|

|

|

|

|||||

|

|

Costco Wholesale Corporation COST released its first-quarter fiscal 2026 results on Dec. 11, after the closing bell, drawing fresh attention from investors tracking the retail sector’s performance. Given its stable growth and loyal membership base, Costco has historically weathered economic hiccups better than many competitors. Now that its latest earnings are out, investors are contemplating whether to increase their stake, hold tight to their current investments or sell off shares in response to new data and market trends.

Shares of Costco have fallen 2.7% since the release of its first-quarter fiscal 2026 earnings, reflecting investor caution over the top-line miss. Nonetheless, both revenues and earnings improved year over year, driven by robust membership growth, resilient traffic, double-digit e-commerce gains and margin expansion. (Read: Costco Beats Q1 Earnings Estimates With 6.4% Comparable Sales Growth)

The company's ability to generate strong comparable sales across regions highlights its effective pricing strategy and member loyalty. Comparable sales, excluding gasoline prices and foreign exchange impacts, rose 6.4%. In the United States, comparable sales increased 5.9%, while Canada and Other International markets saw gains of 9% and 6.8%, respectively.

Costco ended the quarter with 81.4 million paid members, representing a 5.2% increase from the prior year. Executive memberships, a more profitable category for Costco, increased 9.1% year over year to reach 39.7 million, accounting for 74.3% of worldwide sales. The company's commitment to value and quality has fostered strong loyalty among members.

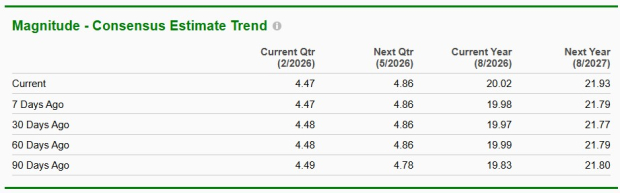

Over the past seven days, the Zacks Consensus Estimate for the current fiscal year has moved up by 4 cents to $20.02, while the estimate for the next fiscal year has increased 14 cents to $21.93. These estimates indicate expected year-over-year growth rates of 11.3% and 9.6%, respectively.

Costco’s resilient business model, centered around a membership-based structure, continues to be a major growth driver. The company’s high membership renewal rates, coupled with its efficient supply chain management and bulk purchasing power, ensure competitive pricing. The renewal rate remained healthy at 92.2% in the United States and Canada and 89.7% worldwide.

Members pay an annual fee for access to Costco's warehouses, where they can purchase goods at significant discounts. This model not only ensures a steady inflow of revenues but also creates a sense of exclusivity and value among its members. Membership fee income rose 14% year over year to $1,329 million in the first quarter, benefiting from strong renewal rates and the annualized benefit of the recent membership fee increase.

Costco’s ability to evolve with changing consumer preferences has also played a vital role in its expansion. The company adjusts its product mix to include both everyday essentials and unique, high-demand items — a strategy that strengthens its appeal across diverse customer segments. Through data-driven market analysis and an adaptable merchandising approach, Costco has steadily expanded its presence in both domestic and international markets. Management reiterated confidence in sustaining 30-plus net warehouse openings annually over the coming years, with a balanced mix between the U.S. and international markets.

Digital acceleration and logistics investments are monetizing Costco’s assortment and big-ticket capability. Digitally enabled comparable sales surged 20.5% year over year, supported by 24% growth in website traffic and 48% growth in app engagement. Management highlighted checkout productivity improvements of up to 20% in warehouses adopting pre-scan technology, while AI-driven pharmacy inventory systems improved in-stock levels to more than 98% and supported mid-teen growth in prescription volumes. The company’s same-day delivery offering, supported by partnerships with Instacart in the United States and Uber Eats and DoorDash across international markets, delivered standout performance during the quarter.

This robust operational performance translated into strong financial results. Costco generated $4,688 million of operating cash flow in the first quarter of fiscal 2026 and concluded the quarter with $16,217 million in cash and equivalents. Management invested nearly $1.53 billion in capital expenditures during the quarter and signaled approximately $6.5 billion for fiscal 2026, reflecting investments in warehouse openings, logistics infrastructure and digital capabilities.

Costco's impressive sales figures are part of a larger retail picture where competition is intensifying. Rivals like Ross Stores, Inc. ROST, Dollar General Corporation DG and Target Corporation TGT are investing in expanding their product assortments, enhancing supply-chain efficiency, and upgrading in-store and digital experiences to capture greater market share. These retailers are also sharpening their value propositions through competitive pricing, private-label expansion and targeted promotional strategies.

Moreover, margins remain a critical area to monitor, with potential concerns stemming from any deleverage in the selling, general and administrative rate. Additionally, foreign exchange volatility and potential tariffs on key imports create uncertainty.

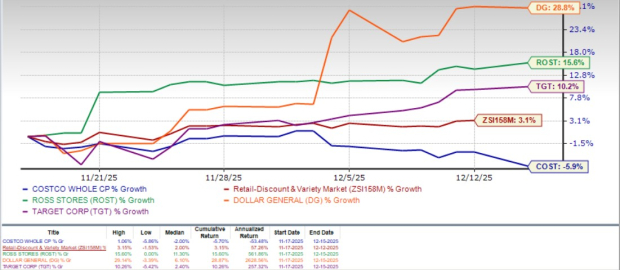

Costco stock has fallen 5.9% over the past month against the industry’s rise of 3.1%. A sneak peek into key retail peers' performance reveals that shares of Dollar General have risen 28.8% during the said time frame, while Ross Stores and Target have climbed 15.6% and 10.2%, respectively.

However, the stock is trading at a significant premium to its peers. Costco's forward 12-month price-to-earnings ratio stands at 41.81, higher than the industry’s ratio of 30.15 and the S&P 500's 23.35. Costco is trading at a premium to Target (with a forward 12-month P/E ratio of 12.71), Ross Stores (26.40) and Dollar General (19.55).

While Costco continues to trade at a notable premium to its peers, reflecting investor confidence in its strong brand image, loyal membership base and long-term growth potential, the stock’s recent underperformance relative to the industry highlights some caution. With such a high valuation, even minor setbacks could trigger a pullback in the stock.

Costco remains one of the most dependable names, supported by its steady membership growth, operational efficiency and disciplined expansion. However, with the stock already priced quite high, there may not be much room for short-term gains unless growth stays strong. For existing investors, holding the stock makes sense, given its long-term strength and resilience, while potential investors may want to wait for a more attractive entry point before buying in. Costco currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours |

Krispy Kreme Revenue Falls as Chain Exits Underperforming Locations

TGT COST

The Wall Street Journal

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite