|

|

|

|

|||||

|

|

Canadian Natural Resources Limited (CNQ) may have touched a fresh 52-week high last Thursday, but the stock still shows little sign of losing momentum. Its steady climb reflects more than just favorable commodity moves — it highlights a business firing on all cylinders, executing well, and outperforming peers through disciplined operations and shareholder-focused capital allocation. Even as investors take note of the rally, the underlying fundamentals continue to strengthen in ways that justify taking a closer look.

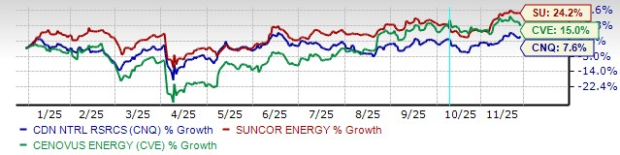

The broader Canadian energy space has been healthy this year, but CNQ’s position remains distinctive. Year to date, the stock is up 7.6% compared with 15% for Cenovus Energy (CVE) and more than 24% for Suncor Energy (SU). Yet CNQ’s performance becomes far more compelling when viewed alongside its consistent earnings delivery, deep resource base, and best-in-class dividend program. This combination sets up the rest of the analysis — a closer look at what is driving the stock and why many investors still believe there is room for further upside.

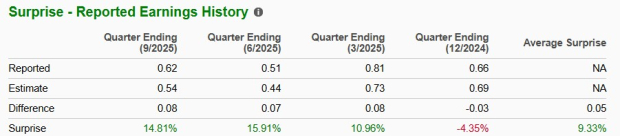

Before diving into the details, it’s worth noting one more important setup: CNQ has beaten the Zacks Consensus Estimate in three of the last four quarters, with an average surprise of 9.3%. In a sector often defined by volatility, that consistency is powerful. It frames the story of a company with tangible operational traction, expanding production, improving mix, and building meaningful cash-flow leverage.

CNQ’s third-quarter numbers showcased a company at scale, achieving record production of 1.62 million BOE/d — an 18.9% jump from last year. Both liquids and natural gas reached all-time highs, supported by strong execution and accretive acquisitions across the Duvernay, Montney and Palliser regions. This production momentum also helped materially expand near-term cash generation. Adjusted funds flow reached roughly C$3.9 billion, reinforcing the strength of CNQ’s operating engine.

This performance also highlights the advantage that Canadian Natural maintains over peers like Suncor Energy and Cenovus. While all three producers benefit from Canada’s high-quality resource base, CNQ’s long-life, low-decline assets deliver steadier output and require less sustaining capital. Oil sands mining averaged 581,000 barrels per day at over 100% utilization in the quarter — another reminder that the company is executing with precision and consistency, even in a volatile pricing environment.

One of CNQ’s biggest strengths continues to be its deep, low-decline resource base. With the second-largest reserves among global energy producers, the company enjoys multidecade production visibility — a luxury that peers like Suncor Energy and Cenovus cannot quite match. The completion of the AOSP swap with Shell further strengthened this position, giving Canadian Natural full ownership of the Albian oil sands mines and an 80% stake in the Scotford Upgrader. The deal adds a stable 31,000 barrels per day of zero-decline bitumen, enhancing integration, reducing volatility, and improving long-term cash-flow strength.

Operating costs across the oil sands remain exceptionally competitive. Mining and upgrading costs averaged roughly C$21 per barrel, while thermal in-situ projects continued to deliver some of the lowest costs in the sector. These strong metrics allow CNQ to widen margins, strengthen operating leverage, and handle periods of weaker commodity prices more effectively than many of its peers.

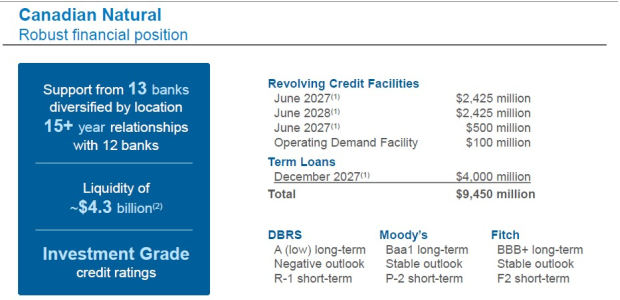

CNQ’s financial profile is one of the cleanest in the global energy sector. With investment grade credit ratings, net-debt-to-EBITDA of just 0.9X, and more than C$4.3 billion in liquidity, the balance sheet offers stability and flexibility. The company has returned roughly C$6.2 billion to its shareholders year to date through dividends and buybacks, including C$1.5 billion in the third quarter alone.

Dividend durability is a core part of CNQ’s identity. The company has increased its dividend for 25 straight years — a rare feat among global oil producers — compounding at roughly 21% annually since 2001. Management has already boosted its 2025 payout to an annualized C$2.35 per share and reiterated its intention to return 100% of free cash flow once net debt reaches C$12 billion. This clarity matters for long-term investors who prefer predictable and rising income streams.

Valuation also supports the upside case. CNQ trades at a forward P/E near 15X, slightly above the industry average. While the stock is more expensive than Suncor Energy, it remains cheaper than Cenovus — a pricing setup that reflects investor willingness to pay a modest premium for CNQ’s stability, superior cost structure, and consistent execution.

Even after reaching a new 52-week high, CNQ’s investment story remains compelling. The company combines record production, disciplined capital allocation, a fortress-like balance sheet, and a dividend growth streak, which only a few global energy companies can match. The Zacks Rank #1 (Strong Buy) stock supports this view: consistent earnings surprises and improving growth forecasts position the stock solidly.

In short, Canadian Natural continues to offer an appealing blend of resilience, scale, and shareholder value. For investors seeking stability with room for upside, the stock remains a high-quality candidate within the North American energy landscape.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-10 | |

| Feb-09 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite