|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

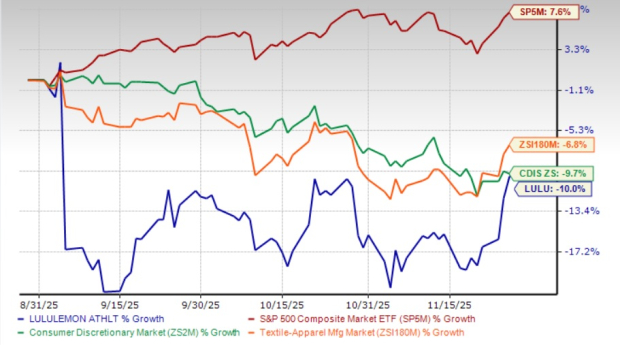

lululemon athletica inc. LULU has lost lust in recent months, with its shares recording a 10% decline in the past three months. The recent stock decline is greater than the Textile - Apparel industry’s 6.8% loss and the Consumer Discretionary sector’s 9.7% decline in the past three months. The stock also underperformed the S&P 500’s gain of 7.6% in the same period.

LULU’s performance is significantly weaker than that of Guess Inc. GES, G-III Apparel Group GIII and Hanesbrands HBI, which rose 1.5%, 9.2% and 4.5%, respectively, in the past three months.

At the current share price of $181.94, lululemon trades 14.2% above its 52-week low of $159.25. Meanwhile, LULU stock’s price is 57% below its 52-week high of $423.32. Despite the decline in share price, the stock trades above its 50-day moving average, indicating a bullish near-term sentiment.

lululemon’s dismal performance on the bourses is mainly due to soft business trends, led by persistent softness in North America, mainly the United States, alongside weak margins and rising costs. The company is experiencing a meaningful slowdown in its casual and lounge categories, where core franchises have become predictable and less compelling to customers. While performance apparel remains a bright spot, the soft response to key lifestyle products has weighed on overall demand, traffic and brand momentum in its largest market.

From a profitability standpoint, the retailer is grappling with margin headwinds driven by higher product costs, increased markdowns and a structurally more expensive trade environment. Elevated tariffs and the loss of duty advantages have further tightened margin flexibility, forcing the company to manage pressures through selective pricing actions, vendor negotiations and cost discipline. These dynamics have created a tougher backdrop for earnings performance and dampened investor sentiment.

Additionally, lululemon continues to witness SG&A expense deleverage due to planned investments in strategies and initiatives to fuel long-term growth. These investments include digital marketing and seasonal store openings to drive guest acquisition, build brand awareness and expand testing for longer-term growth opportunities.

On its last reported quarter’s earnings call, the company highlighted that higher reciprocal tariff rates, combined with the removal of the U.S. de minimis exemption, are expected to have a material impact on margins. Management now expects a fiscal 2025 gross margin decline of 300 basis points (bps), largely due to $240 million in tariff-related impact, while SG&A deleverage adds further strain.

lululemon is in a transition phase. The company is refreshing its product engine, accelerating design cycles and rebalancing its assortment to revive demand in categories that have lost relevance. New creative leadership, enhanced product innovation and a more agile go-to-market approach are expected to rebuild brand heat over time. While these initiatives will take several seasons to fully materialize, management remains confident that improved product newness and better execution will ultimately restore growth and strengthen the company’s longer-term fundamentals.

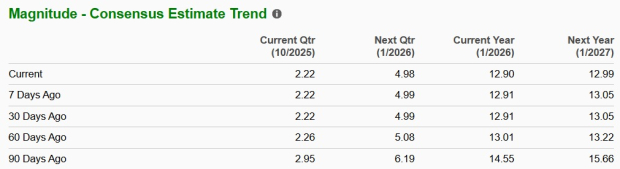

The Zacks Consensus Estimate for lululemon’s fiscal 2025 and 2026 EPS decreased by a penny and 0.5%, respectively, in the past seven days. The downward revision in earnings estimates indicates that analysts are skeptical about the company’s near-term growth potential.

For fiscal 2025, the Zacks Consensus Estimate for LULU’s revenues implies 3.7% year-over-year growth, while the EPS estimate suggests an 11.9% decline. The consensus mark for fiscal 2026 revenues and earnings indicates 5.1% and 0.7% year-over-year growth, respectively.

LULU’s current forward 12-month price-to-earnings (P/E) multiple is 14.02X. This multiple is lower than the industry average of 16.28X and the S&P 500’s average of 23.48X, making the stock appear relatively cheap.

Despite the stock decline, the company is trading at a higher valuation than some of its competitors. Its peers, such as Guess, G-III Apparel and Hanesbrands, are delivering solid growth and trade at higher multiples. Guess, G-III Apparel and Hanesbrands have forward 12-month P/E ratios of 9.76X, 10.05X and 10.14X — all significantly higher than LULU.

On a fundamental basis, lululemon remains a structurally strong brand with multiple long-term advantages supporting its outlook. Despite near-term softness in the United States, the company continues to demonstrate exceptional brand health, with a loyal and expanding guest base across all age groups and strong engagement through its membership program. Management emphasized that performance apparel, one of lululemon’s core differentiators, continues to grow and gain market share even in a challenging activewear environment, underscoring the company’s innovation capability and deep consumer trust.

International markets remain a powerful growth engine, with robust momentum in China and the rest of the world driven by new store openings, rising brand awareness and early-stage market penetration. This global diversification provides a meaningful buffer against U.S. volatility and positions the brand for sustained expansion.

lululemon is also strengthening its product creation capabilities. Investments in design talent, faster development cycles and a richer pipeline of innovation are expected to lift product newness and reaccelerate long-term growth. Paired with strong cash flow, disciplined investment and solid balance sheet flexibility, lululemon retains a durable foundation for future performance.

lululemon’s recent stock performance reflects meaningful near-term challenges, from weakening demand in key U.S. categories to margin pressure and downward estimate revisions. Analysts have trimmed their forecasts, acknowledging softer trends and a slower earnings trajectory in the coming quarters. While this has weighed on sentiment, it has also pushed the stock to a far more attractive valuation relative to both the broader market and its own historical norms. At current levels, shares trade at a noticeable discount, offering investors an appealing entry point.

This cheaper valuation sits against a backdrop of strong long-term fundamentals. lululemon’s global brand strength, expanding international footprint, innovation-led product engine and disciplined financial management remain intact. These pillars position the company to regain momentum once its product refresh, design acceleration and assortment reset fully take hold.

Given its durable competitive advantages and long-term growth potential, investors may consider retaining positions in this Zacks Rank #3 (Hold) despite its near-term turbulence. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 |

Companies Are Replacing CEOs in Record Numbersand Theyre Getting Younger

LULU

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite