|

|

|

|

|||||

|

|

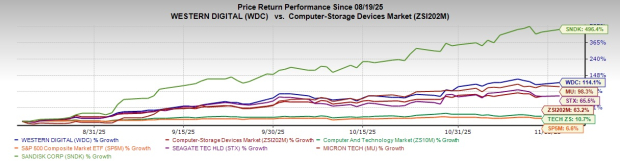

Western Digital Corporation’s (WDC) shares have jumped 114.1% over the past three months, outpacing the 63.2% return in the Zacks Computer-Storage Devices industry. The stock has also outperformed the Zacks Computer & Technology sector, as well as the S&P 500’s growth of 10.7% and 6.6%, respectively. The rapid ramp-up of AI is fueling strong demand for high-capacity storage, pushing shipments to record levels, boosting gross margins, and securing long-term customer agreements for Western Digital.

The company has successfully outpaced its tough rival in the HDD business, Seagate Technology Holdings plc (STX) and competitors from the broader storage space like Micron Technology (MU), both of which grew 65.5% and 98.3%, respectively, during the same time frame. WDC has, however, underperformed the newly separated entity from its own, Sandisk Corporation (SNDK), which climbed 496.4% in three months.

Dublin, Ireland-based Seagate is a top provider of data storage technology and infrastructure solutions. The company’s primary product offering is hard disk drives, which are commonly referred to as disk drives, hard drives or HDDs. Idaho-based Micron is a leading global provider of semiconductor memory solutions, manufacturing high-performance DRAM, NAND, NOR, 3D XPoint and other memory technologies under brands like Micron, Crucial and Ballistix, for use in computing, consumer, networking and mobile products.

To further enhance its Flash business and improve emphasis on its core HDD market, WDC has completed the separation of its HDD and Flash businesses into two independent, publicly traded companies, each with a specific focus on its respective market, in February 2025. With a deep understanding of memory and storage technology, the new SanDisk is well-equipped to take advantage of AI opportunities while maximizing the value of its products for both consumers and businesses.

WDC has a 52-week high of $178.45. Following a strong rally, investors may wonder if WDC still holds meaningful upside or if expectations have outpaced fundamentals. Let’s break down the pros and cons to assess the road ahead.

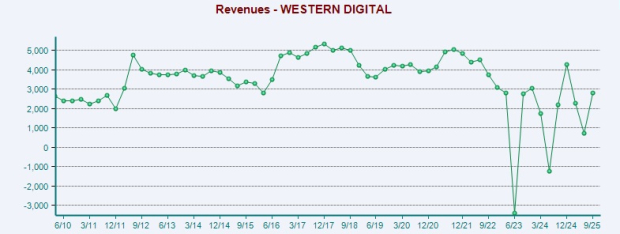

As a pure-play HDD leader, Western Digital is a key enabler of the data-intensive AI ecosystem. The company is performing well, meeting customers’ surging exabyte needs and turning that demand into solid financial results. It entered fiscal 2026 on a strong note with both top and bottom lines growing sharply by 27% and 137% year over year, respectively. Continued focus on innovation and operational discipline positions the company well to capitalize on new growth opportunities as the AI revolution drives massive increases in data creation and storage demand.

As agentic AI scales across industries and multimodal LLMs become standard, Western Digital is seeing accelerating AI-driven use cases that fuel sustained demand for data infrastructure. AI now generates vast volumes of synthetic and real-world data, reshaping how information is created, scaled, stored, and monetized. With data as the foundation of AI, HDDs remain the most reliable, scalable, and cost-efficient solution for managing the rapidly growing zettabytes of data in an AI-driven economy. It is harnessing AI across its operations to improve efficiency and accelerate innovation. AI is modernizing firmware development, speeding feature delivery and boosting factory productivity by up to 10% through better yield management, defect detection, test optimization, and faster issue diagnostics.

The surge in AI and data-heavy workloads at hyperscalers is driving strong demand for Western Digital’s high-capacity storage. Customers are quickly shifting to larger drives, with shipments of its latest ePMR products — 26TB CMR and 32TB UltraSMR — surpassing 2.2 million units in the September quarter. WDC is expanding ePMR technology, advancing head wafer and media innovations to increase areal density, and boosting manufacturing throughput through automation, AI tools, and enhanced testing processes to meet the rapidly growing exabyte demand.

Its ePMR and UltraSMR platforms continue to deliver reliable, scalable, and cost-effective solutions in the data center market, and the company is building on this foundation with next-generation HAMR drives. All seven major customers have placed orders through mid-2026, with most extending into the year’s end and one securing supply through 2027, emphasizing WDC’s significance in the AI data economy and strong confidence in its HAMR roadmap. HAMR development remains on schedule, with qualification beginning with one hyperscaler in early 2026 and expanding to up to three by year-end, supporting a volume ramp-up in the first half of 2027. Its next-generation ePMR drives are also on track to finish qualification by early 2026, ensuring a smooth and cost-efficient transition to HAMR.

For the second quarter of fiscal 2026, management anticipates ongoing revenue growth, buoyed by strong data center demand and better profitability driven by increased adoption of high-capacity drives.

Backed by a steady transition to higher-capacity drives and disciplined cost management across production facilities and the supply chain, WDC continues to expand its margin performance. In the fiscal first quarter, it reported a non-GAAP gross margin of 43.9%, up 660 basis points (bps) year over year and 260 bps sequentially, above its guidance (41-42%). For the fiscal second quarter, WDC expects non-GAAP gross margin in the range of 44-45%, while non-GAAP operating expenses are expected to decline sequentially between $365 million and $375 million.

This guidance reflects the company’s continued optimism about the demand trajectory for high-capacity storage, especially within data centers. The improving margin outlook also highlights Western Digital’s focus on cost efficiency, product mix optimization and strong pricing discipline.

Furthermore, Western Digital continues to balance strategic investment with strong shareholder returns. Driven by momentum, the board approved a 25% dividend increase, while solid free cash flow and margin gains underscored strong execution. In the fiscal first quarter, the company generated $672 million in operating cash flow, repurchased 6.4 million shares for $553 million, and paid $39 million in dividends. Since launching its capital return program in fourth-quarter fiscal 2025, it has returned $785 million to shareholders, showcasing its commitment to disciplined capital allocation and long-term value creation.

Nonetheless, macroeconomic volatility, including tariffs and global trade tensions, remains a near-term concern for Western Digital and may create demand swings in the enterprise, distribution, and retail segments. At the same time, the rapid AI-driven surge in storage needs is putting additional strain on the industry, as the move to higher-capacity drives increases manufacturing complexity and lengthens production cycles. High debt load is an added woe that jeopardizes its ability to pursue accretive acquisitions and other growth endeavors. As of Oct. 3, 2025, cash and cash equivalents were $2 billion, while long-term debt (including the current portion) was $4.7 billion.

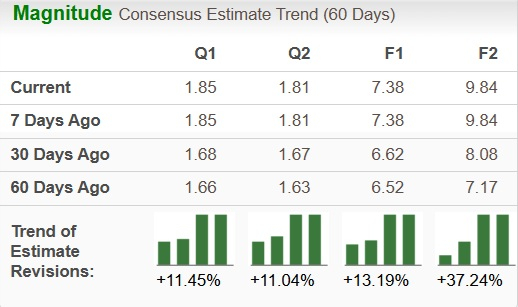

WDC’s estimates revisions are on an upward trajectory currently. The Zacks Consensus Estimate for WDC’s earnings for fiscal 2026 has been revised north 13.2% to $7.38 over the past 60 days, while the same for fiscal 2027 has gone up 37.2% to $9.84.

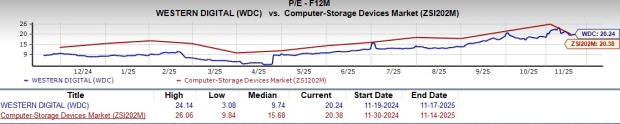

From a valuation standpoint, WDC appears to be trading cheaper compared to the industry but above its mean. Going by the price/earnings ratio, the company’s shares currently trade at 20.24 forward earnings, lower than 20.38 for the industry but above the stock’s mean of 9.74.

Backed by ongoing advances in ePMR and HAMR and a solid order pipeline extending through 2027, the company expects to maintain robust revenue growth, improve operational efficiency, and continue delivering shareholder value, while carefully managing capacity and addressing industry challenges. Strong free cash flow and a dividend hike signal a shareholder-friendly strategy. Agentic AI is driving future data growth, while its platform business is growing with increased on-prem and cloud storage demand, and continued investment to scale further.

Boasting a Zacks Rank #1 (Strong Buy) at present, WDC seems to be a good investment bet now. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 37 min | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite