|

|

|

|

|||||

|

|

The market shift toward a hybrid and cloud-based learning system focusing on adult learning programs besides K-12 offerings is boding well for United States education-services companies, like Stride, Inc. LRN and Grand Canyon Education, Inc. LOPE.

Stride is currently focusing on boosting its career learning program offerings through an AI adaptive platform, wherever necessary, alongside fixing its technical glitches to boost long-term enrollment growth and revenue visibility. On the other hand, Grand Canyon Education is banking on its diversified program offerings and the hybrid ABSN platform for incremental leverage, while battling operational pressures and market-driven constraints.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

This Virginia-based education company is benefiting from offering a hybrid education model that combines online and blended solutions, merging digital flexibility with in-person engagement. As the market is shifting from traditional school choices to more virtual and career-oriented options, the diversified offerings by Stride fit perfectly into the puzzle. In the first quarter of fiscal 2026, its Career Learning segment’s revenues grew 16.3% year over year to $257.8 million, with enrollments growing 20%. This segment’s revenues outpaced the revenue growth for the General Education segment, which was 10.2% year over year in the fiscal first quarter.

Moreover, LRN’s focus on hybrid innovation also benefits from state-level funding flexibility, enabling partnerships with school districts that seek scalable, cost-effective solutions. The K12 Tutoring collaboration with the Lake Forest School District in Delaware to offer innovative, tailored educational solutions to students can be considered in this regard.

Apart from offering diversified programs, LRN’s investments in affordable learning offerings are encouraging. Stride is working on sculpting programs that meet the current market demand trends, as well as being affordable at the same time. At the start of fiscal 2026, the company rolled out free ELA tutoring for every second and third grader in its serving community. This program enables a child to work on reading, writing and communication skills.

However, Stride’s fiscal 2026 start was unsatisfactory due to the technical glitches witnessed after the rollout of two technology platforms, including a front-end learning platform and a back-office platform. At the start of August 2025, it started to witness withdrawals due to poor platform performance, such as login issues, leading to low conversion rates. The new upgrade did not go as planned, leading to approximately 10,000-15,000 fewer enrollments, which could have been achieved otherwise. This scenario is expected to pull back near-term prospects for Stride.

This Arizona-based for-profit education services company is gaining from a strong programmatic diversification approach. With healthcare representing nearly 30% of its total enrollments, Grand Canyon Education is currently invested in expanding across education, business, counseling, social work, engineering and technology, including cybersecurity. By catering to the labor demand across these fields, the company’s diversified portfolio offers it a competitive edge in the market, along with uninterrupted revenue visibility and sustained growth.

Besides, LOPE’s hybrid ABSN platform is another positive aspect to be noted. The ABSN platform is an efficient system for funneling advanced-standing students into nursing through affordable and flexible eight-week courses, with more than 19,400 students already enrolled.

The company’s strategic marketing adjustments, like shifting more spend toward social media outreach, expanding reach among younger students at a lower cost than traditional high-school-based recruiting, are boding well as well. Coupled with robust employer partnerships, innovative delivery models and a proven track record of workforce-aligned education, Grand Canyon Education continues to demonstrate durable, multi-pillar growth supported by long-term structural demand.

Despite a strong business portfolio, LOPE is facing headwinds in the form of high costs and a decline in revenue per student in certain segments. A rise in benefit and technology service costs due to heavy investments in digital infrastructure and partner initiatives is pressuring the bottom line. Headwinds reflect a mix of cost inflation, revenue mix shifts, regulatory uncertainty and broader demographic pressures that create challenges even as LOPE’s core growth drivers remain intact.

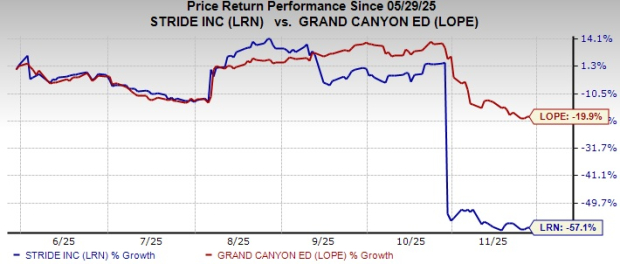

As witnessed from the chart below, in the past six months, Grand Canyon Education’s share price performance stands well above Stride’s, even though both stocks reflect a declining trend.

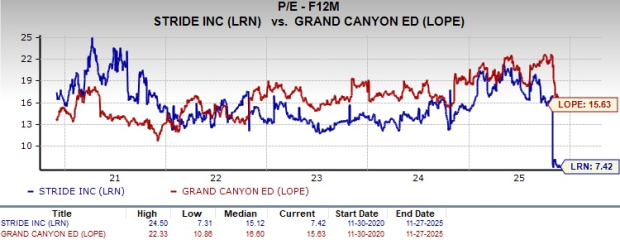

Considering valuation, over the last five years, Stride is trading below Grand Canyon Education on a forward 12-month price-to-earnings (P/E) ratio basis.

Overall, from these technical indicators, it can be deduced that LOPE stock offers a diminishing growth trend with a premium valuation, while LRN stock offers a declining growth trend with a discounted valuation.

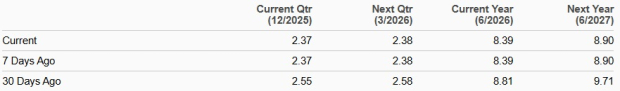

LRN’s earnings estimates for fiscal 2026 and fiscal 2027 have moved south over the past 30 days. Nonetheless, the revised figures for fiscal 2026 and 2027 imply year-over-year improvements of 3.6% and 6.2%, respectively.

LRN's EPS Trend

The Zacks Consensus Estimate for LOPE’s 2025 and 2026 earnings has trended upward over the past 30 days. The revised estimated figures of 2025 and 2026 reflect 12.9% and 11.2% year-over-year growth, respectively.

LOPE's EPS Trend

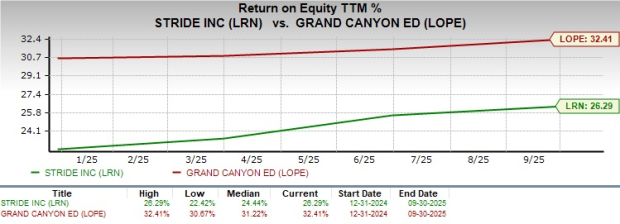

Grand Canyon Education’s trailing 12-month ROE of 32.4% significantly exceeds Stride’s average, underscoring its efficiency in generating shareholder returns.

Stride continues to leverage its hybrid K-12 and career learning ecosystem, supported by strong enrollment momentum in its Career Learning segment and expanding partnerships with school districts. Its affordability initiatives, including free ELA tutoring, enhance long-term engagement. But its fiscal 2026 trajectory has been disrupted by significant technical platform failures, reducing near-term visibility and leading to declining earnings estimate trends, even as longer-term growth remains intact.

Contrarily, Grand Canyon Education presents a more stable and diversified growth profile, backed by strong program breadth across healthcare, counseling, technology, and business. Its ABSN platform is scaling efficiently, supported by high enrollment levels and lower-cost digital recruiting strategies that continue to expand reach. Although higher technology and benefits expenses are pressuring margins, its earnings estimates are rising with a desirable ROE position.

LOPE offers more durable long-term demand drivers, unlike LRN, which carries execution risks. Summing up, coupled with stronger share performance and a Zacks Rank #2 (Buy), LOPE stock offers a more compelling investment proposition compared to LRN stock, which currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 11 hours | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite