|

|

|

|

|||||

|

|

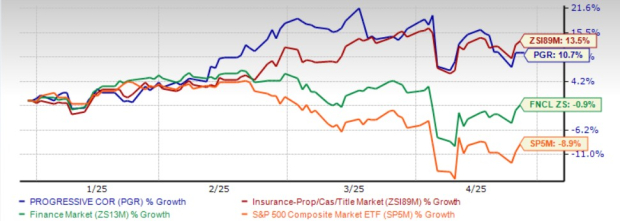

Shares of The Progressive Corporation PGR have gained 10.7% year to date, underperforming the industry’s rally of 13.5% but outperforming the Finance sector and the Zacks S&P 500 composite’s decline of 0.9% and 8.9%, respectively, in the said time frame.

PGR is one of the country’s largest auto insurance groups, the largest seller of motorcycle and boat policies, the market leader in commercial auto insurance and one of the top 15 homeowners carriers based on premiums written. This insurer is set to deliver steady profitability, given its solid market presence, a convincing portfolio of products and services, and underwriting and operational expertise.

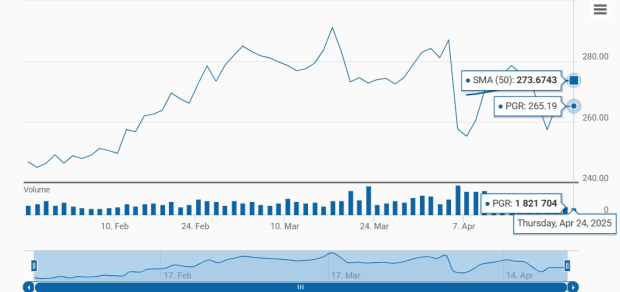

Progressive shares are trading below the 50-day moving average, indicating a bearish trend.

The 50-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as it is the first marker of an uptrend or downtrend.

Shares of Allstate Corporation ALL and Travelers Companies TRV, two other auto insurers, have also lagged the industry year to date. Shares of Allstate have gained 1.1% while that of Travelers have gained 8.1% in the said time frame.

Travelers is one of the leading writers of auto and homeowners’ insurance and commercial U.S. property-casualty insurance. Successful execution of growth strategies and stability in the markets where it operates are set to drive TRV’s auto and homeowners' business and commercial business.

Travelers is poised to grow on solid retention, better pricing, increased new business and positive renewal premium change.

Allstate continues to refine its business strategy by focusing on core strengths and shedding underperforming segments. Allstate expects total Property-Liability policies in force to increase this year as auto insurance policy renewal rates improve and new business continues to grow.

Rising premiums, growing protection services business and streamlining initiatives poise Allstate well for growth.

PGR is currently expensive. It is trading at a P/B multiple of 5.37, higher than the industry average of 1.62. Given its market-leading presence, growth prospects, rising estimates and better return on invested capital, its premium valuation is justified.

Shares of Allstate and Travelers are also trading at a premium to the industry.

PGR is poised for growth based on its strategic initiatives, such as prioritizing auto bundles, lowering exposure to risky properties and increasing segmentation through product rollouts.

A compelling product portfolio and prudent underwriting help it maintain healthy policies in force, and a solid retention ratio drives improvement in premiums. Policy life expectancy (PLE), a measure of customer retention, has improved in the last few years across all business lines. Distinctive new auto insurance options, along with competitive pricing, should help sustain improvement in PLE.

In tandem with the industry trend, PGR has also implemented digitalization, including the adoption of AI.

Over a decade, PGR’s combined ratio has averaged less than 93%, which compares favorably with the industry average combined ratio of more than 100%.

Prudent underwriting, and favorable reserve development, should help the company maintain its momentum. Also, its reinsurance program shields the balance sheet from the impacts of catastrophe events and active weather years.

A robust cash flow ensures consistent investment in growth strategies, including digitalization aimed at enhancing margins. PGR has been improving its book value and gradually decreasing its leverage, drawing on its operational expertise. Although its leverage remains above the industry average, its times interest earned ratio is higher than the industry average.

Three analysts have raised earnings estimates for 2025, whereas five have raised forecasts for 2026 in the past seven days. The Zacks Consensus Estimate for 2025 has moved 0.8% higher, whereas the same for 2026 has moved 1% north in the same time frame.

The Zacks Consensus Estimate for Progressive’s 2025 earnings is pegged at $15.70 per share, indicating an increase of 11.7% from the year-ago reported figure, while the same for 2026 is pegged at $15.91 per share, indicating a year-over-year increase of 1.4%.

The long-term earnings growth rate is pegged at 9.6%, better than the industry average of 7.5%. Its Growth Score is B.

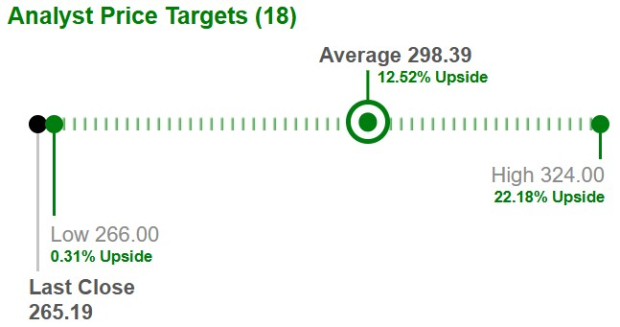

Based on short-term price targets offered by 18 analysts, the Zacks average price target is $298.39 per share. The average suggests a potential 12.5% upside from the last closing price.

Return on equity for the trailing 12 months was 33.5%, comparing favorably with the industry’s 8.3%. This reflects its efficiency in utilizing shareholders’ funds.

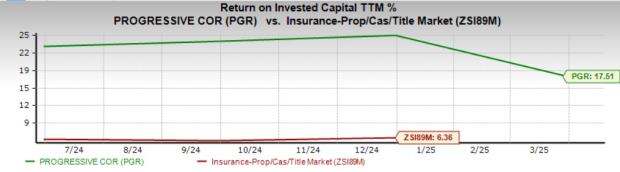

Also, return on invested capital (ROIC) has been increasing over the last few quarters as the company raised its capital investment over the same time frame. This reflects PGR’s efficiency in utilizing funds to generate income. ROIC in the trailing 12 months was 17.5%, better than the industry average of 6.4%.

Progressive’s leading market presence, effective pricing strategy, and sound underwriting standards are likely to drive the continued strength of its shares. Optimistic growth projections, positive analyst sentiment, an impressive dividend history, and a VGM Score of B instill confidence in PGR.

Hence, despite its premium valuation, this Zacks Rank #2 (Buy) stock holds solid potential to attract investor interest and be a worthy inclusion to their portfolios. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 7 hours | |

| 8 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite