|

|

|

|

|||||

|

|

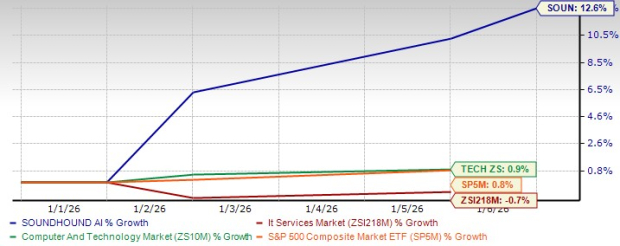

SoundHound AI, Inc. SOUN has entered 2026 with solid operating momentum, but its stock valuation leaves little room for error. Shares are up 12.6% year to date, clearly outperforming the Zacks Computers – IT Services industry and the broader Zacks Computer and Technology sector, even as the stock trades well below its 52-week high of $22.17. At around $11.23 as of Jan. 6, investors are debating whether SoundHound’s premium multiple reflects durable fundamentals or if expectations have already moved ahead of execution.

SoundHound currently trades at a 19.98X forward 12-month price-to-sales ratio, a premium to the Zacks Computers – IT Services industry average of 15.91X and above its own three-year median of 17.52X. While the company’s historical valuation range has been extremely wide, the current multiple implies confidence that recent growth trends can persist and eventually translate into operating leverage. This valuation backdrop is critical, as SoundHound is still in an investment phase and remains loss-making on a GAAP basis.

The stock’s recent pullback highlights the market’s more cautious stance. SoundHound is currently trading below both its 50-day and 200-day moving averages, signaling near-term technical weakness despite its strong relative performance versus benchmarks. For investors, this setup suggests the stock is no longer pricing in straight-line optimism and may remain volatile as sentiment shifts between long-term growth potential and short-term execution risk.

Operationally, SoundHound delivered a strong third quarter. The company reported record third-quarter 2025 revenue of $42 million, up 68% year over year, reflecting broad-based demand across automotive, restaurants, enterprise, financial services and emerging voice commerce initiatives. Management raised full-year revenue guidance to $165–$180 million, reinforcing confidence in sustained top-line growth.

SoundHound’s diversified customer base and expanding footprint across millions of endpoints have reduced reliance on any single vertical. Importantly, gross margins remained healthy on a non-GAAP basis, underscoring the scalability of the platform even as the company continues to invest aggressively in product development and go-to-market expansion.

One of the most important long-term drivers is SoundHound’s push into agentic voice commerce. The company is moving beyond basic voice assistants toward AI agents that can complete real-world transactions. Recent launches and partnerships underscore this strategy.

At CES 2026, SoundHound showcased expanded in-vehicle and smart-device capabilities that allow users to order food, make restaurant reservations, pay for parking and book travel using voice alone. Integrations with OpenTable and Parkopedia extend this ecosystem, enabling hands-free reservations and parking payments directly from the vehicle interface. Meanwhile, a new partnership with TomTom highlights how multi-agent voice navigation can be tightly integrated with mapping and route intelligence, strengthening SoundHound’s position with automotive OEMs.

These initiatives are still early, but they open the door to transaction-based monetization models that could complement subscription and usage-based revenue over time.

While SoundHound remains unprofitable, earnings expectations are gradually improving. Over the past 30 days, the Zacks Consensus Estimate for 2026 loss per share has remained unchanged at 5 cents, an improvement from the year-ago estimated loss of 14 cents. Revenue expectations for 2026 imply 38.9% growth, reflecting confidence that enterprise adoption and voice commerce initiatives will scale meaningfully.

This combination of high growth and narrowing losses supports the investment case, but it also reinforces why the stock commands a premium multiple.

Despite strong momentum, several challenges remain. First, valuation is unforgiving. At nearly 20X forward sales, SoundHound is priced as a category leader with sustained execution ahead. Any slowdown in growth, delays in voice commerce rollouts, or customer spending pullbacks could pressure the multiple.

Second, competitive intensity is rising. Large platform companies and well-funded AI startups continue to invest heavily in conversational AI, agent frameworks and multimodal assistants. Nuance Communications, owned by Microsoft MSFT, remains a formidable competitor with deep penetration in healthcare and contact centers, where it continues to set benchmarks for accuracy and conversational quality. Cerence CRNC is another key rival, maintaining leadership in automotive voice systems through long-standing OEM partnerships and shaping the embedded voice market that SoundHound aims to disrupt. LivePerson LPSN also adds pressure, competing aggressively in enterprise automation and increasingly positioning itself as a full-stack agentic AI platform, further heightening competitive intensity across the space.

Third, macro and industry-specific factors, particularly in automotive, remain a swing factor. Management has acknowledged pressure from global tariffs and broader auto industry softness, which could weigh on near-term deployments even as long-term demand remains intact. The broader auto industry is moving through a transitional phase, balancing near-term pressure with longer-term technology-driven opportunity. Automakers continue to face headwinds from uneven global vehicle demand, lingering tariff impacts, and cautious consumer spending, which have slowed production cycles and delayed some infotainment and software rollouts.

Despite SoundHound’s strong revenue growth, expanding enterprise footprint and rising visibility in voice commerce, the stock’s current valuation leaves limited margin for disappointment. Trading near 20X forward sales and below key moving averages, SoundHound needs consistent execution and clearer progress toward profitability to support further upside. While long-term prospects around agentic AI and voice-driven transactions remain compelling, near-term risk-reward looks uneven given the premium pricing and ongoing losses. With SOUN currently carrying a Zacks Rank #4 (Sell), the stock appears better suited for investors to wait on the sidelines until valuation becomes more reasonable or earnings momentum shows clearer acceleration.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 min | |

| 37 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite