|

|

|

|

|||||

|

|

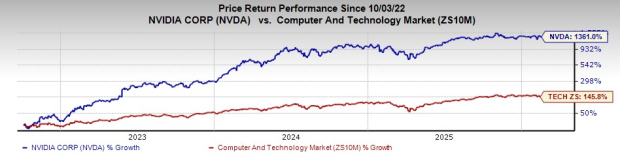

Since the November 2022 launch of ChatGPT, trained on more than 10,000 NVIDIA NVDA GPUs, AI infrastructure demand has accelerated at an unprecedented pace, propelling NVIDIA to the center of the compute economy. The stock has risen more than 1300% since 2022 October and now commands over $4.4 trillion in market capitalization, with multiple sources stating that NVIDIA controls more than 80% of the AI chip market. In its last reported, third quarter of fiscal 2026, NVIDIA reported $57 billion in revenue (up 62% year over year), including $51.2 billion from data center, as hyperscaler CapEx expectations for 2026 climbed to roughly $600 billion. Visibility into $0.5 trillion of Blackwell and Rubin revenues through 2026 underscores the scale of the AI buildout.

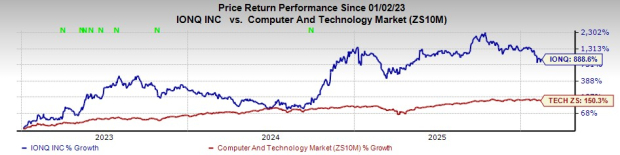

In contrast, quantum computing entered the investment limelight in 2023, with momentum accelerating through 2024-2025. IonQ IONQ has gained 889% over the past three years, supported by 222% revenue growth in the third quarter of 2025 to $39.9 million, a record 99.99% two-qubit gate fidelity and a strengthened $3.5 billion cash position. As governments and enterprises explore quantum advantage use cases, investors are asking whether IonQ can replicate NVIDIA’s platform-driven dominance this time in a new computing paradigm.

Lets find out.

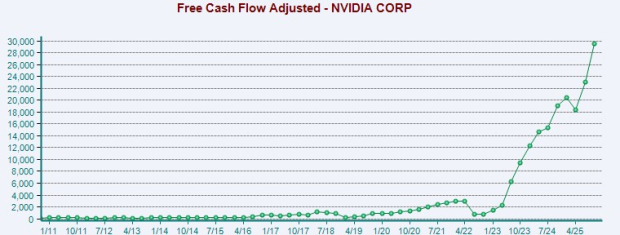

Over the past three and a half years, NVIDIA has delivered a remarkable growth trajectory backed by strong strategic execution, product growth and strong capital markets performance. Since the 2022 launch of ChatGPT, demand for accelerated computing has surged stupendously. In the most recent quarter, NVDA generated revenues from data center, highlighting robust secular demand across cloud hyperscalers, enterprise AI workloads and foundational model training cycles. In the third quarter of fiscal 2026, NVIDIA generated and $31.9 billion in net income, with GAAP gross margins of 73.4%. Operating cash flow exceeded $23.8 billion and free cash flow reached approximately $22.1 billion, indicating a robust capital structure. This financial strength supports aggressive R&D investment and multi-generation platform transitions from Ampere to Blackwell and Rubin.

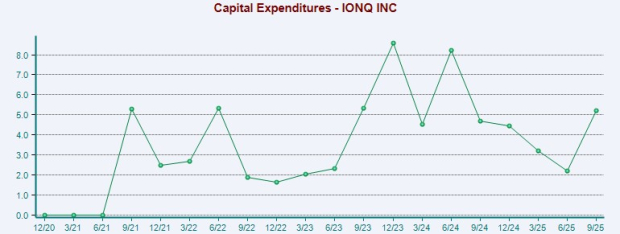

By contrast, IonQ is still in the early stages of commercial growth but has shown accelerating momentum that aligns with long-term expansion goals. The company’s third-quarter 2025 revenues exceeded guidance by 37%. The company has raised significant capital, resulting in a $2 billion equity offering that boosted pro-forma cash to $3.5 billion, providing a strong balance sheet to invest in R&D, acquisitions and platform scaling. Strategic moves such as the acquisition of Oxford Ionics and Vector Atomic and more recently the announced $1.8 billion SkyWater Technology deal to internalize semiconductor fabrication, strengthen IonQ’s technology stack across computing, networking and sensing.

Looking ahead, IonQ’s ability to build sustained momentum depends on continued technical execution and broader market adoption. Unlike GPUs, where demand is already well established across hyperscalers and enterprise workloads, commercial quantum computing remains nascent and concentrated in early enterprise and government contracts. IonQ’s third-quarter 2025 milestones, including 99.99% two-qubit gate fidelity and expanded algorithmic qubit performance, along with strategic acquisitions like Oxford Ionics and Vector Atomic, strengthen its long-term platform position. With a strong cash balance and no debt, IonQ can continue investing in R&D and expanding its platform. However, broader revenue scaling and profitability are likely tied to future deployments of larger-scale, fault-tolerant systems and wider industry adoption, a multi-year journey compared with NVIDIA’s current commercial footprint.

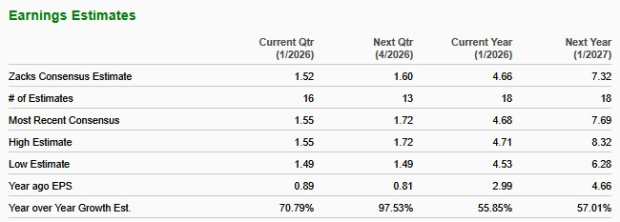

The Zacks Consensus Estimate for NVIDIA’s fiscal 2027 earnings stands at $7.32 per share, implying approximately 57% growth over the projected fiscal 2026 figure, underscoring continued operating leverage and earnings expansion.

In contrast, IonQ is expected to remain in a loss position. The Zacks Consensus Estimate for IonQ’s 2027 earnings stands at a loss of $1.74 per share, indicating an estimated 65.8% year-over-year improvement from 2026, suggesting narrowing losses rather than near-term profitability.

For Investors, NVIDIA, carrying a Zacks Rank #2 (Buy), offers solid earnings growth, strong cash flow and leadership in AI chips, making it a dependable core stock for long-term growth.

IonQ, with a Zacks Rank #3 (Hold), is earlier in its growth journey and carries more risk. However, its much lower share price may allow investors to gradually build a position for future gains. A balanced strategy, holding more NVIDIA while slowly accumulating IonQ, could help manage risk while keeping upside exposure. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 min | |

| 26 min | |

| 28 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite