|

|

|

|

|||||

|

|

Carnival Corporation & plc CCL and Royal Caribbean Cruises Ltd. RCL remain two dominant forces steering the global cruise industry’s recovery, each capitalizing on resilient travel demand and record onboard spending trends.

With booking momentum holding strong and pricing power at multi-year highs, both stocks have staged impressive rebounds. Yet, investors are now weighing which company offers the more compelling opportunity as the sector transitions from post-pandemic resurgence to sustained profitability and balance-sheet repair. In this faceoff, we break down how the two cruise giants stack up across growth prospects, financial health and valuation to determine which name is better positioned now.

Carnival’s third-quarter fiscal 2025 results show it firing on multiple cylinders. Management highlighted record revenues, net income and yields, with strong onboard spending and close-in demand continuing to surprise to the upside. The company is also demonstrating cost discipline, beating expectations on unit costs thanks to operational efficiencies.

Customer deposits hit a fresh record in third-quarter fiscal 2025, signaling elevated booking momentum and pricing power into 2026. Leadership is confident that returns can keep rising, given ongoing margin expansion and a long runway for same-ship yield improvement. Meanwhile, Carnival is rapidly strengthening its financial position, lowering leverage to 3.6x and nearing investment-grade metrics, paving the way for a return to dividends and buybacks.

The company’s refreshed commercial initiatives, including exclusive destinations like Celebration Key and a multi-brand strategy spanning North America and Europe, are already contributing to ticket price premiums and enhanced guest experiences. With minimal new capacity additions ahead, Carnival is positioned to drive growth from pricing rather than ship deployments, supporting continued free cash flow generation.

That said, Carnival’s turnaround is still ongoing. Net interest expense remains materially higher than pre-pandemic levels, and despite improvements, leverage is not yet at the company’s long-term target. Looking ahead to 2026, management acknowledged several headwinds: the rollout of a new loyalty program pressuring yields, incremental destination-related operating costs, and elevated dry dock spending, together adding up to as much as 200 basis points of margin drag next year.

Royal Caribbean continues to benefit from a healthy global appetite for leisure travel, with consumers willing to prioritize vacations even as spending normalizes. Management highlighted all-time-high guest satisfaction, strong new-to-cruise demand and growing loyalty, all helping sustain pricing power. Booking trends remain robust, with record rates for both 2025 and 2026, and higher average per-day pricing locked in early.

The company is also delivering margin growth through tight cost discipline, supported by technology and AI efficiencies. It expects “anemic” cost growth even while expanding destination offerings, a formula management believes supports continued earnings acceleration. A solid balance sheet further enables capital return through dividends and share buybacks.

Looking ahead, RCL is leaning into its competitive strengths: innovative ships, exclusive destinations and a fast-scaling digital commerce platform that is driving more onboard revenue pre-cruise. Private islands and beach clubs are proving high-margin revenue engines, further differentiating the brand as more capacity flows into the Caribbean.

Despite the momentum, there are still areas of concern. Yield growth has slowed from prior double-digit surges, reflecting tougher comparisons and mix shifts that increase reliance on close-in demand, particularly in shorter itineraries. Management acknowledged a slightly more promotional Caribbean environment tied to rising industry supply in the region.

New destination rollouts and onboard expansion also come with structural costs and higher depreciation. Additionally, RCL expects increased fuel and regulatory expense pressures, including full exposure to the European Union emissions trading system in 2026. Global minimum tax changes will also drive taxes higher. These below-the-line headwinds could partially offset revenue gains.

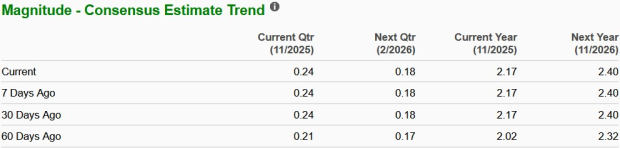

The Zacks Consensus Estimate for Carnival’s fiscal 2026 sales and EPS indicates year-over-year increases of 4.3% and 10.8%, respectively. In the past 60 days, earnings estimates for fiscal 2026 have witnessed upward revisions, as shown in the chart.

The Zacks Consensus Estimate for Royal Caribbean’s 2026 sales and EPS implies year-over-year growth of 9.4% and 14.5%, respectively. In the past 60 days, earnings estimates for 2026 have witnessed downward revisions.

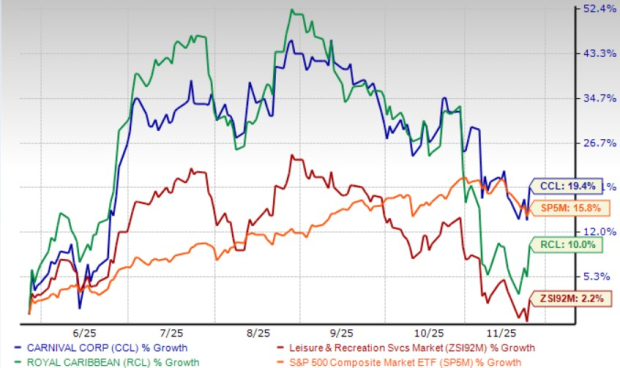

Royal Caribbean stock has risen 10% in the past six months, significantly outpacing its industry’s growth of 2.2%. Meanwhile, Carnival’s shares have gained 19.4% in the same time.

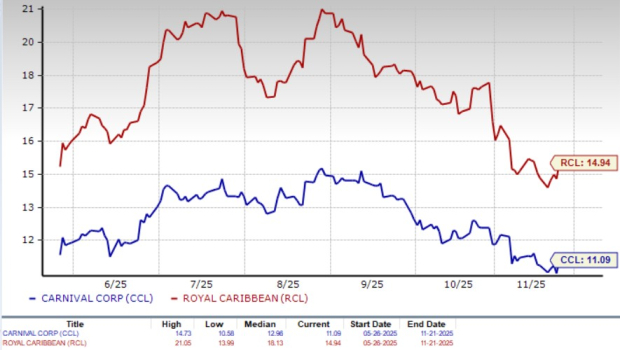

RCL is trading at a forward 12-month price-to-earnings ratio of 14.94X, below its median of 18.13X over the last year. CCL’s forward earnings multiple sits at 11.09X, below its median of 12.96X over the same time frame.

Carnival appears to offer the more compelling upside at this stage of the recovery, given its accelerating operational turnaround, faster improvement in financial health and stronger recent stock momentum. The company is generating meaningful gains in pricing and onboard spending while benefiting from record customer deposits that signal continued booking strength. Carnival’s strategic shift toward enhancing destinations and driving more yield from its existing fleet provides a clearer path to sustained margin expansion and growing free cash flow.

Although reinvestment needs remain, Carnival’s progress toward a healthier balance sheet and the potential reinstatement of shareholder returns provide catalysts that could unlock further valuation gains. Royal Caribbean remains a high-quality operator with strong demand trends, so existing investors in both should hold on.

Both CCL and RCL carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite