|

|

|

|

|||||

|

|

International Business Machines Corporation IBM and Microsoft Corporation MSFT are two of the leading players in the global cloud computing industry. IBM offers cloud and data solutions that aid enterprises in digital transformation. In addition to hybrid cloud services, the company provides advanced information technology solutions, computer systems, quantum computing and supercomputing solutions, enterprise software, storage systems and microelectronics.

On the other hand, Microsoft’s Azure cloud platform offers several hybrid solutions that can host applications and workloads and provide security and operational tools for hybrid environments. Azure hybrid services range from virtualized hardware that hosts traditional IT apps and databases to integrated platform as a service solution for on-premises, edge and multi-cloud scenarios.

With a focus on hybrid cloud and AI (artificial intelligence), both IBM and Microsoft are strategically positioned in the cloud infrastructure market and have the wherewithal to cater to the evolving demands of business enterprises. Let us delve a little deeper into the companies’ competitive dynamics to understand which of the two is relatively better placed in the industry.

IBM is poised to benefit from healthy demand trends for hybrid cloud and AI, which drive the Software and Consulting segments. The company’s growth is expected to be aided by analytics, cloud computing and security in the long term. IBM recently extended its collaboration with NVIDIA Corporation NVDA to scale AI workloads and agentic AI applications. Per the latest agreement, IBM aims to launch a content-aware storage (CAS) capability for its hybrid cloud infrastructure offering (dubbed IBM Fusion) and expand its watsonx integrations with NVIDIA while introducing new IBM Consulting capabilities.

The CAS capability will enable firms to extract the hidden meaning of unstructured data for inferencing to scale and enhance AI applications without compromising on security. The integration of watsonx with NVIDIA Inference Microservices will offer firms greater accessibility to leading AI models across multiple cloud environments. IBM’s watsonx platform is likely to be the core technology platform for its AI capabilities. This enterprise-ready AI and data platform delivers the value of foundational models to the enterprise, enabling them to be more productive.

Despite solid hybrid cloud and AI traction, IBM is facing stiff competition from Amazon Web Services and Microsoft Azure. Increasing pricing pressure is eroding margins, and profitability has trended down over the years, barring occasional spikes. The company’s ongoing, heavily time-consuming business model transition to the cloud is a challenging task. Weakness in its traditional business and foreign exchange volatility remain significant concerns.

Microsoft has doubled down on the cloud computing opportunity. Azure’s increased availability in more than 60 announced regions globally is expected to have strengthened Microsoft’s competitive position in the cloud computing market. The rising adoption of enterprise capabilities of Azure OpenAI and Copilots across Microsoft 365, Dynamics 365 and Power Platform is expected to be a game changer. With Azure AI, Microsoft is building out the app server for the AI wave, providing access to the most diverse selection of models to meet customers’ unique cost, latency and design considerations. The number of Azure AI customers and average spending continues to grow. The company has more than 60,000 Azure AI customers, up nearly 60% year over year.

Microsoft is aggressively expanding its cloud infrastructure, with data centers now operating in more than 60 regions globally. Recent announcements of new cloud and AI investments in Brazil, Italy, Mexico and Sweden demonstrate the company's commitment to meeting long-term demand signals. The company's partnership with OpenAI continues to yield benefits, with significant Azure commitments driving commercial bookings growth of 67%.

However, the substantial capital expenditure required for AI infrastructure expansion may weigh on margins in the coming quarters. The company's cloud gross margin percentage decreased 2 points year over year to 71% in the second quarter of fiscal 2025, primarily due to AI infrastructure scaling costs. Capital expenditures, including finance leases, reached $20 billion, with approximately half allocated to long-lived assets supporting 15-year monetization horizons. In addition, while Azure's growth remains impressive, the company faces capacity constraints in AI services that could limit near-term growth potential.

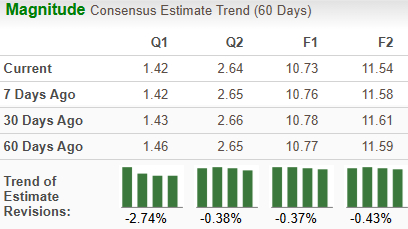

The Zacks Consensus Estimate for IBM’s 2025 sales and EPS implies year-over-year growth of 3.1% and 3.9%, respectively. The EPS estimates, however, have been trending southward over the past 60 days.

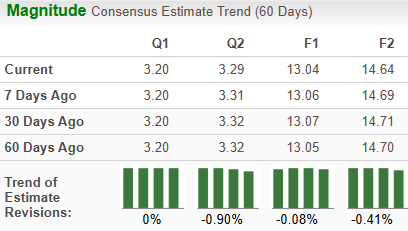

The Zacks Consensus Estimate for Microsoft’s 2025 sales and EPS implies year-over-year growth of 12.3% and 10.5%, respectively. The EPS estimates have been trending southward over the past 60 days.

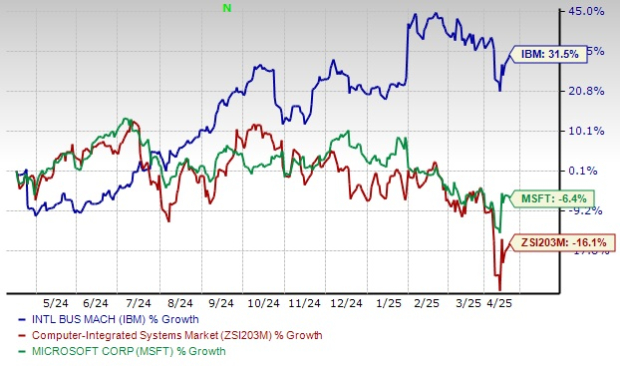

Over the past year, IBM has gained 31.5% against the industry’s decline of 16.1%. Microsoft has lost 6.4% over the same period.

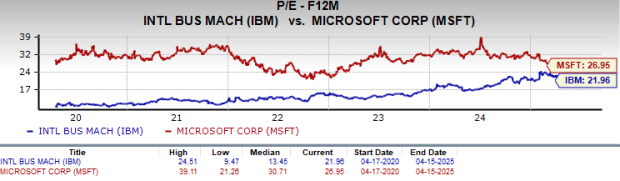

IBM looks more attractive than Microsoft from a valuation standpoint. Going by the price/earnings ratio, IBM’s shares currently trade at 21.96 forward earnings, significantly lower than 26.95 for Microsoft.

Both IBM and Microsoft carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both companies expect their sales and profits to improve in 2025. Microsoft has shown steady revenue and EPS growth for years, while IBM has been facing a bumpy road. However, with a better price performance and attractive valuation metrics, IBM is relatively better placed than Microsoft, although both appear to be on a level playing field in terms of Zacks Rank. Consequently, IBM seems to be a better investment option at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| 32 min | |

| 33 min | |

| 33 min | |

| 35 min | |

| 47 min |

Nvidia Partner Surges After Earnings Beat; Expects 'Momentum' To Continue In 2026

NVDA

Investor's Business Daily

|

| 48 min | |

| 54 min | |

| 55 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite