|

|

|

|

|||||

|

|

Royal Caribbean Cruises Ltd. RCL reported mixed third-quarter 2025 results on Oct. 28, with adjusted EPS surpassing expectations and revenues coming in slightly below. The company posted year-over-year growth in key metrics, supported by continued solid demand for cruise vacations and strong close-in bookings.

Adjusted earnings per share came in at $5.75, up 11% from the prior year. Revenues totaled $5.14 billion, reflecting a 5% increase from the year-ago period. Higher capacity and strong booking trends helped lift performance, with the company delivering nearly 2.5 million vacations in the quarter. The company also highlighted healthy onboard spending and high guest satisfaction, which continue to support financial momentum heading into the remainder of the year.

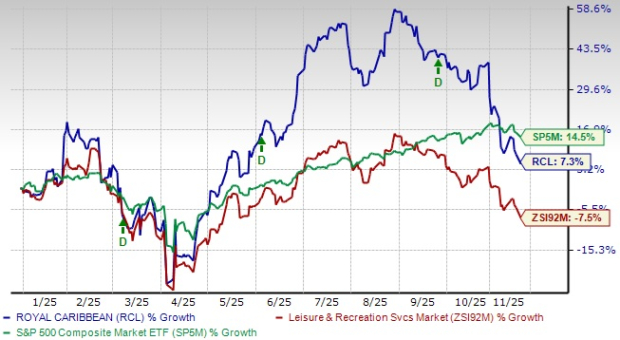

Shares of Royal Caribbean have risen 7.3% in the year-to-date period against the Zacks Leisure and Recreation Services industry’s 7.5% decline. Over the same timeframe, the stock has outperformed the S&P 500’s growth of 14.5%.

The stock has outperformed some other players, including Carnival Corporation & plc CCL, Norwegian Cruise Line Holdings Ltd. NCLH and OneSpaWorld Holdings Limited OSW. So far in the year, Carnival and OneSpaWorld have rallied 2% and 0.4%, respectively, while Norwegian Cruise has lost 31.9%.

Although the quarter showed solid demand and growth, the 15.5% drop in the stock following the results brings focus to the drivers of performance and the areas of concern ahead.

Royal Caribbean is benefiting from a robust demand environment, supported by rising consumer interest in leisure travel and the brand’s ability to deliver differentiated vacation experiences. The company’s broad portfolio of itineraries, modern fleet and high guest satisfaction scores remain key drivers of sustained booking strength across markets.

During the third quarter, management highlighted accelerated bookings across both new and existing ships, particularly for close-in sailings. Booked load factors for 2025 and 2026 remained within historical ranges but at record levels, with 2026 pricing tracking at the high end of historical norms. The company also noted that 2026 bookings are trending well above prior-year levels, underscoring strong demand across itineraries. Looking ahead, Royal Caribbean expects strong booking momentum to continue as demand remains broad-based across brands and regions.

The company is advancing a strategic fleet expansion plan centered on innovation, guest experience and long-term margin enhancement. Newer vessels are designed with high-margin amenities, improved fuel efficiency and stronger revenue-generating potential, strengthening Royal Caribbean’s competitive positioning across global markets.

Offerings across the fleet, including Star of the Seas and Celebrity Xcel, are expected to drive double-digit capacity growth in late-2025 while contributing to incremental yield improvement. The company also emphasized strong early interest in offerings such as Star of the Seas, Celebrity Xcel, the Royal Beach Club Paradise Island and especially Celebrity River, which sold out its opening deployment almost immediately.

Looking further ahead, the introduction of Legend of the Seas in 2026 and a long-term shipbuilding agreement with Meyer Turku — featuring Icon 5 (2028) and an option for a seventh Icon-class ship — reinforce the company’s long-term commitment to sustainable growth. Royal Caribbean expects these next-generation ships and destination expansions to deepen brand loyalty, attract new guests and support steady capacity and yield growth.

Digital engagement has become a major revenue and experience driver for Royal Caribbean, with technology playing an increasingly central role in shaping the end-to-end customer journey. The company’s focus on convenience, personalization and frictionless onboard experiences has led to higher guest satisfaction and stronger spending trends.

In the third quarter, Royal Caribbean reported double-digit growth in e-commerce visits and conversion rates, with nearly 90% of onboard revenues booked pre-cruise through digital channels. Management also emphasized the growing role of data, AI and predictive analytics in shaping personalized offers and optimizing pricing across its commercial systems. These capabilities have helped drive record levels of pre-cruise purchases and greater cross-brand loyalty engagement. Looking forward, the company expects digital adoption to rise further as more guests engage through the app and as personalized recommendations become more targeted.

In 2025, the company expects adjusted EPS to be between $15.58 and $15.63 compared with the previous expectation of $15.41-$15.55.

The Zacks Consensus Estimate for RCL’s 2025 and 2026 earnings implies a year-over-year uptick of 32.5% and 14.6%, respectively. EPS estimates for 2025 have increased in the past 60 days. This upward trend reflects strengthened analyst confidence in the stock’s near-term prospects.

Conversely, Carnival, Norwegian Cruise and OneSpaWorld’s earnings in the current year are likely to witness year-over-year increases of 52.8%, 14.8% and 20%, respectively.

While Royal Caribbean’s demand backdrop remains healthy, it acknowledged several near-term headwinds that could temper performance. In the third quarter of 2025, net cruise costs excluding fuel rose 4.3%, reflecting higher operating expenses and ongoing investments in new destinations such as Perfect Day Mexico and the Royal Beach Club Nassau. The company noted that while technology and scale efficiencies helped, these structural costs still weighed on margins.

Looking ahead, additional pressures stem from higher fuel expenses, projected at $1.14 billion for 2025, and increased dry dock activity planned for 2026, including several modernization projects. The company also highlighted a more promotional environment in the Caribbean due to broader industry capacity growth. Even so, Royal Caribbean remains confident that strong pricing and disciplined execution will help offset these near-term challenges.

Royal Caribbean stock is currently trading at a discount. RCL is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 13.98X, below the industry average of 15.48X, reflecting an attractive investment opportunity.

Other industry players, such as Carnival, Norwegian Cruise and OneSpaWorld, have P/E ratios of 13.30X, 10.29X and 19.69X, respectively.

Royal Caribbean’s solid booking trends, expanding fleet and strengthening digital ecosystem underline its strong demand backdrop and long-term growth potential. Earnings revisions have also moved higher, reflecting increased analyst confidence. However, rising cost pressures, heightened industry capacity in key markets and upcoming dry dock activity introduce near-term uncertainties. With these mixed signals, the stock’s post-earnings pullback appears tied more to these headwinds than to any deterioration in demand fundamentals.

Given this setup, this Zacks Rank #3 (Hold) company appears fairly valued at current levels. Existing investors may consider holding RCL as earnings visibility for 2026 improves, while new investors might wait for a more attractive entry point before initiating positions.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite