems. Rigetti remains on track to deliver a 100-plus qubit chiplet-based system with roughly 99.5% median 2-qubit gate fidelity by year-end. In 2026, the company expects to deploy a 150-plus qubit platform with approximately 99.7% fidelity, leveraging arrays of 9-qubit chiplets.

By 2027, Rigetti is targeting more than 1,000 qubits using larger 36-qubit chiplets while pushing fidelity to approximately 99.8%. Although this falls slightly short of management’s benchmark for true quantum advantage, it represents meaningful progress toward that milestone. Looking ahead, Rigetti said achieving 99.9% fidelity and incorporating error correction remain the final thresholds, which could support practical applications in areas like drug discovery, forecasting, and advanced materials.

Management also highlighted growing ecosystem alignment, including participation in NVIDIA’s NVQLink initiative, which is intended to tightly integrate Rigetti QPUs into future hybrid quantum–AI computing environments. Supporting these technological strides, the company maintains a solid financial position with a strengthened cash balance and no debt on its books.

RGTI carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space that have announced quarterly results are Boston Scientific Corporation BSX, West Pharmaceutical Services, Inc. WST and Exact Sciences Corporation EXAS.

Boston Scientific, carrying a Zacks Rank of 2 (Buy), reported third-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outpaced the consensus mark by 1.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Boston Scientific has a long-term estimated growth rate of 16.4%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.4%.

West Pharmaceutical reported third-quarter 2025 adjusted EPS of $1.96, beating the Zacks Consensus Estimate by 17.4%. Revenues of $804.6 million surpassed the Zacks Consensus Estimate by 2.4%. It currently carries a Zacks Rank #2.

West Pharmaceutical has a long-term estimated growth rate of 9.8%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.5%.

Exact Sciences reported third-quarter 2025 adjusted EPS of 24 cents, beating the Zacks Consensus Estimate by 84.6%. Revenues of $850.7 million surpassed the Zacks Consensus Estimate by 4.9%. It currently sports a Zacks Rank #1.

Exact Sciences has a long-term estimated growth rate of 30.1%. EXAS’ earnings surpassed estimates in each of the trailing four quarters, the average surprise being 352.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite