|

|

|

|

|||||

|

|

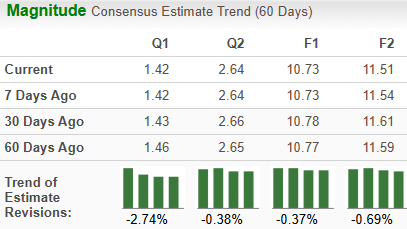

International Business Machines Corporation IBM is scheduled to report first-quarter 2025 earnings on April 23. The Zacks Consensus Estimate for sales and earnings is pegged at $14.45 billion and $1.42 per share, respectively. Earnings estimates for IBM for 2025 have declined to $10.73 per share from $10.77 over the past 60 days, while the same for 2026 have decreased to $11.51 from $11.59.

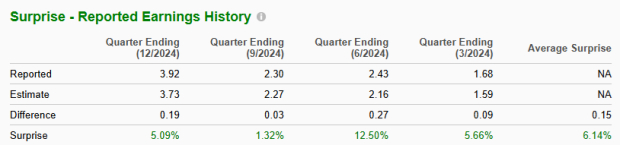

The cloud and data platform delivered a four-quarter earnings surprise of 6.1%, on average, beating estimates on each occasion. In the last reported quarter, the company pulled off an earnings surprise of 5.1%. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Our proven model does not predict an earnings beat for IBM for the first quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

IBM currently has an ESP of -1.68% with a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

During the to-be-reported quarter, IBM collaborated with Walmart’s white-label delivery service, Walmart GoLocal, to simplify the operational workflow for retailers. Through the recent collaboration, Walmart GoLocal’s extensive suite of capabilities will be available on IBM’s order management system. The IBM platform will offer an intuitive, highly customizable interface that will minimize complex modification requirements and allow retailers to easily avail Walmart’s services. IBM also extended its collaboration with Juniper Networks, Inc. to drive productivity in core enterprise workflows.

Per the renewed agreement, IBM aims to integrate its watsonx platform with Juniper’s Mist AI (artificial intelligence) to address the complexities of managing IT networks and help improve user experiences and lower operational costs. These are likely to have generated incremental revenues for the Consulting segment.

The Zacks Consensus Estimate for revenues from the Consulting segment is pegged at $5.1 billion, while our model projects revenues of $5.17 billion.

During the reported quarter, IBM extended its collaboration with NVIDIA Corporation NVDA to scale AI workloads and agentic AI applications. Per the latest agreement, IBM aims to launch a content-aware storage (CAS) capability for its hybrid cloud infrastructure offering (dubbed IBM Fusion) and expand its watsonx integrations with NVIDIA while introducing new IBM Consulting capabilities. The companies will collaborate to provide hybrid AI solutions to business enterprises that capitalize on open technologies and platforms, supporting data management, performance, security and governance. The integration of watsonx with NVIDIA Inference Microservices will offer firms greater accessibility to leading AI models across multiple cloud environments.

IBM also completed the acquisition of HashiCorp Inc. for an enterprise value of $6.4 billion. The acquisition is expected to strengthen the two companies’ shared mission to help clients innovate faster, enhance security and fully leverage the potential of the cloud. The acquisition brings powerful synergies across various strategic growth areas of IBM, such as Red Hat, watsonx and IT automation solutions. These are likely to have translated into incremental revenues in the Software segment.

The Zacks Consensus Estimate for revenues from the Software segment is pegged at $6.27 billion, while our model projects revenues of $5.97 billion.

However, despite solid hybrid cloud and AI traction, IBM faces stiff competition from Amazon Web Services and Microsoft’s Azure. The company’s ongoing, heavily time-consuming business model transition to the cloud is a challenging task. Weakness in its traditional business and foreign exchange volatility remain significant concerns. Increasing pricing pressure is eroding margins, and profitability has trended down over the years, barring occasional spikes.

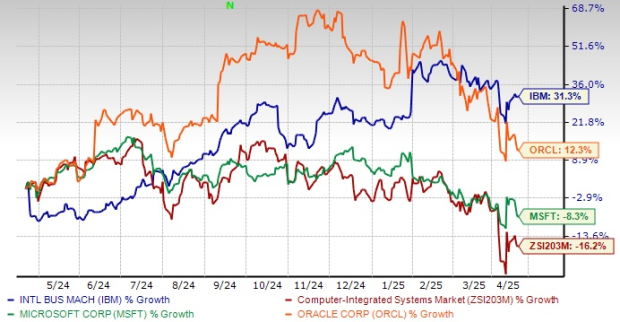

Over the past year, IBM has gained 31.3% against the industry’s decline of 16.2%. It has outperformed peers like Microsoft Corporation MSFT and Oracle Corporation ORCL over this period. While Oracle has gained 12.3%, Microsoft declined 8.3%. Notably, IBM inked an agreement to acquire Applications Software Technology LLC, a global Oracle consultancy firm, during the quarter. The transaction builds on IBM's previous acquisition of Accelalpha in 2024, further enhancing its capabilities to assist clients in deploying, managing and maximizing the value of Oracle cloud solutions.

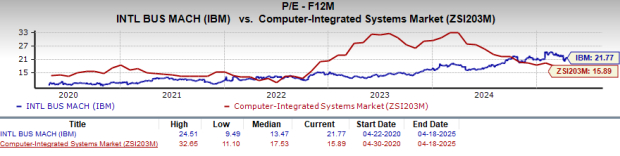

From a valuation standpoint, IBM appears to be trading at a premium relative to the industry and is trading well above its mean. Going by the price/earnings ratio, the company shares currently trade at 21.77 forward earnings, higher than 15.89 for the industry and the stock’s mean of 13.47.

IBM aims to benefit from the increasing propensity of business enterprises to undertake a cloud-agnostic and interoperable approach to secure multi-cloud management with a diligent focus on hybrid cloud and generative AI solutions. With a surge in traditional cloud-native workloads and associated applications, along with a rise in generative AI deployment and quantum computing, there is a radical expansion in the number of cloud workloads that enterprises are currently managing. This has resulted in heterogeneous, dynamic and complex infrastructure strategies, which has led to a healthy demand trend.

However, IBM’s frequent acquisitions have escalated integration risks. Buyouts have negatively impacted the company’s balance sheet in the form of high levels of goodwill and net intangible assets. IBM’s margins might have been strained by limited cost-cutting opportunities and stiff competitive pressures, likely delaying key product launches.

IBM is trading at premium valuation metrics, and investors could wait for a better entry point to cash in on its long-term fundamentals. With declining earnings estimates, the stock is witnessing a negative investor perception. Consequently, it might be prudent to avoid the stock at the moment.

However, IBM expects its growth to be driven primarily by analytics, cloud computing and security services. A better business mix, improving operating leverage through productivity gains and increased investments in growth opportunities will likely be conducive to long-term growth. IBM is poised to benefit from strong demand for hybrid cloud and AI, driving growth in the Software and Consulting segments in the long run.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 min | |

| 19 min | |

| 25 min | |

| 26 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite