|

|

|

|

|||||

|

|

Datadog DDOG has expanded its cloud monitoring platform with the acquisition of Metaplane, a company that specializes in end-to-end data observability. Metaplane’s machine learning-powered tools help businesses detect, prevent, and fix data quality issues across their entire data stack, helping build greater trust in the information that powers AI models and modern applications.

This move builds on Datadog’s earlier launches like Data Jobs Monitoring and Data Streams Monitoring, strengthening its push into the fast-growing data observability space. As platforms like Snowflake and Databricks become central to business operations, Datadog’s new capabilities give customers better visibility across the full data lifecycle, from production systems to final consumption, instead of just monitoring data after it reaches a warehouse.

With businesses increasingly relying on AI and data-driven products, full-stack data observability is becoming a key requirement. By integrating Metaplane’s technology, Datadog is helping data teams catch problems earlier, improve reliability, and drive faster innovation across their organizations. It also strengthens Datadog’s position as a broader, more complete observability platform for the modern cloud era.

The acquisition comes at a time when Datadog’s customers are expanding their use of cloud, AI, and data-driven applications. DDOG ended 2024 with around 30,000 customers, including 45% of the Fortune 500, and more than 3,600 customers generating $100,000 or more in ARR. While the company was already a leader in observability for infrastructure, applications, and logs, it lacked full-stack visibility into the quality and flow of business data itself. Adding Metaplane fills this important gap as companies demand deeper data monitoring.

Bringing Metaplane’s capabilities into the platform also supports Datadog’s strategy of expanding product adoption. As of the fourth quarter, 50% of customers used four or more products, and 12% used eight or more. Offering end-to-end data observability as part of the core platform should improve retention, boost cross-sell opportunities, and drive higher long-term revenues, especially as businesses increasingly seek integrated solutions for cloud, AI, and data operations.

Datadog's financial trajectory remains robust, with guidance for first-quarter 2025 projecting revenues between $737 million and $741 million, suggesting 20-21% year-over-year growth. The full-year 2025 outlook appears promising, with expected revenues between $3.175 billion and $3.195 billion and non-GAAP earnings per share in the range of $1.65-$1.70.

The Zacks Consensus Estimate for 2025 revenues and earnings is pegged at $3.19 billion and $1.68 per share, respectively. This indicates a year-over-year improvement of 18.7% in the top line and a decrease of 7.69% in the bottom line. The earnings estimates have been revised downward by a penny over the past 30 days.

See the Zacks Earnings Calendar to stay ahead of market-making news.

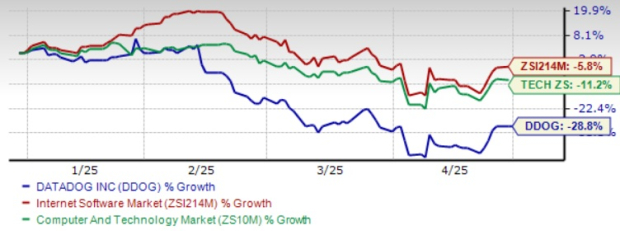

In the year-to-date period, DDOG shares have plunged 28.8%, underperforming the Zacks Computer and Technology sector and the Zacks Internet – Software industry’s decline of 11.2% and 5.8%, respectively.

From a valuation perspective, Datadog currently trades at a forward 12-month P/S ratio of 10.33X, which is at a significant premium compared to the Zacks Internet - Software industry average of 4.84X. While this valuation gap suggests that investors have high growth expectations for this stock, it is not a good pick for a value investor. A value score of F further reinforces an unattractive valuation for DDOG at this moment.

Datadog faces increasing pricing pressure from competitors in the observability and cloud monitoring space. Its competitors include IBM IBM, Microsoft MSFT and Broadcom in the on-premise infrastructure monitoring space. In the Cloud monitoring market, Datadog competes with native solutions from cloud providers, such as Amazon’s AMZN Web Services, Google Cloud Platform and Microsoft Azure, besides facing stiff competition from Cisco Systems, Dynatrace and Splunk in APM and Log Management.

Additionally, Datadog is suffering from cost escalations in the form of research and development, sales and marketing and general and administrative expenses that soared 29.4%, 31.3% and 29.6% year over year to $211.6 million, $173.3 million and $38.7 million, respectively, in the fourth quarter of 2024, a trend that will likely continue through the quarters in 2025. This is expected to hurt the company’s bottom line, at least in the near term.

While Datadog faces short-term headwinds from higher costs and rising competition, its long-term growth prospects remain strong. The expansion into data observability with the Metaplane acquisition strengthens its platform and supports future cross-sell opportunities. Solid customer growth, strong cloud and AI tailwinds, and promising revenue projections for 2025 suggest that Datadog is still well-positioned for the future. Given its premium valuation and the 28.8% year-to-date decline, it may be wise for investors to hold the stock for now.

Datadog currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite