|

|

|

|

|||||

|

|

Roku ROKU is slated to report first-quarter 2025 results on May 1.

For the first quarter of 2025, Roku expects total net revenues of $1.005 billion, indicating an increase of 14% year over year. The company anticipates Platform revenues to grow 16% year over year, and Devices revenues are expected to remain flat year over year due to elevated inventory from lower holiday sales. It expects first-quarter total gross profit of $450 million and adjusted EBITDA of $55 million.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $1 billion, suggesting year-over-year growth of 13.96%. The consensus mark for loss is pinned at 20 cents per share. The estimate indicates a year-over-year growth of 42.86%.

See the Zacks Earnings Calendar to stay ahead of market-making news.

In the last reported quarter, the company delivered an earnings surprise of 45.45%. The company’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 55.07%.

Our proven model predicts an earnings beat for Roku this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

ROKU has an Earnings ESP of +65.17% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

As Roku prepares to report first-quarter 2025 earnings, investors should maintain a cautious stance. Despite strong Platform momentum in 2024, Devices revenues and gross profit were impacted by increased seasonal discounting across the industry, including at Roku. This resulted in an excess inventory position at the end of 2024, which is expected to have weighed slightly on gross margins in the first quarter of 2025.

Platform growth remains healthy, with management estimating 16% year-over-year growth for the first quarter of 2025. Streaming services distribution and advertising activities both contributed to the expected increase, with advertising activities anticipated to grow faster than subscription revenues. However, the absence of political advertising spend compared to the fourth quarter, along with seasonal trends, might have tempered advertising momentum in the quarter under review.

The Roku Channel continues to expand rapidly, reaching approximately 145 million people in the United States and delivering 82% year-over-year growth in Streaming Hours during the fourth quarter. Enhancements to the Roku Experience, including an AI-powered content row and expanded ad formats, such as Brand Showcases and Action Ads, are driving increased engagement and monetization. Nevertheless, macroeconomic uncertainty and competitive shifts in the ad market may present near-term volatility.

Roku operates in an increasingly competitive advertising landscape, facing new pressures in the first quarter of 2025 as companies like Netflix NFLX, Warner Bros. Discovery WBD, and Disney DIS expand their ad-supported streaming offerings. The global reach, brand strength, and established advertiser relationships of these companies may have challenged Roku’s ability to capture ad budgets and sustain advertising momentum during the quarter under review.

Roku’s international expansion into markets like Mexico, Canada, and the United Kingdom is expected to have driven user growth in the first quarter of 2025. However, as the company remains focused on scaling its international presence before prioritizing monetization, the immediate impact on revenues is expected to have been limited.

The Zacks Consensus Estimate for average revenue per user is pegged at $42.09.

The consensus mark for first-quarter 2025 Devices revenues is pegged at $127 million, and for Platform revenues, it is pinned at $877 million.

Shares of Roku have lost 11.6% in the year-to-date period compared with the Zacks Consumer Discretionary sector and the S&P 500 index’s decline of 4.9% and 6.4%, respectively.

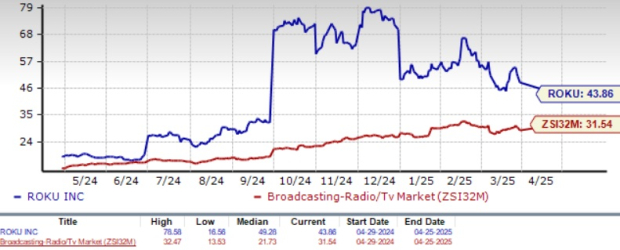

From a valuation perspective, Roku currently trades at a price-to-cash flow ratio of 43.86X, which is at a significant premium compared to the Zacks Broadcast Radio and Television industry average of 31.54X. While this valuation gap suggests that investors have high growth expectations for this stock, it is not a good pick for a value investor. A value score of D further reinforces an unattractive valuation for ROKU at this moment.

Roku continues to demonstrate strong platform fundamentals with robust user engagement, innovative Home Screen monetization, and healthy international expansion. However, investors should adopt a cautious stance ahead of first-quarter 2025 results. Elevated inventory levels and margin pressures from seasonal discounting in Devices, combined with intensifying competition in ad-supported streaming, may weigh on near-term performance. While Platform revenues are poised for double-digit growth and advertising activities remain a key strength, given Roku’s premium valuations and potential volatility in advertising trends, patience could reward investors seeking a more attractive entry point.

Roku’s platform growth trajectory remains healthy, but current valuations largely reflect its projected growth. With first-quarter gross margins pressured by excess holiday inventory, seasonal advertising trends normalizing, and competitive intensity rising in ad-supported streaming, investors should consider maintaining existing positions while awaiting a more favorable entry point. The company's innovations in Home Screen monetization and international expansion offer long-term upside, but prudent investors may benefit from patience ahead of first-quarter results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 |

Six Months, 9 Offers and $81 Billion. How Hollywood's Nasty Takeover Was Won.

NFLX +13.77% WBD

The Wall Street Journal

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite