|

|

|

|

|||||

|

|

Netflix NFLX is slated to report first-quarter 2025 results on Thursday.

For the first quarter of 2025, Netflix forecasts revenues to increase 11%, which equates to 14% growth on an F/X neutral basis, which is modestly below the full-year guidance due to the timing of price changes and the seasonality of the ads business.

The company anticipates total revenues to be $10.416 billion, suggesting growth of 11.2% year over year. The consensus mark for revenues is pinned at $10.54 billion, above the company’s expectations, indicating 12.5% year-over-year growth.

NFLX has projected earnings of $5.58 per share. The Zacks Consensus Estimate for the same is pegged at $5.74 per share, currently above the company’s expectations. The estimate has remained steady over the past 30 days.

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

In the last reported quarter, the company delivered an earnings surprise of 1.67%. The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 7.17%.

Netflix, Inc. price-eps-surprise | Netflix, Inc. Quote

Our proven model does not predict an earnings beat for Netflix this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

NFLX has an Earnings ESP of -2.23% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

As Netflix approaches its first-quarter 2025 earnings report, investors should maintain current positions rather than adding to them at present valuations, despite the company's strong performance trajectory. The streaming giant ended 2024 with impressive numbers, adding a record 19 million paid subscribers in the fourth quarter to reach 302 million memberships, while growing revenues 16% year over year.

For first-quarter 2025, Netflix has guided an operating margin of 28.2%. This slower growth compared to previous quarters reflects typical first-quarter seasonality and the timing of price changes, alongside headwinds from the strengthening U.S. dollar. The company's content momentum continues with the return of highly anticipated shows, including Squid Game, Wednesday and Stranger Things, scheduled throughout 2025. First-quarter specifically featured the third season of Alpha Males in January, followed by the Chinese romantic comedy I am Married...But! in February, with period piece The Lady's Companion closing the quarter in March.

Live content remains a growing focus, with the 52-week WWE programming deal beginning to materialize and preparations for future NFL Christmas Day broadcasts following last year's success. The ad-supported tier also continues gaining traction, representing more than 55% of sign-ups in markets where available, with further monetization expected throughout 2025.

Netflix's push into international markets continues with region-specific content like The Trauma Code: Heroes on Call (Korea), Little Siberia (Finland), and The Snow Girl 2 (Spain), all premiering in the first quarter, helping drive global engagement alongside unscripted hits like Single's Inferno season 4. While the company targets doubling its advertising revenues in 2025 and expects an operating margin of 29% for the full year, the stock currently trades at elevated multiples reflecting much of this anticipated growth.

The potential impact of further price increases on subscriber retention, alongside growing competition from the likes of Apple AAPL, Amazon AMZN and Disney’s DIS streaming platforms, beside near-term currency pressures, suggests investors should maintain positions but exercise patience before adding to them ahead of first-quarter results.

The Zacks Consensus Estimate for paid total streaming net membership additions is pegged at 4.36 million.

The consensus mark for first-quarter 2024 Asia-Pacific revenues is pegged at $1.22 billion, indicating 20.1% growth from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for Latin America revenues is pegged at $1.25 billion, suggesting a rise of 8.1% from the figure reported in the previous quarter.

Moreover, the consensus mark for EMEA revenues is pegged at $3.3 billion, suggesting an increase of 11.8% from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for the United States and Canada revenues is pegged at $4.73 billion, indicating a 12.1% rise from the figure reported in the year-ago quarter.

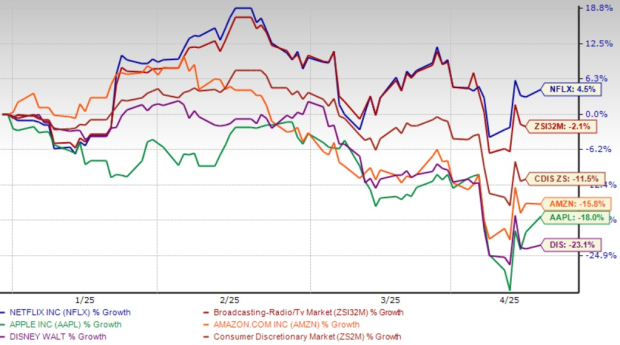

Shares of Netflix have gained 4.5% in the year-to-date period compared with the Zacks Consumer Discretionary sector, Apple, Amazon and Disney’s decline of 11.5%, 18%, 15.8% and 23.1%, respectively.

Now, let’s look at the value Netflix offers investors at current levels. Currently, NFLX is trading at 35.4X forward 12 months earnings, above its five-year median of 33.79X. Meanwhile, the Zacks Broadcast Radio and Television industry’s forward earnings multiple sits at 25.29X. The company’s valuation looks somewhat stretched compared with its range and the industry average.

Netflix demonstrates strong business fundamentals with record subscriber growth, an expanding content slate, and promising international expansion. However, investors should consider holding positions rather than adding at current valuations ahead of first-quarter 2025 results. While the company's advertising revenues are poised to double in 2025 and operating margins continue improving to a targeted 29%, much of this growth appears priced in. Currency headwinds, intensifying premium competition, and uncertain subscriber retention following recent price increases suggest waiting for a more attractive entry point. The return of flagship shows and live sports initiatives creates long-term value, but patience may reward investors seeking better risk-reward dynamics.

Netflix's trajectory remains positive, but current valuations largely reflect its projected growth. With first-quarter traditionally showing seasonal weakness, currency headwinds persisting, and competition intensifying, investors should maintain existing positions while awaiting a more favorable entry point. The company's content strength and advertising potential provide long-term upside, but prudent investors might benefit from patience ahead of first-quarter results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 47 min |

Iran Says Khamenei Killed As U.S.-Israeli Attacks Continue; How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 1 hour |

Trump Says Khamenei Killed In U.S.-Israeli Attacks. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours |

Trump Says Khamenei Likely Killed In U.S.-Israeli Attacks On Iran. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 6 hours | |

| 6 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite