|

|

|

|

|||||

|

|

Intellia Therapeutics NTLA has made good progress with the advancement of its in vivo candidate, lonvo-z (or, NTLA-2002), which is currently in late-stage development for hereditary angioedema (HAE).

HAE is marked by severe swelling attacks in various body organs, limbs and tissues, which can be painful and even life-threatening. Despite the current treatment options that require chronic administration for disease control, HAE attacks still occur. Lonvo-z aims to prevent HAE attacks by suppressing the plasma kallikrein activity.

Intellia recently completed enrollment in the pivotal phase III HAELO study, which evaluated lonvo-z, its novel in vivo CRISPR gene editing therapy, for treating patients with HAE. Top-line data from the same is expected by mid-2026.

A successful data readout from the HAELO study lonvo-z will provide a major boost to the company’s near-term growth prospects. Intellia remains on track to submit a potential biologics license application for lonvo-z in HAE in the second half of 2026.

Besides lonvo-z, Intellia is advancing another in vivo candidate — nex-z (or, NTLA-2001), which is being developed for treating transthyretin (ATTR) amyloidosis.

Intellia is developing nex-z in collaboration with drug giant Regeneron Pharmaceuticals REGN. Nex-z is being evaluated in two late-stage studies, MAGNITUDE and MAGNITUDE-2, for ATTR amyloidosis with cardiomyopathy (ATTR-CM) and ATTR amyloidosis with polyneuropathy (ATTRv-PN), respectively.

While NTLA is the lead party in the deal for nex-z, REGN shares 25% of the development costs and commercial profits. The company’s top line currently comprises only collaboration revenues from its partners, like Regeneron and others.

Recently, Intellia temporarily paused patient dosing in both the MAGNITUDE and MAGNITUDE-2 studies after a patient experienced grade 4 liver transaminase elevations and increased total bilirubin following dosing with nex-z in the MAGNITUDE study.

Subsequently, the FDA placed a clinical hold on the phase III MAGNITUDE and MAGNITUDE-2 studies for ATTR-CM and ATTRv-PN, respectively, last month. Although the company is actively working with investigators and regulators to understand the issue and develop additional risk-mitigation strategies, it has raised concerns about nex-z’s safety in the long run.

Meanwhile, the regulatory setback faced by nex-z has cast a doubt on the near-term outlook for lonvo-z. Given that Intellia is a clinical-stage gene editing company, the successful development of its pipeline candidates remains in key focus for NTLA heading into 2026.

Intellia’s pipeline of innovative CRISPR-based therapies holds promise. However, upon successful development and potential approval, the candidates are likely to face competition from other therapies that are also being developed using CRISPR/Cas9 gene editing technology to address various diseases in specific areas.

CRISPR Therapeutics CRSP is the first and only company in the world to market a CRISPR/Cas9-based therapy. CRSP’s one-shot gene therapy, Casgevy, was approved in late 2023 and early 2024 across the United States and Europe for two blood disorder indications — sickle cell disease (“SCD”) and transfusion-dependent beta-thalassemia (“TDT”).

CRSP has developed Casgevy in partnership with large biotech, Vertex Pharmaceuticals, which is responsible for the therapy’s global development and commercialization.

Meanwhile, Beam Therapeutics BEAM is developing its genome-editing candidate, BEAM-101, in the phase I/II BEACON study for treating SCD.

Beam Therapeutics is also developing in vivo therapies in early to mid-stage studies for treating AATD-associated liver disease and glycogen storage disease Ia.

Year to date, shares of Intellia have plunged 26.9% against the industry’s rise of 20.4%. The stock has also underperformed the sector and the S&P 500 during the same time frame, as seen in the chart below.

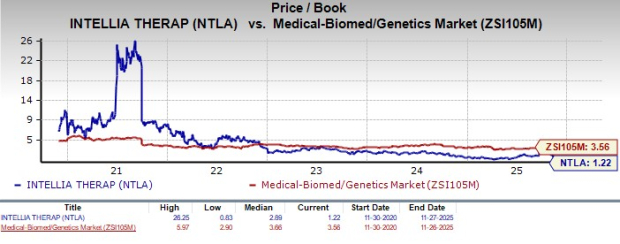

From a valuation standpoint, Intellia is trading at a discount to the industry. Going by the price/book ratio, the company’s shares currently trade at 1.22, lower than 3.56 for the industry. The stock is trading below its five-year mean of 2.89.

The Zacks Consensus Estimate for Intellia’s 2025 loss per share has narrowed from $4.14 to $4.00 over the past 60 days. Loss per share estimates for 2026 have also narrowed from $4.10 to $3.61 during the same time frame.

Intellia currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite