|

|

|

|

|||||

|

|

Ecolab ECL recently expanded its data-center-focused portfolio with the launch of a fully integrated Cooling as a Service (CaaS) program designed to elevate cooling performance from site to chip. Arriving at a time when AI-driven workloads are rapidly intensifying demand on global data center infrastructure, the new offering combines Ecolab’s 3D TRASAR technology, smart Coolant Distribution Units and a century of cooling management expertise.

For investors, the move underscores Ecolab’s growing emphasis on next-generation, sustainability-oriented solutions that support mission-critical industries. By offering a holistic, scalable cooling platform tailored to AI-era performance needs, Ecolab positions itself to capture incremental demand as data center operators seek reliable ways to optimize power, conserve water and streamline operations.

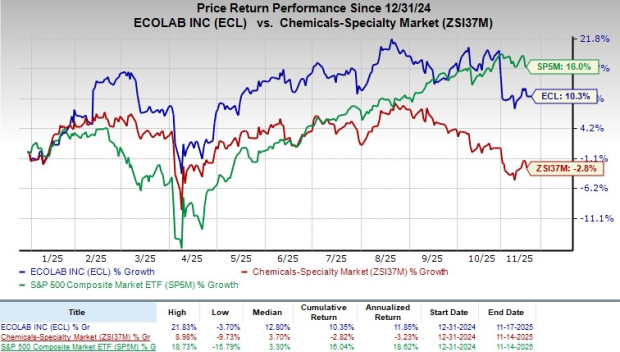

Following the announcement, the company's shares traded flat at yesterday’s closing. In the year-to-date period, shares have gained 34.7% against the industry’s 10.8% decline. The S&P 500 has gained 12.2% in the same time frame.

Ecolab’s expanded cooling program strengthens its long-term growth profile by anchoring the company more deeply in the accelerating data center ecosystem—one of the most durable, resource-intensive end markets of the AI era. By offering a holistic, tech-enabled solution that improves efficiency, reduces water and power use and integrates directly into mission-critical cooling infrastructure, Ecolab positions itself for recurring, services-driven revenue and stronger customer retention.

ECL currently has a market capitalization of $73.24 billion. In the last reported quarter, ECL delivered an earnings surprise of 0.49%.

Ecolab’s new Cooling as a Service program is designed as a full end-to-end cooling ecosystem that spans the entire data center environment—from facility infrastructure all the way to high-performance computing chips. The offering integrates Ecolab’s 3D TRASAR Technology for Direct-to-Chip Liquid Cooling into its smart Coolant Distribution Unit (CDU), creating a unified, intelligent cooling layer that continuously monitors, adjusts and optimizes system performance. Backed by more than 102 years of cooling management expertise, the program ties together water management technologies, connected coolant, smart hardware and real-time analytics to help operators maintain peak thermal efficiency with fewer operational headaches.

The timing of the launch is also strategically aligned with the surge in AI-driven compute demand, which is pushing data centers to expand faster and run hotter than ever before. As operators face pressure to boost performance while lowering the environmental burden on water, power and local communities, Ecolab’s CaaS platform offers a next-generation solution built for the realities of the AI era. Leadership describes the platform as a dynamic hub that integrates cooling and power infrastructure, giving operators clearer insights and stronger control over efficiency. With seamless site-to-chip cooling management and a service-driven model, Ecolab is positioning itself to meet a rapidly scaling market that needs reliable, resource-conscious cooling on a global scale.

Per a report by MarketsandMarkets, the global data center cooling market is projected to increase from $11.08 billion in 2025 to $24.19 billion by 2032, at a CAGR of 11.8%.

The industry is driven by the increasing growth of data creation and cloud computing. As more businesses establish themselves on cloud services and adopt newer technologies like AI and Big Data, the processing load and heat generation of data centers increase, necessitating effective cooling solutions to operate optimally.

Currently, ECL carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Medpace Holdings MEDP, Intuitive Surgical ISRG and Boston Scientific BSX.

Medpace, currently sporting a Zacks Rank #1 (Strong Buy), reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, carrying a Zacks Rank #2 (Buy) at present, posted a third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite