|

|

|

|

|||||

|

|

As the final calendar pages of 2025 turn, the holiday shopping season once again underscored its importance to the retail industry. From Black Friday through Christmas week, consumer demand has remained resilient despite lingering concerns about inflation, trade policies, a cooling labor market and still-elevated interest rates. While shoppers became more selective, they continued to spend, prioritizing value and brands that deliver convenience, speed and flexible pricing.

To meet these shifting behaviors, retailers adopted innovative strategies and enhanced delivery logistics as consumers seamlessly transitioned between digital and physical channels. Shoppers browsed online, picked up in stores, ordered via mobile apps, and even turned to AI-driven chatbots to discover products and compare prices. Retailers that invested in real-time inventory visibility, faster fulfillment, frictionless checkout and AI-powered demand forecasting appear well-positioned to emerge as holiday winners.

At the same time, industry participants relied on targeted promotions, loyalty programs and data-driven pricing to stimulate demand without eroding profitability. Subscription perks, exclusive member offers and buy-now-pay-later options helped convert value-conscious shoppers. Moreover, disciplined cost control and aggressive marketing not only safeguard margins but also drive healthy sales volumes.

These dynamics are already reflected in the sales data. The National Retail Federation projects U.S. holiday sales for November and December to exceed $1 trillion for the first time, with year-over-year growth of 3.7%-4.2%, translating into total sales of $1.01-$1.02 trillion. This strength is reinforced by Adobe’s latest data, which showed online spending during Cyber Week — the five-day period from Thanksgiving through Cyber Monday — jumped 7.7% year over year to $44.2 billion.

Undoubtedly, holiday performance often serves as a preview of how retailers may fare in the year ahead. Strong traffic trends, inventory discipline and customer retention metrics during this period often translate into sustained revenue momentum. Here are four retail stocks to consider for 2026 against the backdrop of a projected record-breaking 2025 holiday season — Amazon.com, Inc. AMZN, Ross Stores, Inc. ROST, Walmart Inc. WMT and Costco Wholesale Corporation COST.

Amazon continues to dominate global e-commerce by combining unmatched product selection, industry-leading fulfillment capabilities and technological innovation. These strengths become especially visible during peak holiday shopping periods. Its Prime ecosystem drives customer loyalty and repeat purchases, while ongoing investments in faster delivery, regionalized fulfillment, and last-mile logistics enhance convenience and reduce shipping times. Amazon’s data-driven personalization, AI-powered recommendations, and growing use of automation across warehouses improve conversion rates and operational efficiency.

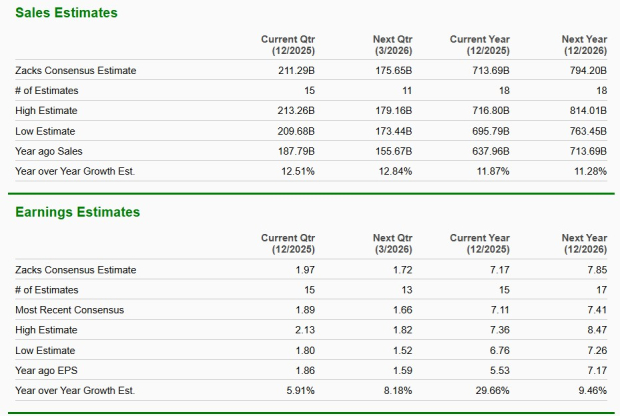

The Zacks Consensus Estimate for Amazon’s current financial-year sales and EPS implies growth of 11.9% and 29.7%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 11.3% rise in sales and 9.5% growth in earnings. This Zacks #2 (Buy) Ranked company has a trailing four-quarter earnings surprise of 22.5%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ross Stores continues to demonstrate the strength of its off-price model, driven by compelling branded assortments, effective merchandising execution and strong customer engagement across regions. Management highlighted broad-based category momentum, improved vendor partnerships, and successful marketing initiatives that are enhancing traffic and basket trends . Store expansion and disciplined inventory management further reinforce its ability to capitalize on favorable buying opportunities, particularly during peak holiday shopping periods. With a resilient value proposition and a proven operating playbook, Ross appears well-positioned to sustain market share gains and long-term growth.

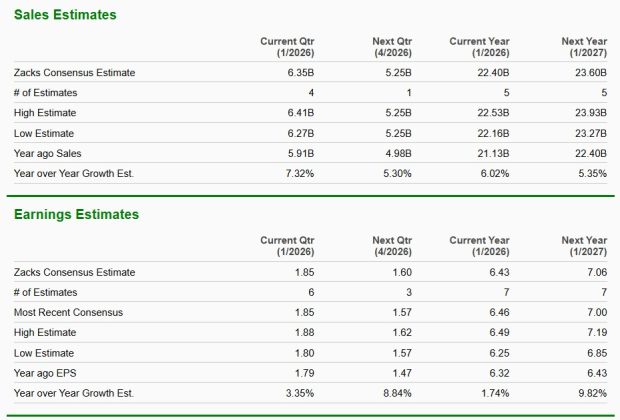

The Zacks Consensus Estimate for Ross Stores’ current financial-year sales and EPS implies growth of 6% and 1.7%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 5.4% rise in sales and 9.8% growth in earnings. This Zacks #2 Ranked company has a trailing four-quarter earnings surprise of 6.7%, on average.

Walmart continues to strengthen its position as a leading omnichannel retailer, leveraging a broad assortment, accelerated e-commerce momentum, and growing higher-margin profit streams such as advertising and membership. During the holiday season, Walmart’s combination of everyday low prices and omnichannel convenience positions it as a preferred destination for value-conscious shoppers. Its focus on faster fulfillment and tech-powered innovation, particularly in automation and AI, enhances customer convenience and operational efficiency. Market share gains across grocery, general merchandise, and health & wellness reflect durable brand relevance and customer loyalty. This scale-driven, diversified profit model supports steady growth well beyond the holiday period.

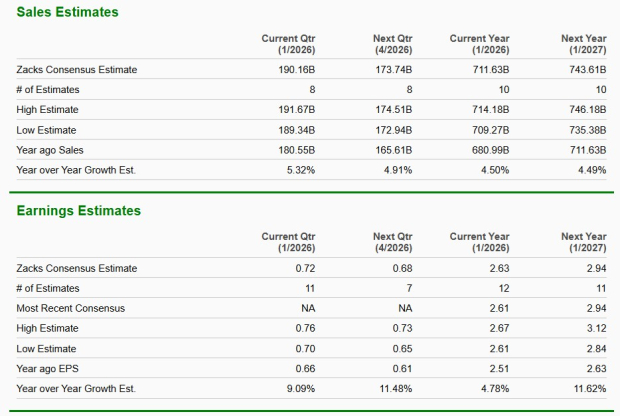

The Zacks Consensus Estimate for Walmart’s current financial-year sales and EPS implies growth of 4.5% and 4.8%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 4.5% rise in sales and 11.6% growth in earnings. This Zacks Rank #3 (Hold) company has a trailing four-quarter earnings surprise of 0.8%, on average.

Costco’s differentiated membership-driven model continues to fuel strong traffic, brand loyalty and market share gains, supported by a curated value-oriented assortment and an expanding global footprint. Holiday periods typically amplify bulk purchasing and gift-related categories, reinforcing Costco’s traffic and basket-size advantages. The company’s investments in digital capabilities, personalization and operational technology, including AI-enhanced inventory systems, are improving efficiency and elevating the member experience. Robust membership renewal rates and rising Executive penetration reinforce the strength of Costco’s recurring revenue base. Costco's disciplined expansion strategy and focus on quality, value and newness underscore its competitive moat.

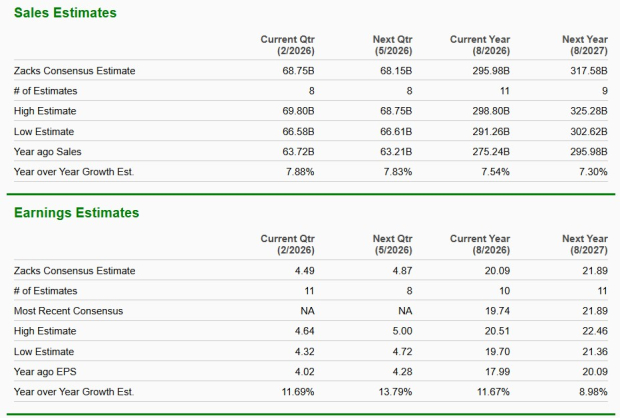

The Zacks Consensus Estimate for Costco’s current financial-year sales and EPS implies growth of 7.5% and 11.7%, respectively, from the year-ago period’s actuals. For the next fiscal year, the consensus estimate indicates a 7.3% rise in sales and 9% growth in earnings. This Zacks Rank #3 company has a trailing four-quarter earnings surprise of 0.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 43 min | |

| 2 hours | |

| 3 hours | |

| Feb-24 | |

| Feb-24 |

Tech Firms Arent Just Encouraging Their Workers to Use AI. Theyre Enforcing It.

AMZN

The Wall Street Journal

|

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

MercadoLibre Stock Climbs After Posting Mixed Q4 Results, Strong E-Commerce Growth

AMZN

Investor's Business Daily

|

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite