|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

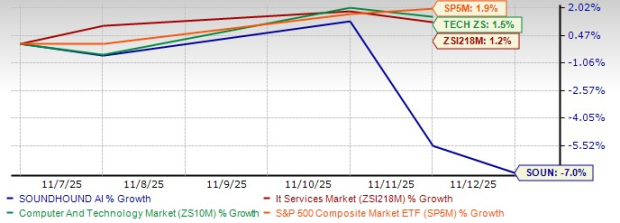

SoundHound AI, Inc. SOUN has had an eventful few weeks. The conversational AI company reported strong third-quarter 2025 results on Nov. 6, delivering 68% year-over-year revenue growth, improving margins and raising its full-year outlook. Yet the market’s reaction proved cautious. Shares slid about 7% since the release, significantly underperforming the Zacks Computers – IT Services industry, which gained 1.2% during the same period. The stock also trailed the broader Zacks Computer and Technology sector’s 1.5% rise and the S&P 500’s 1.9% gain. The pullback has investors asking whether this decline signals deeper concerns or presents a potential opportunity.

At its current price, SoundHound trades at a steep 47% discount to its 52-week high of $24.98, although it still sits more than 121% above its 52-week low.

SOUN Share Price Performance

Its valuation remains elevated, with a forward 12-month P/S ratio of 26 compared with the industry’s 16.67, reflecting both strong revenue growth expectations and high market optimism surrounding its voice and agentic AI solutions.

SOUN's Valuation

But after a 7% post-earnings decline, the big question for investors is whether the dip has opened an attractive entry point or if risks remain too hard to ignore. To answer that, let's evaluate both the company’s accelerating growth prospects and the operational and competitive challenges still shaping its trajectory.

SoundHound posted third-quarter revenues of $42 million, up 68% year over year, marking another record quarter fueled by growth across enterprise AI, restaurants, automotive, IoT, and financial services. Management highlighted accelerating global adoption of conversational and voice AI, supported by millions of embedded endpoints and continued traction for its Amelia 7 platform, including the enhanced Amelia 7.3 update (read more: SoundHound Q3 Earnings Beat as AI Momentum Drives 68% Sales Growth).

The company’s in-house Polaris speech foundation model is becoming a clear differentiator, cutting error rates by up to three times and improving speed while reducing reliance on expensive third-party LLMs. This shift improves product performance and supports margin expansion.

Enterprise demand remains strong, with healthcare, financial services, insurance, IT services and telecom driving new and expanded multi-year deals. Restaurant AI deployments continue to scale across major chains and a new high-volume IoT partnership with a major China-based hardware company could add millions of device integrations in coming years.

SoundHound is also preparing for long-term growth in Voice Commerce, expected to begin commercial rollouts in 2026 with multiple OEMs already in advanced pilots.

The company ended the quarter with $269 million in cash and no debt, giving it solid flexibility to invest and compete as industry costs rise.

SoundHound’s losses continued to narrow in the third quarter, with a non-GAAP net loss of $13 million and an adjusted EBITDA loss of $14.5 million. Non-GAAP gross margin improved to 59% thanks to cloud efficiencies and greater use of in-house models. Management reiterated that it expects to reach breakeven as it exits 2025 and enters 2026, supported by roughly $20 million in acquisition synergies and strong revenue momentum.

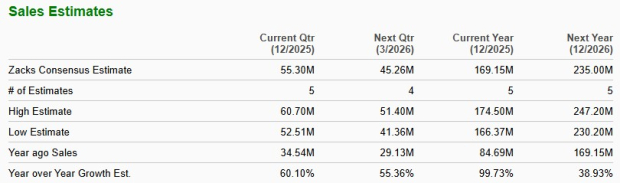

Analysts expect meaningful bottom-line improvement as well. The 2025 loss estimate stands at 13 cents per share, down sharply from last year’s $1.04 loss, while the 2026 estimate narrows further to 5 cents. Revenues are projected to nearly double in 2025 and grow about 39% in 2026, reflecting expectations of scaling and margin gains.

SOUN EPS Estimate Trend

SOUN Revenue Estimate Trend

While SoundHound trades at a premium forward P/S of 26, its rapid growth, increasing market share, and improving leverage could justify the valuation—though any slowdown in AI spending or enterprise adoption remains a risk.

Even with strong growth, several issues are tempering investor sentiment. The 7% post-earnings dip reflects concerns around near-term headwinds, including ongoing weakness in the automotive sector. Management noted that global tariffs and industry softness limited automotive deployments, with recovery timing still unclear.

GAAP results were pressured by a $66 million non-cash fair-value charge tied to recent acquisitions, pushing net loss to $109.3 million and creating volatility that can unsettle investors. Operating costs also continue to rise due to acquisitions, expanding headcount, and data center investments, extending the path to consistent profitability.

The Interactions acquisition adds strategic scale but brings integration risks as SoundHound works to merge legacy systems and unify go-to-market models. Competition from large LLM providers remains intense, potentially influencing pricing and sales cycles despite SoundHound’s in-house model advantage.

A premium valuation adds another layer of pressure, leaving shares more vulnerable if revenue growth slows or product rollouts face delays.

SoundHound faces growing competition from Nuance Communications —now part of Microsoft MSFT, Verint Systems VRNT and LivePerson LPSN, each pushing deeper into conversational and enterprise AI. Nuance Communications continues to leverage Microsoft’s cloud and Copilot ecosystem, while Verint Systems expands its AI-driven customer engagement suite. LivePerson is also broadening its agentic automation tools. Yet SoundHound’s proprietary speech models and agentic framework give it an advantage in accuracy, latency and deployment flexibility. Even as Nuance Communications, Verint Systems and LivePerson compete aggressively, SoundHound’s vertical depth and in-house technology help defend market share.

SoundHound’s long-term prospects remain compelling. The company is scaling rapidly across multiple industries, its proprietary AI models give it strong differentiation, and its expansion into agentic AI and Voice Commerce positions it at the forefront of next-generation human–machine interaction. Revenue growth is strong, enterprise adoption is increasing and cost synergies from acquisitions should support margin expansion in 2026.

However, investors must weigh these strengths against ongoing losses, elevated expenses, GAAP volatility, competitive pressures and softness in certain verticals. At 26X forward sales, the valuation assumes significant execution success. The recent pullback brings the stock meaningfully below its 52-week high but does not necessarily make it “cheap,” given the premium to industry averages.

With its Zacks Rank #3 (Hold), the stock appears balanced between opportunity and risk. SoundHound’s long-term story remains intact, but the current setup suggests that investors may want to wait for greater clarity on profitability progress, integration milestones and broader AI spending trends. For those with a higher risk appetite and a long-term horizon, the recent dip may offer an improved entry point. More conservative investors may prefer to monitor the stock for signs of sustained margin improvement and stabilization in key sectors. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 9 hours | |

| 12 hours | |

| 13 hours | |

| 15 hours | |

| 15 hours | |

| 15 hours | |

| 18 hours | |

| 18 hours | |

| 18 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite