|

|

|

|

|||||

|

|

The Coca-Cola Company KO is slated to report fourth-quarter 2025 earnings on Feb. 10, before the opening bell. The company is expected to register year-over-year top and bottom-line growth when it posts fourth-quarter numbers.

The Zacks Consensus Estimate for revenues is pegged at $12.05 billion, implying 4.4% growth from the year-ago quarter's reported figure. The consensus estimate for earnings is pegged at 57 cents per share, indicating 3.6% growth from the prior-year quarter’s reported figure. The consensus mark for earnings has moved up by a penny in the past seven days.

The Atlanta, GA-based company has been reporting steady earnings, as evidenced by its positive earnings surprise trend in the trailing 11 quarters. Coca-Cola delivered a trailing four-quarter earnings surprise of 5.2%, on average. On the last reported quarter’s earnings call, the company registered an earnings surprise of 5.1%. Given its positive record, the question is, can KO maintain its momentum?

Coca-Cola Company (The) price-eps-surprise | Coca-Cola Company (The) Quote

Our proven model conclusively predicts an earnings beat for KO this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Coca-Cola has a Zacks Rank #3 and an Earnings ESP of +0.89%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Coca-Cola’s fourth-quarter 2025 results are expected to reflect the strength of its all-weather strategy and the resilience of its global portfolio. KO’s momentum has been fueled by solid organic revenue growth, effective pricing actions and continued gains in global value share across the non-alcoholic RTD category. The company’s ability to command premium pricing underscores the strength of its brand portfolio and execution discipline. Strategic revenue growth management and affordability initiatives are helping balance pricing with consumer retention.

KO’s ongoing focus on innovation, digital transformation and marketing excellence further sharpens its competitive edge, with breakthrough product launches and culturally resonant campaigns elevating brand relevance. The company’s refreshed marketing model blends digital, live, and in-store touchpoints to build stronger, more personalized consumer connections. Margin expansion, driven by productivity gains, easing inflation and disciplined revenue growth management, reinforces its financial durability.

Looking ahead, Coca-Cola expects to maintain strong margin discipline, supported by further productivity gains, favorable price/mix dynamics and gradual easing of inflationary pressures. Our model predicts the adjusted operating margin to contract 10 bps year over year to 23.9% in the fourth quarter, led by a 110-bps decline in the adjusted gross margin, offset by an improvement in the SG&A expense rate.

However, Coca-Cola is expected to have faced notable volume pressure in key markets, reflecting evolving consumer behavior and economic challenges, particularly in North America and Europe. The company is witnessing soft volumes as low-income consumers remain value-conscious amid inflationary pressures. These widespread volume challenges signal waning consumer momentum, particularly in lower-income groups.

While Coca-Cola continues to rely on price/mix gains to support revenues, the persistence of volume softness raises concerns about sustained demand, making recovery efforts in lagging regions even more critical. Our model estimates a 0.2% decline in volume for fourth-quarter 2025.

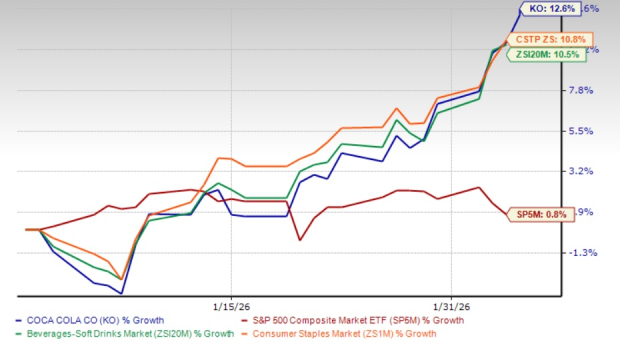

KO shares have exhibited an uptrend, rising as much as 12.6% year to date. The stock has surpassed the broader industry and the Consumer Staples sector’s 10.5% and 10.8% growth, respectively. The KO stock has also outperformed the S&P 500 index, which has risen 0.8% in the same period.

The Coca-Cola stock has outperformed its competitors, Monster Beverage Corporation MNST and Keurig Dr Pepper Inc. KDP, which have risen 6.7% and 0.1%, respectively, year to date. However, the stock has underperformed PepsiCo Inc.’s PEP growth of 16.9% in the same period.

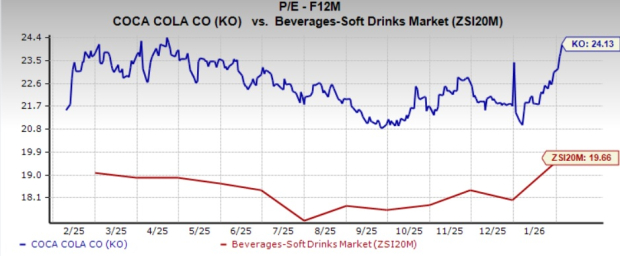

From the valuation standpoint, KO trades at a forward 12-month P/E multiple of 24.13X, exceeding the industry average of 19.66X and the S&P 500’s average of 22.62X. Coca-Cola’s valuation appears quite pricey.

KO undoubtedly commands a high valuation, reflecting its strong market positioning, brand power and long-term growth potential compared with other non-alcoholic beverage companies. However, we believe that its valuation is too stretched at this time.

Coca-Cola remains a powerhouse in the beverage industry, commanding more than 40% of the global non-alcoholic beverage market. The company’s enduring success is driven by a formidable market presence, world-class marketing capabilities and a relentless focus on innovation. With a portfolio boasting more than 4,700 products and 500 brands, spanning sodas, juices, waters and energy drinks, Coca-Cola continues to reinforce its leadership.

KO’s dominant market share, broad product range and strategic emphasis on innovation and digital transformation position it well for sustained long-term growth. However, short-term headwinds such as inflationary pressures, global macroeconomic uncertainties and unfavorable currency fluctuations remain challenges to navigate.

Coca-Cola heads into its fourth-quarter 2025 earnings release with solid momentum, supported by steady organic revenue growth, effective pricing actions and disciplined execution. The company’s strong earnings surprise history, coupled with a favorable Earnings ESP, suggests a reasonable likelihood of another earnings beat. However, Coca-Cola’s elevated valuation limits upside potential at current levels, even as it reflects the company’s market leadership and long-term strengths.

Regardless of how the Coca-Cola stock moves post its fourth-quarter results, the company remains a compelling long-term investment, backed by solid profitability and a growing global presence. Prospective investors should assess the current valuation before initiating a position, while existing shareholders may find it wise to stay invested. The upcoming earnings are likely to reinforce Coca-Cola’s resilience and sustained growth outlook.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours |

Monster Beverage Posts Higher Fourth-Quarter Profit as Energy Drink Sales Rise

KO

The Wall Street Journal

|

| 5 hours |

Monster Beverage Posts Higher Fourth-Quarter Profit as Energy Drink Sales Rise

MNST

The Wall Street Journal

|

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 8 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite