|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

With consumers becoming more selective about where they spend, Sprouts Farmers Market, Inc. SFM and Ollie’s Bargain Outlet Holdings, Inc. OLLI are two retailers gaining attention for their value-focused propositions. SFM operates within the highly fragmented grocery industry, positioned as a differentiated health-focused retailer built around fresh produce, natural foods and supplements, while OLLI competes in the closeout and off-price segment, offering brand-name merchandise at deeply discounted prices.

As both retailers navigate shifting consumer priorities, the central question for investors becomes: which company is better positioned to deliver stronger returns in the months ahead?

Sprouts Farmers faces headwinds as slowing comparable sales, shrinking basket sizes and margin normalization signal fading operating momentum. While SFM’s overall third-quarter fiscal 2025 results were decent, comparable-store sales of 5.9% came below management’s expectations and well under the 10.2% and 11.7% growth in the preceding two quarters. This moderation was attributed to tough year-over-year comparisons and a softening consumer backdrop. This slowdown impacts early 2026, as SFM will face tough comparisons from last year’s double-digit sales. The company’s flat to 2% comparable-store growth guidance for the fourth quarter of fiscal 2025 reflects this normalization.

Consumer behavior is adding pressure, particularly in middle-income and younger trade areas where shoppers are becoming more cautious. Management noted that while traffic remains positive, basket sizes are thinning, especially at the “end of the basket.” This pattern resembles prior inflationary pullbacks and reveals that even health-oriented shoppers are becoming value sensitive. Such behavior limits AUR growth. We expect comparable-store sales growth of just 1% and 1.6% in the first and second quarters of 2026, respectively.

Management acknowledged that margin performance will soften in the near term as strong prior-year comparisons and moderating comps weigh on profitability. For the fourth quarter of fiscal 2025, SFM cautioned that both gross margin and SG&A rates are “normalizing,”. Management pointed out that EBIT margins will be flat year over year, with only a “little bit positive” contribution from gross margin offset by pressure on SG&A. We expect gross margin expansion to slow down to 20 basis points (bps) in the final quarter, following expansion of 60 bps, 90 bps and 130 bps in the preceding three quarters.

Nonetheless, Sprouts Farmers has been implementing several initiatives focused on product innovation, customer experience and targeted marketing. The company is expanding its presence in the natural and organic segment while enhancing convenience through its website, mobile app and updated store formats. Private-label offerings now account for more than 25% of sales, with plans to launch about 7,000 new products in 2025, supporting higher-margin growth.

Moreover, Sprouts Farmers is strengthening its omnichannel strategy and supply-chain capabilities. Partnerships with Uber Eats, DoorDash and Instacart have accelerated online visibility, driving a 21% year-over-year rise in e-commerce sales in the third quarter, which now make up 15.5% of sales. The nationwide launch of the Sprouts Rewards loyalty program is boosting engagement.

Store expansion remains robust as well, with nine new openings in the third quarter and a total count of 464 locations, supported by a pipeline of roughly 140 approved sites. Management expects 37 openings in 2025 and continued acceleration to achieve 10%-unit growth by 2027.

Ollie’s continues to strengthen its competitive standing with the core strategy of “buying cheap and selling cheap,” supported by strict cost controls and a focus on improving store productivity. Its loyalty program, Ollie’s Army, remains a powerful growth engine, ending the recent quarter with more than 16 million active members — an increase of over 10% year over year.

These members contribute over 80% of total sales and typically spend about 40% more per visit, helping drive a roughly 5% increase in comparable store sales, supported primarily by higher transaction volumes. The company is well-positioned to benefit from a favorable closeout environment and increased consumer trade-down behavior as shoppers seek greater value.

OLLI continues to reinforce its value-oriented model by leaning into a merchandising strategy that thrives on brand-name closeouts. The company benefits from a steady flow of high-quality deals, allowing it to consistently source recognized brands at attractive terms. This dependable access to compelling inventory strengthens its ability to deliver meaningful savings versus traditional retailers, a core driver of customer loyalty in a value-conscious consumer environment. At the same time, its opportunistic approach to real estate helps the company deepen presence in underserved markets.

On the operational side, Ollie’s is laying the groundwork for sustained expansion by scaling its distribution infrastructure. Management’s plan to enlarge key distribution centers ensures the network can support a significant increase in store count without running into capacity constraints. This proactive buildout reduces long-term logistical risk. With stronger distribution coverage and a clear roadmap for future facilities, Ollie’s is positioning itself to maintain a multi-year growth runway supported by an efficient, well-prepared supply chain.

Ollie's remains committed to its long-term expansion strategy, aiming to have more than 1,300 stores. The company has consistently expanded its store network, achieving an impressive CAGR of 9.5%, growing from 388 stores in fiscal 2020 to 559 stores in fiscal 2024. Ollie's new store real estate model prioritizes flexibility and focuses on second-generation sites within the size range of 25,000-35,000 square feet with an average initial cash investment of approximately $1 million. The company targets first-year annual new store sales of approximately $4 million.

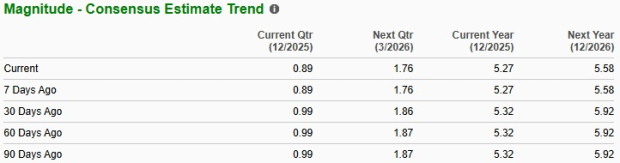

The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and EPS implies year-over-year growth of 14.2% and 40.5%, respectively. The consensus estimate for EPS for the current financial year has declined 5 cents to $5.27 over the past 30 days.

The Zacks Consensus Estimate for OLLI’s current fiscal-year sales and EPS indicates year-over-year increases of 16.4% and 16.5%, respectively. The consensus estimate for EPS for the current fiscal year has been unchanged at $3.82 over the past 30 days.

Over the past year, shares of Sprouts Farmers have slumped 45.2%, while Ollie's has gained 23.9%. Sprouts Farmers’ decline reflects investor concerns over slowing comparable-store sales, margin normalization, rising SG&A costs and intensifying competition from grocers. In contrast, Ollie’s gain stems from strong operational momentum, expanding customer loyalty through the Ollie’s Army program, as well as disciplined and profitable store expansion.

Sprouts Farmers is trading at a forward price-to-sales (P/S) multiple of 0.85, below its median of 0.98 in the past three years. Ollie's forward 12-month P/S multiple sits at 2.61, above its median of 2.19 in the past three years.

Ollie’s appears better positioned for investors seeking upside at this stage. While Sprouts Farmers continues to invest in innovation, digital engagement and store expansion, its slowing sales trajectory, margin normalization and increasing consumer price sensitivity point to a period of moderated performance. In contrast, Ollie’s benefits from a strengthening closeout environment, a highly engaged loyalty base, disciplined execution and a well-planned distribution network that supports sustained expansion. Taken together, the current backdrop favors OLLI as the more attractive retail stock for near to medium-term returns.

Sprouts Farmers currently carries a Zacks Rank #5 (Strong Sell), while Ollie’s has a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite