|

|

|

|

|||||

|

|

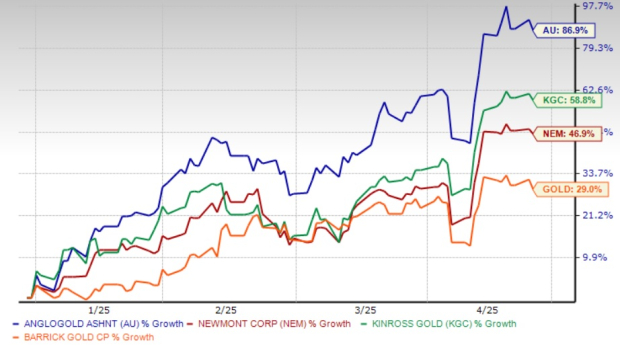

AngloGold Ashanti PLC AU stock has appreciated 86.9% year to date, outperforming the Zacks Mining – Gold industry’s 53.8% rise. In contrast, the Basic Materials sector has risen 0.9%, while the S&P 500 has declined 12.6% in the same timeframe.

The AU stock closed at $43.14 yesterday, 8% shy of its 52-week high of $46.90 achieved on April 16, 2025. AngloGold Ashanti has also outpaced top gold mining stocks like Newmont Corporation NEM, Kinross Gold KGC and Barrick Gold Corporation GOLD, which have rallied 46.9%, 58.8% and 29%, respectively, so far this year.

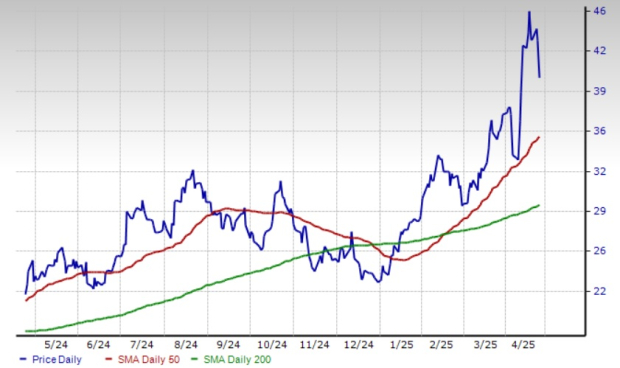

AngloGold Ashanti has been trading above the 200-day simple moving average (SMA) since Jan. 14, 2025. The stock is also currently trading above the 50-day SMA, which continues to read higher than the 200-day SMA, indicating a bullish trend.

With the AU stock riding high, investors may rush to add it to their portfolio. However, before making a decision, it would be prudent to take a look at the reasons behind the surge, the company’s growth prospects and risks (if any) in investing.

Rising Gold Prices: The yellow metal has gained 26% year to date, riding on the escalating tariff tensions and geopolitical uncertainties. Gold briefly hit a record high of $3,500 yesterday before settling lower at $3,370 an ounce as U.S. Treasury Secretary Scott Bessent said he expects a de-escalation in the trade conflict with China soon, calling the prolonged tariff standoff unsustainable. This fueled optimism in stocks and strengthened the dollar.

Gold prices are likely to continue to gain in this uncertain environment, with increased purchases by central banks, hopes of interest rate cuts and geopolitical tensions.

Completion of Centamin Acquisition: In November 2024, AngloGold Ashanti completed the acquisition of Egyptian gold producer Centamin, adding the large-scale, long-life, world-class Tier 1 asset (Sukari) to its portfolio. It has the potential to produce 500,000 ounces annually. The acquisition also added prospective exploration properties in Egypt’s Eastern Desert and projects in Côte d’Ivoire.

Following the acquisition of Centamin, AngloGold Ashanti’s mineral reserves were 31.2 million ounces at the end of 2024.

Lowest Leverage Since 2011: Despite the Centamin acquisition, AngloGold Ashanti ended 2024 with an adjusted net debt to adjusted EBITDA of 0.21, which is the lowest since 2011. The company had $2.6 billion in liquidity, including cash and cash equivalents of $1.4 billion as of Dec. 31, 2024. Its debt-to-capital ratio was 0.23 at the 2024 end compared with 0.38 at the 2023 end.

AU’s board of directors recently approved a revised dividend policy, per which it will target a 50% payout of free cash flow, subject to maintaining an adjusted net debt to adjusted EBITDA of 1.0X. The revised policy introduces a base dividend of 50 cents per share per year. AU’s current payout ratio of 18.55% is lower than the industry’s 29.68%.

The company’s total gold production in 2024, including a contribution of 40,000 ounces from Sukari, was 2.661 million ounces. AngloGold Ashanti sold 2.679 million ounces of gold, a 2% year-over-year rally. The company’s gold income rose 27% to $5.67 billion in 2024, which was mainly driven by a 24% increase in the average gold price.

The company has been facing pressures on labor, material and contractor costs, and the impacts of higher royalties paid. Total cash costs per ounce for the company rose 4% year over year to $1,157 per ounce in 2024. Total cash costs have seen a CAGR of 4.8% over 2022-2024.

All-in-sustaining costs per ounce (“AISC”) for AU rose 4% year over year to $1,611 per ounce in 2024. The company’s AISC has grown, witnessing a CAGR of 6.2% over 2022-2024. AngloGold Ashanti, meanwhile, remains focused on its Full Asset Potential program to offset the inflationary impacts.

Higher gold prices, coupled with operational and efficiency improvements, were mainly instrumental in driving year-over-year gains in earnings and free cash flow in 2024 despite inflated costs. The free cash flow rose to $942 million in 2024 from $109 million in 2023. Earnings were $2.21 per share for 2024 against a loss of 11 cents for 2023.

Gold production for 2025 is projected at 2.9-3.225 million ounces. This suggests year-over-year growth of 9-21%. For 2026, the company expects similar output levels as in 2025.

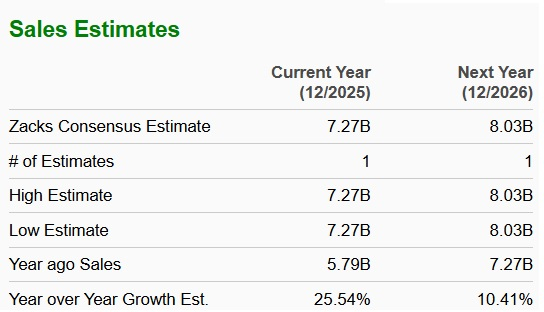

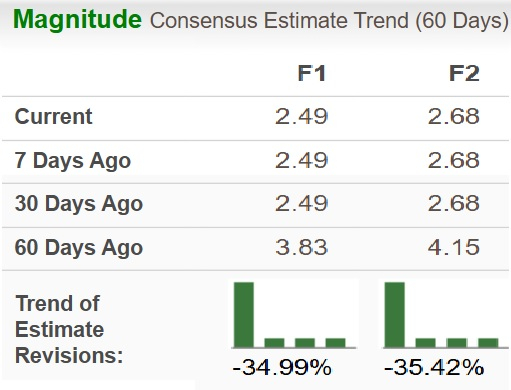

The Zacks Consensus Estimate for AU’s 2025 sales is at $7.27 billion, suggesting 25.5% year-over-year growth. The consensus mark for the year’s earnings is at $2.49, indicating year-over-year growth of 12.7%. The Zacks Consensus Estimate for sales for 2026 suggests 10.4% year-over-year growth. The same for earnings indicates growth of 7.4%.

However, EPS estimates for 2025 and 2026 have been trending south over the past 60 days, as seen in the chart below. This reflects declining confidence among analysts in AU’s earnings growth capabilities. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

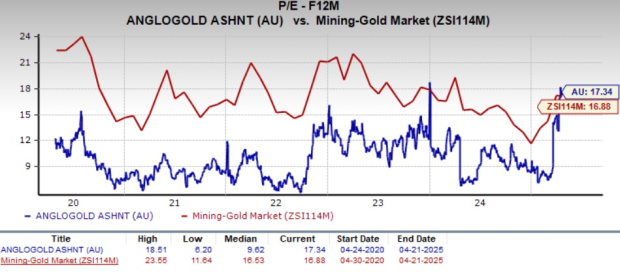

AngloGold Ashanti is currently trading at a forward 12-month earnings multiple of 17.34X, a premium to the industry average of 16.88X. It is also higher than its five-year median. With a Value Score of D, the stock may not present a compelling value proposition at these levels.

Meanwhile, Kinross Gold, Newmont and Barrick Gold are cheaper plays, which are trading below the industry at 15.91X, 14.18X and 12.41X, respectively.

The average price target on AU suggests a 12.4% decline from its last closing price of $43.14. The highest target of $42 also implies a dip of 2.6%.

As of Dec. 31, 2024, AngloGold Ashanti had a diverse portfolio, including 11 operating assets in Argentina, Australia, Brazil, the Democratic Republic of the Congo, Egypt, Ghana, Guinea and Tanzania. These operating assets were supported by greenfields projects in Colombia, Côte d’Ivoire and the United States, and a focused global exploration program, including exploration in the United States.

The company’s proposed joint venture (announced in May 2023) with Gold Fields to combine their Tarkwa and Iduapriem gold mines remains on hold as they have not yet obtained the requisite approvals from the Ghana government. This is expected to create the largest gold mine in Africa, with an extended life, higher production and lower costs.

While AU is poised to benefit from the current surge in gold prices and higher production expectations, increased costs are headwinds. AngloGold Ashanti’s stalled ambitions to build Africa’s largest gold mine continue to weigh on investor sentiment. Considering its premium valuation and a downward trend in earnings estimates, it is advisable to steer clear of this Zacks Rank #5 (Strong Sell) stock for now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Trump's Tariffs Lift Gold Prices. These Mining Stocks Are Basing.

KGC +6.22% NEM

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite