|

|

|

|

|||||

|

|

Celsius Holdings, Inc. CELH and The Coca-Cola Company KO are two of the most closely watched beverage stocks in the market today. Celsius Holdings is a high-growth energy drink brand gaining traction among consumers seeking functional, zero-sugar beverages. With strong momentum in convenience stores, gyms, and online channels — alongside a major distribution deal with PepsiCo, Inc. PEP — Celsius has quickly become a serious contender in the energy drink space.

Coca-Cola is a global beverage powerhouse with over 200 brands in its portfolio and a long history of adapting to consumer trends. From sugar-free sodas and hydration drinks to new product innovations, Coca-Cola continues to evolve while maintaining its dominant market position.

For investors evaluating Celsius Holdings stock versus Coca-Cola stock, the decision comes down to one’s appetite for growth versus their preference for stability. Here's how the two companies stack up in today’s fast-changing beverage industry.

Celsius Holdings has emerged as one of the fastest-growing brands in the beverage market by positioning itself as a clean, health-conscious alternative to traditional offerings. Its zero-sugar, clean-label drinks have struck a chord with Gen Z and millennial consumers who prioritize wellness and performance. This strong brand has powered growth in fitness centers, specialty stores and major national retailers.

The company further expanded its footprint with the acquisition of Alani Nu, completed on April 1, 2025. Combined, Celsius Holdings and Alani Nu contributed approximately 20% of total dollar growth in the energy drink category during the first quarter of 2025. With distinct brand identities and strong consumer appeal, CELH is well-positioned to engage a broader audience and build lasting customer loyalty.

Product innovation remains a central driver of growth for Celsius Holdings. In the first quarter of 2025, the company expanded its portfolio with the launch of new Vibe and ESSENTIALS flavors, along with the debut of CELSIUS HYDRATION, which marked its entry into the fast-growing $1.4 billion hydration powder market. These new offerings are helping Celsius Holdings move beyond on-the-go consumption and into daily household use, increasing brand relevance and driving deeper consumer engagement.

The company has also achieved notable expansion in its retail distribution network, gaining shelf space across major national and regional retailers. However, maintaining this retail momentum requires ongoing investment in marketing, innovation, and supply chain efficiency. As competition intensifies and cost pressure persists, any slowdown in consumer demand or disruption in retailer relationships could pose challenges to sustaining the company's current growth trajectory. Long-term success will depend on Celsius Holdings’ ability to scale effectively while continuing to deliver differentiated, in-demand products.

Coca-Cola remains one of the most reliable and established names in the global beverage industry. Operating in over 200 countries and offering multiple billion-dollar brands across several beverage categories, KO has proven its ability to drive consistent growth through its strong pricing power and global scale. In the first quarter of 2025, Coca-Cola reported a 6% increase in organic revenues, supported by a 5% rise in price/mix and a 1% boost in concentrate sales, highlighting its resilience despite macroeconomic headwinds and geopolitical uncertainty.

The company’s long-term growth strategy is rooted in a blend of brand strength, marketing expertise, and innovation. Coca-Cola is advancing its vision of becoming a total beverage company through a resilient approach that blends cutting-edge marketing, agile product innovation, and disciplined revenue growth management. Its modernized marketing model leverages digital, experiential, and in-store channels to forge stronger, more personalized consumer connections.

To align with shifting consumer preferences, Coca-Cola has diversified its portfolio beyond traditional sugary drinks, expanding into healthier and functional options such as vitaminwater, smartwater, Simply juices, and Dasani. Key initiatives — such as the success of the Real Magic platform, the acquisition of BODYARMOR, and the launch of Coca-Cola Starlight — demonstrate the company’s agility and brand strength.

Coca-Cola is also expanding into the rapidly growing ready-to-drink (RTD) alcoholic beverage market. Following the successful launches of Topo Chico Hard Seltzer, Simply Spiked Lemonade, FRESCA Mixed, and Jack & Coke, the company plans to introduce Bacardi Mixed with Coca-Cola RTD cocktails in 2025. The company aims to balance volume growth with price/mix optimization, while anticipating a tapering impact from inflation-driven pricing pressure as the year progresses.

The Zacks Consensus Estimate for Coca-Cola’s 2025 earnings per share (EPS) has remained unchanged over the past 60 days at $2.96. In comparison, the consensus EPS estimate for Celsius Holdings has moved down by a penny to 94 cents during the same period. This comparison highlights a more optimistic profitability outlook for KO relative to CELH.

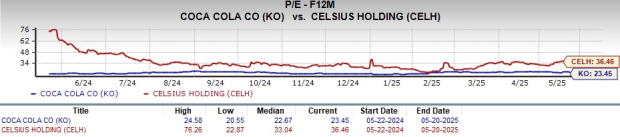

Coca-Cola’s forward P/E of 23.45x reflects its strong earnings visibility while Celsius Holdings trades higher at 36.46x on anticipated growth. Yet, Coca-Cola’s stock has delivered stronger returns. It has risen 14% over the last 12 months against Celsius Holdings’ steep 60.3% decline. It has also outperformed the broader S&P 500 11.8% growth. With macro uncertainty still a factor, investor sentiment is clearly leaning toward Coca-Cola’s proven track record and defensive appeal.

While Celsius Holdings has captured attention with its rapid growth and expanding product lineup, recent earnings estimate cuts and sharp stock underperformance signal rising challenges ahead. In contrast, Coca-Cola continues to deliver steady revenue gains, pricing power, and product innovation across a broad global platform. With stable earnings visibility, better stock performance and a defensive edge in today’s uncertain environment, Coca-Cola stands out as the more reliable and balanced growth play. For investors seeking dependable returns with lower risk, KO is the smarter choice in the beverage sector.

KO currently has a Zacks Rank #2 (Buy), while CELH carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite