|

|

|

|

|||||

|

|

Mission Produce Inc. AVO shares have lost momentum since the release of its fiscal third-quarter 2025 results, with the stock showing a noticeable slowdown in the past three months. This weakening trend has pushed AVO below key industry benchmarks and triggered bearish technical signals, reflecting a shift toward growing investor caution. As a result, the AVO stock slipped below its 200-day simple moving average (SMA) on Nov. 19. Notably, the stock closed at $11.42 on Nov. 19, 2025, moving below the 200-day SMA of $11.58. Since then, the AVO stock has been on a downtrend.

Mission Produce’s drop below the 200-day SMA signals weakness, suggesting a shift from long-term bullish to bearish sentiment. It highlights fading investor confidence and slower buying interest.

However, the stock trades below its 50-day SMA, indicating a bearish sentiment toward its short-term fundamentals and market outlook. SMA is an essential tool in technical analysis that helps investors evaluate price trends by smoothing out short-term fluctuations. This approach also provides a clearer perspective on a stock's long-term direction.

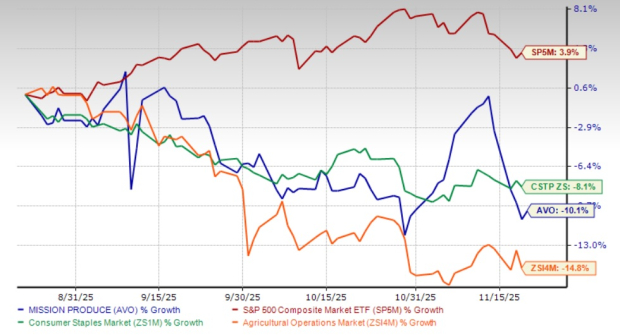

Mission Produce’s lost momentum is evident from its 10.1% decline in the past three months compared with the Zacks Agriculture – Operations industry’s fall of 14.8%. The stock has also underperformed the broader Zacks Consumer Staples sector’s decline of 8.1% and the S&P 500's rally of 3.9% in the same period.

AVO’s performance is notably weaker than that of its competitors, Archer Daniels Midland Company ADM and Dole Plc DOLE, which have declined 8% and 8.4%, respectively, in the past three months. However, the stock fared better than Corteva Inc.’s CTVA decline of 12.3% in the same period.

At its current price of $11.51, the Mission Produce stock trades 20.4% above its 52-week low mark of $9.56 and 24.5% below its 52-week high mark of $15.25.

Mission Produce continues to demonstrate operational resilience, but several underlying challenges are preventing its stock from gaining meaningful traction. While the company delivered another solid quarter, the market remains cautious because many of AVO’s pressures stem from industry structure and business-model dynamics rather than quarterly fluctuations.

One of the biggest overhangs is the normalization of margins in its core distribution business. Last year’s unusually favorable conditions created elevated per-unit profitability that investors now recognize as unsustainable. As margins settle back to historical levels, sentiment has cooled, even as volumes rise. This dynamic reflects the broader nature of the avocado market, which is competitive, price-sensitive, and heavily influenced by global supply patterns.

AVO is also contending with volatile pricing environments, which remain deeply tied to weather, crop cycles, and sourcing shifts across Peru, Mexico, and other key regions. Even when harvests are strong, pricing often softens, which compresses profitability. This structural sensitivity to supply swings keeps earnings visibility relatively limited, a factor that often weighs on valuation.

Another headwind is rising operating complexity and cost intensity across its global footprint. Higher employee-related expenses, incentive costs, and region-specific obligations continue to pressure operating leverage, making it harder for revenue growth to translate into stock-moving profit expansion.

Collectively, these structural pressures, margin normalization, pricing volatility, cost escalation, and investment demands form the fundamental backdrop behind AVO’s subdued stock performance despite operational strength.

The Zacks Consensus Estimate for AVO’s fiscal 2025 and 2026 earnings per share (EPS) was unchanged in the last 30 days. For fiscal 2025, the Zacks Consensus Estimate for AVO’s sales implies year-over-year growth of 12.1%, while the estimate for EPS indicates a 9.5% fall. The consensus mark for fiscal 2026 sales and earnings suggests year-over-year declines of 9.7% and 28.4%, respectively.

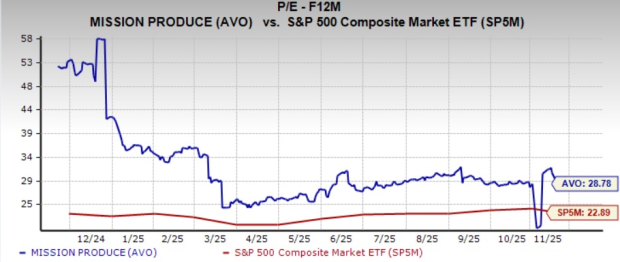

Mission Produce is currently trading at a forward 12-month P/E multiple of 28.78X, exceeding the industry average of 22.89X.

At 28.78X P/E, Mission Produce trades at a significant premium to its industry peers. The company’s peers, such as Archer Daniels, Corteva and Dole, are delivering growth and trade at more reasonable multiples. Archer Daniels, Corteva and Dole have forward 12-month P/E ratios of 13.57X, 17.77X and 9.94X — all significantly lower than that of AVO.

Although the current valuation may seem expensive, it suggests that investors have high expectations for AVO's future performance and growth potential. The company’s capability to execute its strategy and capitalize on a favorable pricing environment is essential for ensuring profitability and consistent performance in its Marketing and Distribution segment. While success in these areas can strengthen its market leadership, its failure can pose serious challenges for AVO.

Mission Produce stands at a crossroads where solid fundamentals coexist with visible market pressures. On the positive side, the company continues to deliver steady operational performance, supported by a vertically integrated model, improving production trends, and stable estimate revisions that signal confidence in its near-term outlook. These strengths demonstrate that AVO’s core business remains intact despite a challenging environment.

However, the market is signaling caution. The stock’s recent decline and its drop below key technical levels reflect weakening sentiment and fading momentum. Bearish trading patterns in the past three months indicate that investors are weighing short-term concerns more heavily than operational progress. At the same time, the company’s premium valuation suggests that the market still expects meaningful future growth and is willing to price in that potential despite near-term volatility.

In essence, AVO’s situation is a blend of optimism and skepticism. Its strong execution and stable earnings outlook support the long-term narrative, but technical softness and a rich valuation highlight the risks investors are factoring in today. Avo currently has a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 31 min | |

| 2 hours | |

| 5 hours | |

| 16 hours | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite