|

|

|

|

|||||

|

|

IonQ IONQ is slated to report first-quarter 2025 results on Wednesday.

For the first quarter specifically, IonQ guided for $7-$8 million in revenues, indicating a slower start to the year compared to its anticipated full-year 2025 revenues of $75-$95 million. This suggests a back-loaded year, with larger revenue contributions expected in later quarters as new technologies and acquisitions begin generating returns.

The Zacks Consensus Estimate for revenues is pegged at $7.5 million, indicating a 1.06% decline year over year.

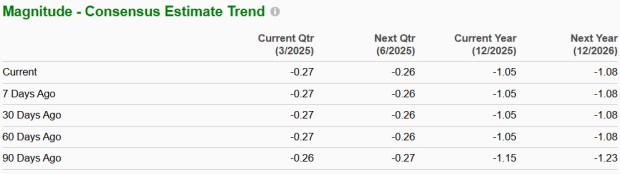

The Zacks Consensus Estimate is pegged at a loss of 27 cents per share, wider than a loss of 19 cents reported in the year-ago quarter. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

In the last reported quarter, the company delivered a negative earnings surprise of 272%. The company’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, the average negative surprise being 57.81%.

IonQ, Inc. price-eps-surprise | IonQ, Inc. Quote

Our proven model does not predict an earnings beat for IonQ this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

IONQ has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

IonQ is approaching its first-quarter 2025 earnings result with significant momentum following a record-breaking 2024, where it achieved 95% year-over-year revenue growth and exceeded its guidance ranges. The company's strategic expansion into quantum networking through acquisitions and its continued innovation in quantum computing are likely to have influenced its first-quarter performance.

The company successfully raised more than $372 million through its at-the-market equity offering in early March, bringing its pro forma cash balance to over $700 million. This substantial war chest strengthens IonQ's financial position but also raises questions about potential dilution effects on shareholders. The early termination of the ATM program indicates management's confidence in having secured sufficient funding for its strategic initiatives. IonQ's acquisition strategy has been aggressive, with the company closing the Qubitekk deal in late 2024 and securing a controlling stake in ID Quantique in first-quarter 2025. These acquisitions have expanded IONQ's quantum networking patent portfolio to nearly 400, reinforcing its position in the growing quantum networking market. However, integrating these acquisitions might have impacted short-term profitability.

A significant development in the first quarter was IonQ's collaboration with Ansys, demonstrating quantum computing outperforming classical computing by 12% for blood pump design simulations. This achievement marks one of the first practical demonstrations of quantum advantage and could accelerate enterprise adoption, potentially boosting future bookings. The $21.1 million project with the U.S. Air Force Research Lab announced in January complements IonQ's earlier $54.5 million AFRL contract, highlighting growing government interest in quantum technologies. These contracts should provide steady revenue streams, though the timing of revenue recognition may impact quarterly results.

Investors should watch for updates on the company's technological roadmap, particularly regarding the XHV technology announced in February, which aims to reduce the size and energy consumption of quantum systems. Progress on this front could enhance IonQ's competitive positioning. Given the company's robust cash position, ongoing technological innovations, and strategic acquisitions, IonQ appears well-positioned in the long term. However, with the first quarter traditionally being a slower quarter and integration costs from recent acquisitions likely impacting near-term profitability, investors might consider waiting for post-earnings clarity before establishing or adding to positions.

Adding to the concerns, the company faces daunting competition from deep-pocketed tech giants like International Business Machines IBM, Alphabet GOOGL-owned Google and Microsoft MSFT, who are pouring billions into quantum computing development. IonQ's relatively limited resources compared to competitors could have hindered its ability to maintain technological leadership in the to-be-reported quarter.

Shares of IonQ have lost 26% year to date, underperforming the Zacks Computer and Technology sector and its peers indicating mounting concerns about the quantum computing, the company's financial sustainability and valuation which suggest investors should hold the stock or wait for a better entry point ahead of its first-quarter 2025 earnings report

The stock's valuation remains elevated given the current losses, suggesting investors might benefit from waiting for a more attractive entry point or holding existing positions while monitoring the execution on the company's technological and commercial initiatives. IONQ stock is trading at a two-year premium with a forward 12-month price/sales of 66.4 compared with the Zacks Computer - Integrated Systems industry’s 2.98.

IonQ presents a conflicting investment case ahead of first-quarter 2025 results. While its recent technological breakthrough with Ansys demonstrating 12% quantum advantage over classical computing marks a significant milestone, the company faces integration challenges from recent acquisitions, including ID Quantique and Qubitekk. The $372 million capital raise strengthens its $700 million war chest but creates dilution concerns. With first-quarter revenue guidance of just $7-$8 million compared with full-year expectations of $75-$95 million, results will likely be back-loaded. Despite strong government contracts and expanded patent portfolio, IonQ's premium valuation remains vulnerable to execution risks and intensifying competition in the quantum computing landscape. Investors should consider waiting for post-earnings clarity on acquisition integration and technology roadmap progress before committing capital.

While IonQ's quantum technology breakthroughs and expanding patent portfolio show promise, investors should approach with caution before first-quarter 2025 results. The company's premium valuation requires flawless execution amid integration challenges from recent acquisitions. With expected back-loaded revenue recognition and intensifying industry competition, current shareholders should maintain positions while new investors might benefit from waiting for post-earnings clarity on growth trajectory and acquisition synergies before establishing positions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 40 min | |

| 1 hour | |

| 3 hours |

Tech Firms Arent Just Encouraging Their Workers to Use AI. Theyre Enforcing It.

GOOGL

The Wall Street Journal

|

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite