|

|

|

|

|||||

|

|

Chipotle Mexican Grill, Inc. CMG stock's premium valuation — trading at a forward 12-month price-to-earnings ratio of 36.81X — has raised eyebrows, especially as the restaurant industry braces for potential disruption from renewed trade tensions and tariff threats. The stock is trading above the Zacks Retail-Restaurant industry’s average of 25.12X and the broader Retail-Wholesale sector’s 22.11X.

The warning signals come as restaurant chains, including peers like Brinker International, Inc. EAT, McDonald's Corporation MCD and Yum! Brands, Inc. YUM face dual threats: slowing discretionary spending and geopolitical risk. Looming macroeconomic risks, concerns around inflation, retaliatory tariffs, and rising labor costs are beginning to cast a shadow over CMG’s near-term prospects.

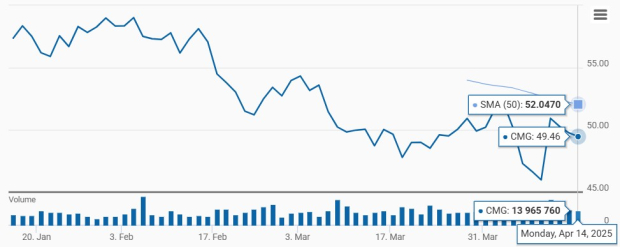

So far this year, shares of Chipotle have declined 18.1% compared with the Zacks Retail – Restaurants industry’s fall of 1.5%. The stock has underperformed the Zacks Retail-Wholesale sector’s and the S&P 500’s declines of 5.7% and 8.4%, respectively.

From a technical perspective, Chipotle stock is currently trading below its 50-day moving average, signaling a bearish trend.

Analysts and investors alike are starting to question how sustainable Chipotle’s momentum is under these conditions. Let’s find out.

Macro Pressures Are Building: The broader economic environment is starting to catch up with even the most resilient players. Inflation remains sticky, interest rates are still elevated, and consumers are becoming more price-conscious. As a premium fast-casual brand, Chipotle is particularly vulnerable to this shift.

Declining profitability remains a concern for CMG. During the fourth quarter of 2024, Restaurant-level margins contracted 60 basis points year over year to 24.8%, weighed down by rising input costs and portion-related investments. Despite promises of back-half relief from initiatives like produce slicers and back-of-house modernization, management expects margin pressure to linger into the first half of 2025.

While many restaurant chains are seeing signs of consumer trade-down behavior, Chipotle has continued to raise menu prices to offset inflationary pressures. This strategy worked well during earlier waves of inflation, but there are signs that consumer tolerance for higher prices may be peaking. The brand's value perception is at risk, especially as grocery inflation moderates and home cooking becomes a more attractive alternative for budget-minded customers.

Tariff Troubles on the Horizon: Chipotle may also find itself caught in the crosshairs of geopolitical trade friction. With about 2% of Chipotle’s product cost tied to imports from Mexico — including avocados, tomatoes and peppers — the newly announced tariffs could shave an additional 60 basis points off margins if implemented fully. While management has done commendable work diversifying suppliers, the risk remains non-trivial. A spike in input costs could pressure margins and force further price hikes, which may not be well received by customers already feeling the pinch.

Other major chains like Brinker, YUM! Brands and McDonald's have acknowledged the potential impact of tariffs, suggesting broader industry-wide implications. Chipotle, despite its nimbleness, is not immune to these macro-level risks.

Chipotle’s 2025 earnings per share (EPS) estimates have been revised downward, dropping from $1.29 to $1.27 over the past 60 days. This downward trend reflects weakening analyst confidence in the stock’s near-term prospects.

Nevertheless, the company is likely to report strong earnings, with projections indicating 13.4% year-over-year growth in 2025. Conversely, industry players like Brinker, YUM! Brands and McDonald's are likely to witness a rise of 102.7%, 9.3% and 4.5%, year over year, respectively.

Despite the concerns, Chipotle is not without its strengths. The company continues to set itself apart by focusing on high-quality, customizable food served quickly in a clean and consistent environment. As part of its broader strategy, Chipotle is doubling down on speed and service through operational upgrades and managerial stability, which are helping drive strong customer loyalty and higher transaction volumes.

To further elevate the customer experience, Chipotle has made significant investments in digital innovation and restaurant design. With digital orders now accounting for more than a third of its sales, the company’s mobile app and “Chipotlane” drive-thru pickup windows are creating faster, more convenient ways for customers to engage with the brand. These enhancements not only increase average check sizes but also boost efficiency, contributing to stronger unit economics and improving throughput during peak hours.

On the sourcing side, Chipotle has taken early steps to mitigate tariff risk by diversifying avocado suppliers beyond Mexico. While not a full hedge, it does reduce exposure relative to less-prepared peers. Additionally, the brand’s focus on automation and kitchen innovation could help offset wage inflation and maintain unit economics.

Chipotle is also positioning itself for global expansion, with promising early traction in Canada, Europe, and the Middle East. By tailoring its strategy for international markets while maintaining its core values, the company is showing that its model can travel. Domestically, it continues to pursue its goal of reaching 7,000 locations, backed by strong unit economics and growing average unit volumes. Together, these efforts are positioning Chipotle for long-term margin expansion and sustainable growth.

Analysts maintain a cautiously optimistic outlook on Chipotle’s stock. Based on short-term price targets from 31 analysts, the average price target is $64.84, suggesting a potential upside of 31.1% from the last closing price of $49.46. Price forecasts range from a low of $48.00, indicating a 2.95% downside risk, to a high of $72.00, which represents a possible 45.6% upside. Meanwhile, Chipotle carries a solid average brokerage recommendation (ABR) of 1.52 on a scale of 1 (Strong Buy) to 5 (Strong Sell), reflecting a favorable consensus. Among 32 brokerage firms, 22 analysts rate the stock as a Strong Buy and three as a Buy, underscoring confidence in Chipotle’s growth potential.

Chipotle remains a strong brand within the fast-casual dining space, backed by its commitment to food quality, digital innovation, and long-term expansion plans. Despite current macroeconomic pressures, including inflation, rising labor costs, and looming tariff threats, the company’s proactive steps — such as supplier diversification, automation, and a focus on customer experience — highlight its operational agility and long-term vision. Continued digital investment and international expansion further strengthen its position for future growth.

That said, Chipotle’s elevated valuation and recent underperformance relative to its industry and broader market introduce caution into the near-term outlook. Margin pressure, waning consumer tolerance for price hikes and geopolitical uncertainties could weigh on earnings and sentiment in the coming quarters. The stock’s downward earnings estimate revisions and technical weakness add to investment hesitancy.

Given these dynamics, existing investors may consider holding on to this Zacks Rank #3 (Hold) stock as Chipotle works through short-term headwinds and executes its strategic initiatives. However, new investors might find it wise to remain on the sidelines until macro risks moderate and momentum begins to recover, especially considering the stock’s premium valuation and recent volatility.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 |

Stock Market Today: Dow Sinks As EU Makes Trump Tariff Move; IBM Dives On This AI Threat (Live Coverage)

MCD

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite