|

|

|

|

|||||

|

|

Newell Brands Inc. NWL is expected to register a year-over-year decline in the top line when it reports fourth-quarter 2025 results on Feb. 6, 2026, before the opening bell. The Zacks Consensus Estimate for quarterly revenues is pegged at $1.89 billion, indicating a decline of 3.3% from the figure reported in the year-ago quarter.

The consensus estimate for the bottom line is pegged at 18 cents per share, which indicates growth of 12.5% from that reported in the year-ago quarter. The consensus mark has been unchanged in the past 30 days.

Newell Brands Inc. price-consensus-eps-surprise-chart | Newell Brands Inc. Quote

In the last reported quarter, the Atlanta, GA-based company delivered a negative earnings surprise of 5.6%. Its bottom line beat the consensus estimate by 23.6%, on average, in the trailing four quarters.

Newell Brands is set to release fourth-quarter 2025 results amid a turbulent macroeconomic environment that has weighed on consumer sentiment and discretionary spending. Persistent inflationary pressures, coupled with geopolitical volatility and rapidly evolving retail dynamics, continue to challenge the company’s ability to drive consistent top-line growth.

On its last earnings call, management expected net sales to fall 1-4% and core sales to decline between 3% and 5%, with a normalized operating margin of 9-9.5% and normalized EPS of $0.16-$0.20. Our model predicts a fourth-quarter normalized operating margin of 9%, up 190 bps from the year-ago period.

From a segment perspective, performance in the fourth quarter is expected to benefit from improving dynamics across key businesses. International operations, which were disrupted by macroeconomic and political instability in markets such as Brazil and Argentina, are projected to return to growth as conditions stabilize. In the United States, competitive pricing actions by peers are beginning to materialize in tariff-exposed categories, particularly in Writing, where Newell Brands’ strong domestic manufacturing footprint provides a structural advantage.

Meanwhile, Outdoor & Recreation, which has faced prolonged softness, is showing early signs of stabilization driven by portfolio simplification, tighter inventory management and a more focused innovation pipeline. We expect the Outdoor & Recreation segment's net sales to decrease 4% for the fourth quarter.

Profitability in the quarter ahead is likely to be supported by continued execution of Newell Brands’ simplification and productivity initiatives. Management expects normalized overheads, as a percentage of sales, to keep declining as cost savings compound and technology investments — including AI-enabled tools — gain broader traction across the organization.

Newell Brands’ ongoing transformation efforts position the company more favorably for the quarter to be reported. Reduced reliance on China sourcing, expanded U.S. manufacturing and automation investments, and a growing pipeline of margin-accretive innovations strengthen supply chain resilience and competitive positioning. With net distribution expected to turn positive and innovation and marketing support reaching their strongest levels in years, management remains confident that these actions will help stabilize near-term performance.

Our proven model does not conclusively predict an earnings beat for Newell Brands this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Newell Brands currently has an Earnings ESP of -1.89% and a Zacks Rank #3. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

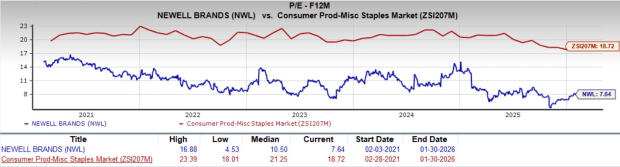

From a valuation perspective, Newell Brands offers an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 7.64X, which is significantly below the five-year high of 16.88X and the Consumer Products - Staples industry’s average of 18.72X, the stock offers compelling value for investors seeking exposure to the sector.

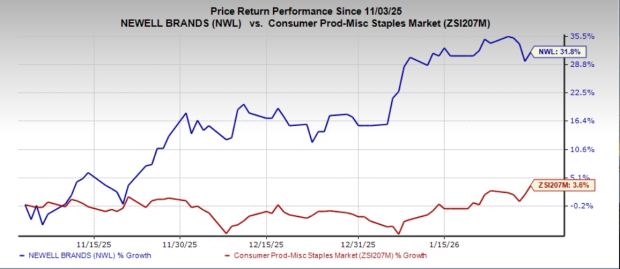

The recent market movements show that NWL shares have gained 31.8% in the past three months compared with the industry's 3.6% growth.

Here are some companies that, according to our model, have the right combination of elements to beat on earnings this reporting cycle.

The Hershey Company HSY currently has an Earnings ESP of +0.78% and sports a Zacks Rank of 1. The consensus estimate for Hershey’s quarterly revenues is pinned at $3 billion, which calls for 3.9% growth from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Hershey’s upcoming quarter’s EPS is pegged at $1.40, which implies a 48% decrease year over year. HSY delivered a trailing four-quarter earnings surprise of nearly 15%, on average.

The Estee Lauder Companies EL has an Earnings ESP of +6.62% and carries a Zacks Rank of 2 at present. EL is likely to register growth in its top and bottom lines when it releases second-quarter fiscal 2026 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $4.2 billion, which implies growth of 5.3% from the figure in the prior-year quarter.

The consensus estimate for Estee Lauder’s bottom line has moved up 3.8% to 83 cents per share in the past 30 days. The estimate indicates 33.9% growth from the year-ago quarter’s actual. EL delivered an earnings surprise of 82.6%, on average, in the trailing four quarters.

Celsius Holdings, Inc. CELH currently has an Earnings ESP of +15.27% and a Zacks Rank of 3. The consensus estimate for Celsius Holdings’ quarterly revenues is pegged at $639.2 million, which indicates a surge of 92.4% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Celsius Holdings’ upcoming quarter’s EPS is pegged at 19 cents, which implies a 35.7% increase year over year. CELH delivered a trailing four-quarter earnings surprise of roughly 42.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 4 hours | |

| 5 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite