|

|

|

|

|||||

|

|

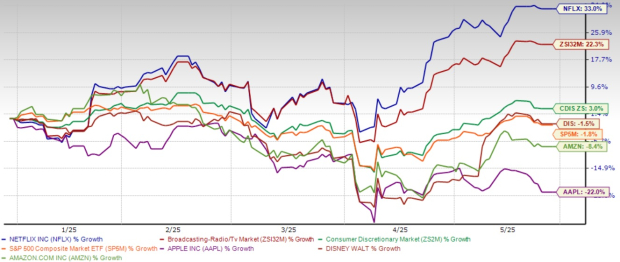

Netflix NFLX has already delivered impressive returns to investors in 2025, with shares climbing 33% year to date, significantly outpacing other streaming competitors like Apple AAPL, Amazon AMZN, and Disney DIS, as well as the broader Zacks Consumer Discretionary sector and the S&P 500. Shares of Apple, Disney and Amazon have lost 22%, 1.5% and 8.4%, respectively, in the same time frame.

However, savvy investors shouldn't let this stellar performance deter them from considering the streaming giant as a long-term investment opportunity. Netflix has set its sights on an ambitious target that has caught the attention of investors worldwide: doubling its revenues by 2030 and achieving a $1 trillion market capitalization.

We discuss three fundamental reasons why Netflix stock remains an attractive buy, even after its significant appreciation.

Netflix recently showcased a remarkable ability to exceed expectations across key financial metrics. The streaming leader delivered earnings per share of $6.61, crushing analyst estimates of $5.68 by an impressive 16.37%. This substantial beat wasn't a one-time occurrence but represents a consistent pattern of outperformance, with Netflix surpassing EPS expectations in four consecutive quarters.

Revenue growth remained robust at $10.54 billion, slightly above the $10.50 billion consensus estimate. More importantly, the company maintained its strong operational discipline, guiding for a 29% operating margin for the full year while projecting $8 billion in free cash flow for 2025. This financial strength provides Netflix with substantial flexibility to continue investing in content while returning cash to shareholders through share buybacks.

The Zacks Consensus Estimate for NFLX’s 2025 revenues is pegged at $44.46 billion, indicating 13.99% year-over-year growth. The consensus mark for earnings is pegged at $25.32 per share, indicating a 27.69% increase from the previous year.

See the Zacks Earnings Calendar to stay ahead of market-making news.

The company's member retention and acquisition trends remain healthy, with Co-CEO Greg Peters noting that retention characteristics for new subscribers joining during major live events like the Paul-Tyson fight and NFL Christmas Day games mirror those of members who join for other premium content. This indicates Netflix's ability to convert event-driven viewers into long-term subscribers, creating sustainable growth momentum.

Netflix's advertising business represents perhaps the most compelling growth catalyst for the company's future. Management expects advertising revenues to roughly double in 2025, driven by the successful rollout of their proprietary ad technology platform across key markets. The company has already launched its first-party ad tech suite in Canada and the United States, with the remaining 10 ad-supported markets scheduled for rollout in the coming months.

This technological advancement provides Netflix with unprecedented control over the advertising experience, enabling more sophisticated targeting capabilities and improved buyer experiences. The platform now offers targeting based on Netflix's unique data, including life stage, interests, and viewing mood, while also supporting advertisers' own onboarded audiences and third-party vendor segments. Co-CEO Peters emphasized that this enhanced targeting capability, combined with Netflix's vast content library, creates superior campaign outcomes for advertisers while improving the member experience.

The advertising opportunity extends far beyond current achievements. Netflix represents only about 6% of consumer spend and ad revenues in the markets it serves, indicating massive room for expansion. With the company's relatively small current advertising footprint providing insulation from broader market softness, Netflix is well-positioned to capture increasing market share as its ad platform matures and advertisers recognize the platform's unique value proposition.

Netflix's content strategy continues to evolve and strengthen, with recent announcements demonstrating the company's commitment to premium storytelling across diverse genres and markets. The partnership with Dan Brown for a new Robert Langdon thriller series, co-created with acclaimed showrunner Carlton Cuse, exemplifies Netflix's ability to attract top-tier creative talent and proven intellectual properties. Brown's Langdon series has sold 250 million copies globally and been translated into 56 languages, providing a ready-made international audience.

The company's global content investment strategy remains robust, with Co-CEO Ted Sarandos highlighting recent commitments, including $1 billion in Mexican production, $2.5 billion in Korean content, and continued expansion across 50 countries worldwide. This localized content creation not only serves regional audiences but also travels globally, creating additional value from each investment.

Netflix's live programming strategy continues to gain traction, with successful events like the Taylor-Serrano fight in July and the expansion to all-day NFL football on Christmas Day 2025. These events generate outsized conversation, acquisition, and retention benefits while commanding premium advertising rates. The company's ability to blend live sports and entertainment with its core on-demand offerings creates a differentiated value proposition that competitors struggle to match.

Netflix's combination of strong financial performance, revolutionary advertising capabilities, and expanding content moat positions the company for continued success. While Netflix trades at a premium with a forward 12-month P/S ratio of 10.84 compared to the broader Zacks Broadcast Radio and Television industry's forward earnings multiple of 3.7, this valuation appears justified given the company's unique position at the intersection of technology and entertainment. Netflix's ability to outcompete both traditional media companies and tech giants speaks to its exceptional business model and execution.

Investors seeking exposure to the streaming leader should consider Netflix's proven execution ability and multiple growth vectors that extend well beyond its impressive year-to-date performance. NFLX currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 54 min | |

| 1 hour |

Trump Says Khamenei Killed In U.S.-Israeli Attacks. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 1 hour | |

| 2 hours | |

| 2 hours |

Trump Says Khamenei Likely Killed In U.S.-Israeli Attacks On Iran. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite