|

|

|

|

|||||

|

|

Archer Daniels Midland Company ADM is slated to report fourth-quarter 2025 results on Feb. 3, before market open. The company is likely to report a bottom-line decline when it posts the quarterly results.

The Zacks Consensus Estimate for the company’s earnings is pegged at 83 cents per share, which indicates a decline of 27.2% from the year-ago quarter’s reported figure. The consensus mark has moved down by a penny in the past 30 days. For revenues, the consensus mark is pegged at $22.3 billion, implying 3.8% growth from the year-ago quarter’s reported figure.

In the last reported quarter, the company delivered an earnings surprise of 3.4%. Its earnings beat the Zacks Consensus Estimate by 4.3%, on average, in the trailing four quarters.

Archer Daniels’s fourth-quarter performance is expected to have remained under pressure as its Ag Services and Oilseeds segment continues to face a challenging margin environment. Management has indicated that global soybean and canola crush margins are likely to have remained broadly flat to slightly improved sequentially, but still well below year-ago levels, largely due to deferred U.S. biofuel policy clarity, evolving global trade dynamics and a weak vegetable oil demand backdrop. While crush volumes are expected to have held up operationally, the softness in the oil leg, especially soybean oil, continues to cap profitability, limiting the upside from strong meal demand and efficient plant execution.

In Refined Products and Other, margins have been pressured by biofuel and trade policy uncertainties, which have hurt biodiesel margins. Weak oil demand and higher crush capacity are also expected to have affected refining margins in the to-be-reported quarter.

The Carbohydrate Solutions segment is expected to have remained another earnings headwind in the fourth quarter. ADM continues to see soft global demand for sweeteners and starches, reflecting weaker consumption trends in packaged foods and corrugated boxes. This pressure is being exacerbated by persistently high corn costs in EMEA, driven by crop-quality issues. While ethanol export demand remains supportive of volumes, management expects margins to moderate sequentially, reinforcing a cautious outlook for both revenues and profitability in the segment in the fourth quarter.

The Zacks Consensus Estimate for the Ag Services and Oilseeds segment’s revenues is pegged at $17.7 billion, suggesting 4.9% year-over-year growth. The consensus mark for the Carbohydrate Solutions segment is $2.6 billion, indicating a year-over-year decline of 4.9%.

Offsetting some of these pressures, Nutrition is expected to have remained a relatively bright spot, albeit with normal seasonal headwinds. Management highlighted ongoing sequential improvements driven by portfolio optimization, cost discipline and network simplification across Human and Animal Nutrition.

However, flavors, particularly those tied to beverage applications, typically experience seasonal softness in the fourth quarter, partially offset by improved utilization at the Decatur East facility and continued momentum in specialty ingredients and biotics. These dynamics suggest stable-to-modestly improved margins but limited top-line acceleration in the to-be-reported quarter. The Zacks Consensus Estimate for the Nutrition segment’s revenues is pegged at $1.85 billion, suggesting 4.3% year-over-year growth.

The company has been actively driving productivity improvements and advancing innovation, while aligning its operations with long-term trends in food security, health and wellbeing. ADM continues to enhance operational efficiency across its production network through better plant uptime, improved utilization and network streamlining initiatives. At the same time, the company is progressing key innovation efforts in areas such as biosolutions, biotics, flavors, natural colors and health and wellness, which are seeing increasing customer engagement and demand. Additionally, ADM’s ongoing focus on strategic simplification, portfolio optimization and disciplined cost control is expected to have supported margins in the to-be-reported quarter.

Our proven model conclusively predicts an earnings beat for Archer Daniels this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Archer Daniels currently has an Earnings ESP of +2.41% and a Zacks Rank #3.

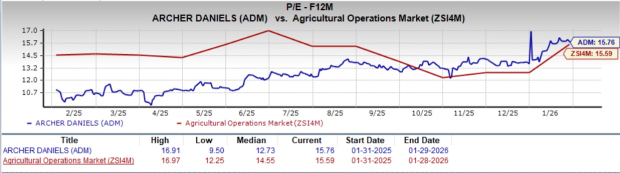

The company has a forward 12-month price-to-earnings ratio of 15.76X, which is below the five-year high of 16.91X and above the Agriculture - Operations industry’s average of 13.59X.

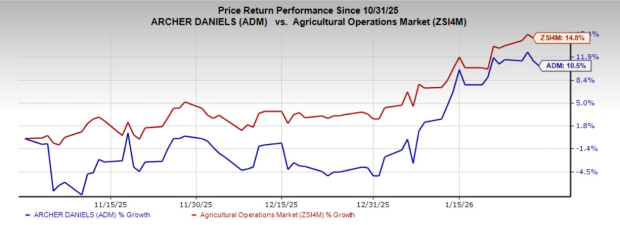

The recent market movements show that ADM shares have risen 10.5% in the past three months against the industry's 14.8% decline.

Here are some other companies that, according to our model, have the right combination of elements to beat on earnings this reporting cycle.

The Estee Lauder Companies EL has an Earnings ESP of +6.62% and carries a Zacks Rank of 2 at present. EL is likely to register growth in its top and bottom lines when it releases second-quarter fiscal 2026 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $4.2 billion, which implies growth of 5.3% from the figure in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Estee Lauder’s bottom line has moved up 3.8% to 83 cents per share in the past 30 days. The estimate indicates 33.9% growth from the year-ago quarter’s actual. EL delivered an earnings surprise of 82.6%, on average, in the trailing four quarters.

Tyson Foods TSN currently has an Earnings ESP of +1.49% and a Zacks Rank of 3. The consensus mark for the upcoming quarter’s revenues is pegged at $14.1 billion, which indicates an increase of 3.7% from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for Tyson Foods’ quarterly earnings per share of $1.01 implies a decline of 11.4% from the figure reported in the year-ago quarter. TSN delivered a trailing four-quarter earnings surprise of 28.6%, on average.

Celsius Holdings, Inc. CELH currently has an Earnings ESP of +15.27% and a Zacks Rank of 3. The consensus estimate for Celsius Holdings’ quarterly revenues is pegged at $639.2 million, which indicates a surge of 92.4% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Celsius Holdings’ upcoming quarter’s EPS is pegged at 19 cents, which implies a 35.7% increase year over year. CELH delivered a trailing four-quarter earnings surprise of roughly 42.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 min | |

| 42 min | |

| 1 hour | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite