|

|

|

|

|||||

|

|

Artificial intelligence remains one of the market’s most dynamic themes, and within this space, both SoundHound AI SOUN and Veritone VERI are positioned around high-growth enterprise applications. SoundHound focuses on conversational and voice-driven AI experiences spanning automotive, restaurants, customer service and IoT devices, while Veritone centers on transforming unstructured data into usable AI assets through its aiWARE platform and rapidly expanding Data Refinery offering.

These companies share several similarities: both operate in enterprise AI, both are shifting toward higher-margin software models, and both posted strong revenue growth in the latest quarter. Each also highlights expanding pipelines and strategic partnerships that could fuel durable adoption. However, they differ sharply in business models, financial profiles, valuation and near-term expectations, making the comparison highly relevant for investors today.

With investor sentiment fractured across AI subsectors, contrasting a premium-valued growth story like SoundHound with a turnaround acceleration story like Veritone offers a timely perspective on where upside potential may lie. Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

SoundHound delivered another quarter of strong revenue expansion, reporting third-quarter 2025 revenue of $42 million, up 68% year over year, supported by diversified deployments across automotive, restaurants, financial services, IoT and telecommunications. Management emphasized that enterprise AI adoption continues to accelerate globally, with the company expanding its presence across millions of endpoints and forging new strategic partnerships that enhance its Agentic+ framework. The earnings call highlighted major product progress, including the rollout of its Polaris multimodal foundation model and integration of acquired Interactions technology to strengthen its agentic contact-center capabilities.

From a competitive standpoint, SoundHound positions itself as a leading independent voice AI platform with proprietary technology and deep language capabilities, supporting cloud, edge and hybrid deployments across 25 languages. Automotive continues to be a major growth engine, with deployments across Jeep, luxury vehicle brands, EV manufacturers and commercial fleets, while restaurant adoption expanded through deals with full-service chains and franchise wins with brands including Five Guys and Firehouse Subs. Consumer device partnerships, including a major commitment for AI-enabled smart devices in Asia, further demonstrate potential scale.

However, SoundHound’s growth remains costly. The company continues to post sizable losses, with GAAP operating loss significantly impacted by fair-value adjustments tied to contingent acquisition liabilities. Integration efforts and rapid scaling, while strategically important, add operational complexity and introduce execution risk. The acquisition-driven expansion strategy also heightens dependency on successful post-merger integration and synergy realization. While management stresses improving efficiency and cost leverage, profitability remains distant.

Another major consideration is valuation expectations. SoundHound captures investor imagination given its technology leadership and high-growth profile, but this enthusiasm requires continuous delivery and market penetration to justify its premium market pricing. Any slowdown in adoption or challenges to monetizing deployments could pressure the stock. The company’s high revenue concentration in emerging verticals like voice commerce and automotive software also exposes it to implementation cycles and OEM timelines.

Overall, SoundHound’s strengths lie in platform scale, differentiated technology, deep enterprise adoption and expanding product breadth. Yet the company’s financial profile remains heavily weighted toward growth investment, with profitability and cash efficiency still forming a critical part of the long-term story.

Veritone’s latest quarter shows a company that has fundamentally reshaped its financial position and strategic focus. Third-quarter 2025 revenue grew 32% year over year to $29.1 million, driven by accelerating Software Products & Services revenue, which rose 55%, and more than 200% excluding Veritone Hire. The company also highlighted a rapidly expanding Data Refinery bookings pipeline exceeding $40 million, up 100% since August and 400% since the first quarter, positioning the business to capitalize on soaring demand for AI-ready data sets.

On the earnings call, management stressed that Veritone has executed a major balance-sheet transformation, retiring all senior secured term debt and repurchasing roughly half of its convertible notes, reducing annual debt service from over $14 million to approximately $800,000. The company also raised more than $100 million in recent equity transactions, giving it liquidity to fund operations through 2026 and support its targeted profitability timeline in the latter half of next year. This financial reset provides stability and reduces solvency risk—key improvements compared to prior periods.

Strategically, Veritone’s positioning in data tokenization and AI application deployment appears increasingly timely. The Data Refinery solution transforms unstructured audio, video, image and text content into monetizable, model-ready datasets, with growing adoption from hyperscalers, media organizations and public-sector agencies. With contracts spanning ESPN, NCAA, Newsmax, CBS and numerous government agencies, Veritone is expanding across both commercial and public segments.

Veritone also benefits from recurring software revenue, improving operating efficiency and a more focused business model after divesting lower-margin operations. Management’s confidence in reaching profitability in 2026 adds credibility, given the improved cost structure. The company remains smaller and earlier in its revenue ramp than SoundHound, but its financial trajectory shows strengthening fundamentals and clearer near-term earnings leverage.

The primary risk for Veritone is execution against its aggressive growth and monetization targets. While pipeline expansion is impressive, converting opportunities into sustained recurring revenue and scaling Data Refinery deployments will determine long-term success. Competition in AI training data and enterprise applications remains intense, requiring continued product innovation and commercial wins.

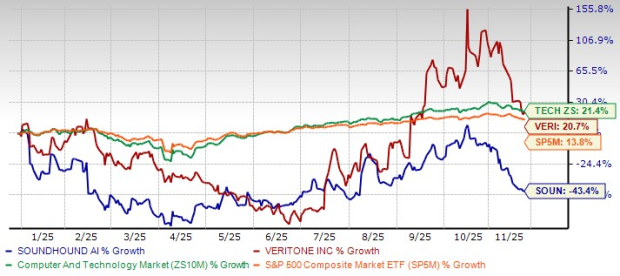

The market has clearly differentiated between the two stocks in 2025. SoundHound shares are down 43.4% year to date (YTD), significantly underperforming both the broader Zacks Computer and Technology sector, which is up 21.4%, and the S&P 500, up 13.8% over the same period. Weak sentiment reflects concerns around losses, dilution risk and valuation.

In contrast, Veritone stock is up 20.7% YTD, performing roughly in line with the tech sector and outperforming the S&P 500. The stock has benefited from improving fundamentals, balance-sheet strengthening and renewed investor confidence in its strategic direction.

SOUN Vs VERI Stock Performance

Valuation represents one of the most notable distinctions between the two companies. SoundHound trades at a forward 12-month price-to-sales (P/S) ratio of 20.64X, reflecting high growth expectations and premium positioning. Veritone trades at a significantly lower 2.71X forward P/S, well below the 6.46X sector average.

This spread introduces a wide divergence in implied upside potential. SoundHound requires sustained execution and margin expansion to support its valuation, while Veritone could see multiple expansions if it continues delivering growth and profitability progress.

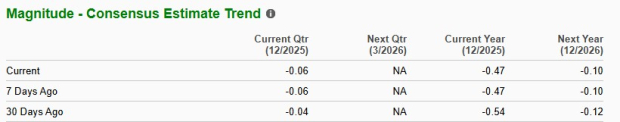

EPS revisions reinforce this divergence. Over the past 30 days, the Zacks Consensus Estimate for SoundHound’s 2025 loss per share remained unchanged at 13 cents, though this reflects improvement from a loss of $1.04 per share in the prior year. The lack of estimate improvement signals limited near-term sentiment shift.

SOUN Stock

Meanwhile, Veritone’s 2025 loss estimate narrowed to 47 cents per share from 54 cents, reflecting analysts’ growing confidence in its path toward improved margins and profitability. This revision trend aligns with operational improvements and balance-sheet strengthening.

VERI Stock

Both companies operate in attractive AI markets and demonstrate strong momentum in their respective domains. SoundHound offers scale, technological leadership and broad enterprise adoption, positioning it well for long-term growth. However, its premium valuation, continued losses and lack of near-term estimate improvement create meaningful execution risk.

Veritone, by comparison, combines accelerating software growth, a transformed balance sheet, improving operating leverage, and positive estimate revisions at a far lower valuation. With the company targeting profitability in 2026 and securing major commercial and public-sector wins, the near-term risk/reward profile appears more favorable.

Considering that SoundHound currently carries a Zacks Rank #4 (Sell) and Veritone holds a Zacks Rank #2 (Buy), Veritone stands out as the solid bet right now and appears to offer greater upside potential in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite