|

|

|

|

|||||

|

|

IonQ, Rigetti, and D-Wave are three of the most popular quantum computing stocks.

However, these quantum pure-plays are trading at unsustainable valuations.

Big tech is the best way to gain safe exposure to the quantum AI opportunity.

If you've invested in artificial intelligence (AI) stocks over the last few years, odds are you've made some money. And if you chose to invest in big tech -- namely, the "Magnificent Seven" -- then you may be wondering just how much higher these mega-cap behemoths can fly.

From time to time, investors become exhausted by the same old run-of-the-mill opportunities and begin to rotate capital into new positions. Over the last year, one emerging pocket of the AI landscape that's garnered its share of intrigue is quantum computing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Within the quantum computing industry, pure-plays like IonQ, Rigetti Computing, and D-Wave Quantum have become all the rage. Around this time last year, all of these companies were trading near penny stock levels. Now, they are collectively worth more than $30 billion.

IONQ Market Cap data by YCharts.

While some traders undoubtedly made money in these speculative stocks, odds are that the easy profits are a thing of the past. Below, I'll break down why investing in IonQ, Rigetti, and D-Wave looks risky right now. From there, I'll make the case for why Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) is my top quantum computing stock and explain how an investment in the internet giant could be worth millions down the road.

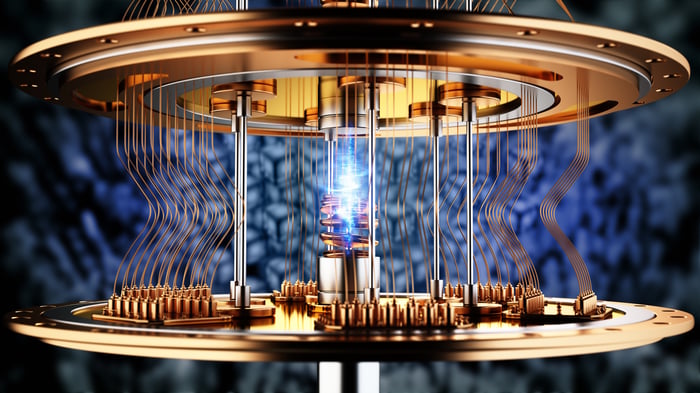

Image source: Getty Images.

Quantum computing is more of a theoretical domain than a concrete opportunity with measurable results. While enthusiasts proclaim that quantum AI will upend classical computing systems, the reality is that this technology currently has little commercial application.

While IonQ, Rigetti, and D-Wave often find their names in headlines featuring exploratory simulations around their trapped ion and superconducting approaches to quantum architectures, none of these companies has truly reached a breakthrough that's led to widespread enterprise adoption.

This begs the question: What has fueled the meteoric rise in quantum computing stocks? To me, the answer is quite simple. Some growth investors became interested in AI businesses beyond semiconductors and software and speculatively opened up positions in the quantum pure-plays.

Over time, IonQ, Rigetti, and D-Wave began to garner some momentum and swiftly turned into meme stocks. While retail investors follow the crowd, leadership at the pure-plays has been capitalizing.

For instance, Rigetti Computing CEO Subodh Kulkarni sold millions worth of stock in May, when shares traded for an already-rich $12. Kulkarni said recently that the company is primarily in a research and development (R&D) phase and remains years away from meaningful revenue.

Meanwhile, IonQ has been on a spending spree of epic proportions. Since 2024, the company has spent more than $2.5 billion on acquisitions. Yet, over this same timeframe, IonQ generated less than $100 million in annual revenue. All the while, losses continue to mount. Given its nominal levels of revenue and cash burn, IonQ has resorted to continuous stock issuances to fund its acquisition pipeline.

IONQ PS Ratio data by YCharts.

Perhaps the most glaring issue I see with the quantum pure-plays is valuation, as you can see in the chart above. Despite some recent selling activity, each of these stocks still trades at price-to-sales (P/S) multiples that are so high that even the most euphoric investors during prior bubbles would blush. For context, Microsoft and Amazon reached peak P/S ratios of 31 and 51, respectively, at the height of the dot-com boom.

In my eyes, IonQ, Rigetti, and D-Wave are all on a chilling collision course with history -- and at this point, I think day traders are cashing out and beginning to move on.

Image source: Getty Images.

Alphabet is one of the most diversified businesses in the technology landscape. Its businesses span cybersecurity, cloud computing, custom chips, autonomous driving, streaming, consumer electronics, and internet search.

Had you invested a sum of $10,000 at the time of Alphabet's IPO and held on to your investment, you would be a millionaire today. Gains of this magnitude speak volumes about Alphabet's ability to develop and monetize new, groundbreaking products.

When it comes to AI, one of Alphabet's most strategic -- albeit overlooked -- assets is its in-house research lab, DeepMind. This subsidiary gives Alphabet an edge when it comes to exploring new technologies and product launches.

When it comes to quantum computing specifically, Alphabet has designed its own processor, known as Willow. Over the past year, Willow has been used in a number of exploratory simulations while being benchmarked against today's most powerful supercomputers.

Even though quantum computing is not yet part of Alphabet's primary revenue and profit drivers, I am encouraged by the company's investments in this technology. In the long run, Alphabet has a unique opportunity to vertically integrate its quantum-powered products into its existing AI ecosystem.

Against this backdrop, I think Alphabet is well-positioned to remain a leader in the $15.7 trillion AI market -- of which an estimated $1.3 trillion in value could stem from quantum applications, according to research from McKinsey & Company.

For these reasons, I think an investment in Alphabet today could be similar to one in its early years in a post-dot-com environment. Artificial intelligence represents a generational opportunity, and within that market, quantum computing could prove to be one of the most disruptive chapters.

Given the company's successful track record of scaling various products and services, I think a buy-and-hold approach to investing in Alphabet could result in more millions for patient investors in the decades ahead as the AI and quantum narratives continue to unfold.

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,222!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,342!*

Now, it’s worth noting Stock Advisor’s total average return is 1,016% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 17, 2025

Adam Spatacco has positions in Alphabet, Amazon, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, IonQ, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 33 min | |

| 54 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Quantum Computing Stocks: Infleqtion Pops In First Day As Public Company

QBTS -6.25% RGTI IONQ

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite