|

|

|

|

|||||

|

|

While a significant amount of money continues to flow into low-cost, plain-vanilla ETFs, the ETF universe is becoming increasingly complex. Most new ETFs being launched are actively managed, and many make use of derivatives.

Two recent regulatory changes—the “ETF Rule” and the “Derivatives Rule”—have made it easier for providers to launch ETFs and incorporate derivatives into their strategies. The explosion in derivative-backed ETFs has been particularly striking.

Most of these new derivative-based ETFs fall into one of three categories:

Buffer or defined outcome ETFs

Leveraged or inverse single-stock ETFs

Option-based income ETFs

Some of the newest products even combine options-selling strategies with leveraged single-stock ETFs. (See: Buffer ETFs Attract Billions as Investors Seek Shelter from Market Turmoil)

This article takes a closer look at ETFs that trade options on single stocks to generate exceptionally high yields—among the hottest-selling funds in the market today. Thanks to their eye-catching distribution rates, these funds are generating significant buzz on social media. However, they generally underperform the underlying stocks, even as they continue to attract assets from investors drawn to their lucrative monthly payouts.

We analyzed the performance of 24 single-stock covered call ETFs in the YieldMax suite from their respective inception dates. We focused on YieldMax because it is the clear leader in this niche, significantly ahead of competitors despite a recent surge in similar offerings.

Many of YieldMax’s ETFs launched in 2023—providing a limited, yet more substantial, performance history compared to most rivals, which are even newer.

Despite their eye-popping distribution rates, these products tend to underperform on a total return basis due to steep declines in share price. Of the 24 YieldMax ETFs we examined, only two managed to slightly outperform their respective underlying stocks.

Option Income ETFs: How the Strategy Works

YieldMax currently offers 48 ETFs in U.S. markets, with total assets under management of over $10 billion. Though relatively new—the oldest, TSLY, debuted in November 2022—the suite has grown rapidly, largely driven by its headline-grabbing distribution yields of 100% or more. Inspired by this success, many copycat ETFs have entered the market.

According to the provider, the primary investment objective of these funds is to seek current income; the secondary objective is to seek exposure to the price movement of the underlying stock, subject to a cap.

These funds do not actually hold the underlying stocks. Instead, they gain synthetic exposure by taking long positions in call options and short positions in put options. They also hold Treasury securities for collateral and additional income.

To generate monthly income, the fund manager sells call options against the synthetic long position. These calls typically have expirations of one month or less and strike prices about 0%–15% above the current share price. In some cases, managers use covered call spread strategies to further enhance yields.

The YieldMax Reddit community has around 44,000 members, many of whom discuss using these ETFs to replace their 9-to-5 jobs or to generate retirement income.

The four most popular products in the suite are linked to some of the hottest and most volatile stocks. The inherent volatility of these stocks leads to higher option premiums—and higher potential income. Each of these ETFs has gathered over $1 billion in AUM.

Yields are calculated by annualizing the most recent monthly payout and dividing it by the fund’s latest NAV. However, yields can vary significantly from month to month as income from selling options depends on fluctuations in the underlying stock, implied volatility, and other factors.

Performance Since Inception

We analyzed the total return—including distributions—of YieldMax ETFs from their inception versus their respective underlying stocks. Some stocks surged, some declined, and others remained relatively flat—but in all cases except those tracking PayPal PYPL and Marathon Digital MARA, the ETF underperformed the stock.

For the four most popular products, the performance gap was substantial—showing that investors may be leaving a lot of money on the table in pursuit of yield.

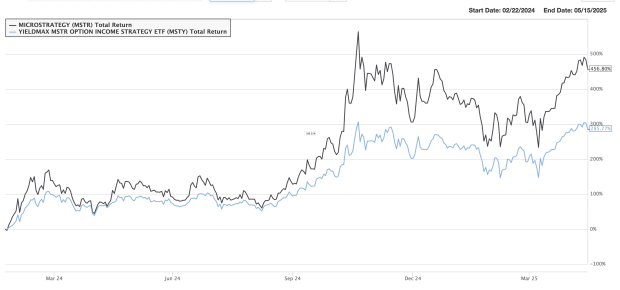

YieldMax MSTR Option Income Strategy ETF (MSTY)

The most popular product in the suite celebrated its one-year anniversary in February and now boasts $4 billion in assets. It is also the highest-yielding single-stock ETF in the lineup, offering a distribution rate of 136%. Since inception, it has delivered a total return of 286%, while MSTR stock has surged 457% during the same period.

Once a little-known, money-losing software firm, Strategy MSTR has become the largest corporate holder of bitcoin and now trades like a leveraged bet on the cryptocurrency. Its stock commands a significant premium over the value of its bitcoin holdings.

Some experts believe the financial engineering behind MSTY—and the premium valuation—may be unsustainable. If you're bullish on bitcoin, why not consider the iShares Bitcoin Trust IBIT, which charges just 0.25% and closely tracks the price of the asset?

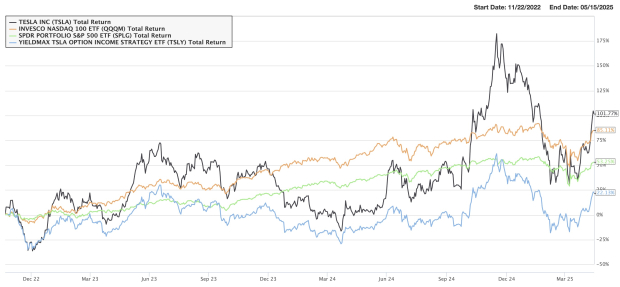

TSLA Option Income Strategy ETF (TSLY)

The oldest product in the suite holds $1.2 billion in assets. Since its debut in November 2022, the ETF has gained approximately 22%—significantly underperforming Tesla TSLA shares, which are up about 102% over the same period. It has also lagged the S&P 500 and Nasdaq-100 indexes, which have gained 53% and 85%, respectively.

For context, low-cost index funds like the SPDR Portfolio S&P 500 ETF SPLG and Invesco NASDAQ 100 ETF QQQM charge just 0.02% and 0.15% in fees, while most option income products charge close to 1%. TSLY currently boasts a striking yield of nearly 107%.

NVDA Option Income Strategy ETF (NVDY)

The second most popular product in the family has generated a total return of about 187% since its inception in May 2023. However, shares of the AI darling NVIDIA NVDA have risen approximately 372% over the same period. Still, the ETF has attracted $1.3 billion in assets.

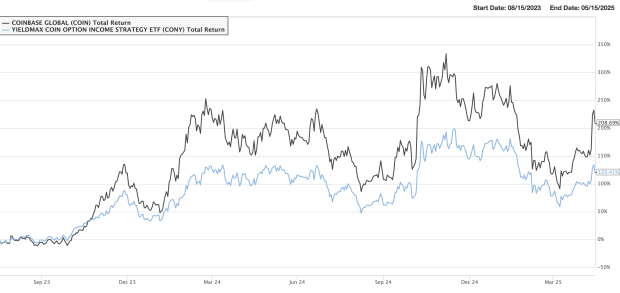

YieldMax COIN Option Income Strategy ETF (CONY)

CONY, which tracks Coinbase COIN—a major beneficiary of bitcoin’s rise—has returned 120% since its debut in August 2023. Over the same period, COIN stock has gained about 209%. The ETF currently sports a yield of 97% and has about $1.1 billion in assets.

Single-Stock Option Income ETFs vs. Diversified ETFs

These ETFs sell one-month call options with strike prices slightly above the current stock price. In doing so, investors give up much of the upside if the stock rises while still bearing most of the downside if the stock falls—creating an asymmetric risk-reward profile.

By contrast, the JPMorgan Equity Premium Income ETF JEPI—which helped launch the covered call trend—uses a bottom-up fundamental process to construct a diversified, defensive portfolio of about 125 stocks. (Read: What's Behind the Surge in Options Income ETFs?)

The fund then sells out-of-the-money S&P 500 index call options to generate monthly income. This portfolio doesn’t experience the outsized moves seen in names like Strategy or Coinbase, which explains why the performance shortfall may not be too striking.

Bottom Line

You should only invest in a fund tied to a single stock if you're bullish on that specific name—in which case, you're generally better off owning the stock directly. If you expect the stock to decline, it’s best to steer clear of any product linked to it.

These ETFs may outperform if the underlying stock remains range-bound. However, since they use market swings as an income-generating strategy, don’t expect jumbo distributions.

If you’re drawn to high monthly income and can accept an asymmetric risk-reward profile—as well as potentially unfavorable and inconsistent tax treatment—these funds may still appeal to you.

ETFs have democratized access to markets, and innovation in the space has been remarkable. But with complex products like these, it’s essential for investors to fully understand how they work—and what outcomes are realistic.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 min | |

| 32 min | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite