|

|

|

|

|||||

|

|

As the artificial intelligence (AI) sector continues to expand, investors are closely monitoring companies specializing in voice AI technologies. Two notable players in this space are SoundHound AI Inc. SOUN and Veritone Inc. VERI. While both companies are relatively small players in the broader artificial intelligence market, they operate at the intersection of voice interfaces, generative AI, and enterprise AI applications—an area increasingly gaining investor attention. Given the recent advancements in multimodal AI and speech-driven automation, these companies could be positioned to benefit from the growing demand for voice-enabled technologies across industries like automotive, media, customer service, and public safety.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

SoundHound AI has emerged as a high-growth contender in voice AI. The company’s focus on conversational AI platforms is yielding explosive revenue gains. In first-quarter 2025, SoundHound’s revenue jumped 151% year over year to $29.1 million – a record quarter. This growth has been fueled by new partnerships and acquisitions that expanded SoundHound’s reach across industries. The company’s voice AI is now used in settings ranging from fast-food ordering (e.g., drive-thrus at White Castle and Applebee’s) to automotive voice assistants, thanks to enterprise deals and its Houndify platform.

SoundHound’s recent acquisitions – including restaurant voice ordering provider SYNQ3, online ordering platform Allset, and AI dialogue firm Amelia – have rapidly increased its scale and customer base. Notably, the Amelia acquisition alone is expected to add $45 million in recurring revenue in 2025, prompting SoundHound to forecast over $150 million in combined revenue for 2025 (nearly double its 2024 sales).

This strong top-line momentum, coupled with a diversified client roster (no single customer made up more than 10% of first-quarter 2025 revenues), underscores SoundHound’s opportunities as voice AI adoption expands.

SoundHound’s financial position is another strength. After going public via SPAC in 2022, the company has shored up its balance sheet. As of first-quarter 2025-end, SoundHound held $246 million in cash with no debt, giving it a healthy runway to fund growth and R&D.

That said, SoundHound is not without challenges. The company remains unprofitable, and its growth comes at the cost of heavy investments. In the first quarter, SoundHound posted an adjusted loss of 6 cents per share. Adjusted EBITDA was a loss of $22.2 million, widening from a loss of $15.4 million, reflecting continued investment in growth and R&D. Another concern is stiff competition in voice AI. Companies like Amazon AMZN for Alexa, Alphabet GOOGL for Assistant, Apple AAPL for Siri, and others all invest heavily in voice AI, which could pressure an independent player. However, SoundHound tries to differentiate itself as an independent platform that clients can use without ceding control to Big Tech.

Veritone presents a very different story in the AI voice arena, one of a smaller, value-oriented play undergoing a turnaround. Veritone is an enterprise AI software provider whose offerings include Veritone Voice (a synthetic voice generation service) and the aiWARE platform for AI workflow orchestration. Unlike SoundHound’s pure-play voice assistant focus, Veritone’s business spans multiple AI applications (media analytics, advertising, energy grid optimization, and government intelligence), with voice AI being one notable component.

In late 2024, Veritone took a major strategic step by divesting its media services division (Veritone One, an advertising agency) for up to $104 million. This move provided an influx of cash ($59.1 million received upfront) and allowed Veritone to focus squarely on its software products and services. Post-divestiture, Veritone’s revenue base is smaller but more recurring. In first-quarter 2025, the company reported $22.5 million in revenue (down 7% year over year), which came entirely from its AI Software and related services now that the media arm is sold. Crucially, Veritone has built up a stable SaaS customer base, with Annual Recurring Revenue (ARR) of $58.7 million in the quarter, spread across 3,156 software customers. Approximately 81% of this ARR comes from subscription customers (as opposed to usage-based or one-time fees), giving Veritone a solid foundation of predictable software revenue. High gross margins reflect this software focus. The first-quarter gross margin was about 61.1% GAAP (65.1% non-GAAP), well above SoundHound’s margin, indicating a potentially profitable core if scale can be achieved.

Veritone is positioning itself for a potential rebound by deepening its focus on vertical-specific AI solutions and expanding its product offerings. A key growth driver is the Veritone Data Refinery or VDR, which has shown strong early traction with a growing pipeline, indicating rising enterprise interest. The company is also making strategic inroads into the public sector, leveraging existing deployments and government certifications to win high-value contracts, such as a recent deal with a California Sheriff’s Office. Its AI voice technology continues to find unique applications, including a partnership with Stats Perform for sports commentary. With new bookings up 22% year over year in the first quarter and expectations for an 18% annual increase at the midpoint in 2025, Veritone appears to be on a path toward recovery.

Despite these positives, Veritone faces significant challenges. Firstly, the company’s recent financial performance has been weak. Even excluding the divested segment, core revenue has been flat or declining. First-quarter’s 7% revenue drop was attributed to lower AI software usage by some major customers (including Amazon) and FX/headwinds in Europe. Veritone’s reliance on a few big customers for its AI services means growth is not yet robust or diversified. Improving the “consumption” part of its SaaS (usage-based revenue) will be key to reigniting growth. Again, Veritone remains unprofitable and carries a heavy debt load. As of March 2025, the company’s cash balance was just $16 million, which is overshadowed by its debt obligations. Veritone has roughly $90 million in convertible notes and over $28 million in term loans outstanding. This leverage is high relative to the company’s market cap and cash flows, introducing refinancing and liquidity risk.

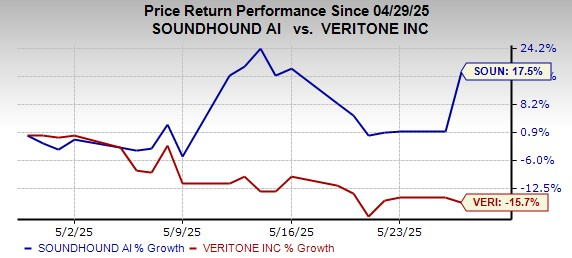

Both SoundHound and Veritone are currently undergoing business transitions while contending with investor skepticism, as reflected in their sharp year-to-date (YTD) stock declines. SoundHound is down 43.9% so far this year, while Veritone has dropped 47.6% in the same time frame. However, their short-term trajectories diverge: SoundHound has bounced back 17.5% in the past month, while Veritone fell another 15.7% over the same period. This recent uptick for SOUN stock suggests improving sentiment as investors digest the company’s growth story.

After its staggering 836% run in 2024, SoundHound’s valuation became quite rich. The stock trades around a 24.56X forward 12-month price-to-sales (P/S) ratio – a steep multiple for a firm still posting losses, reflecting the market’s optimism for future growth. The good news is that the company expects to double revenues in 2025 (guiding for $157–$177 million, roughly 2x 2024 sales), so rapid growth could help boost this valuation over time.

VERI is trading at 0.68X, much lower than the SOUN stock. VERI also currently has a Value Score of D.

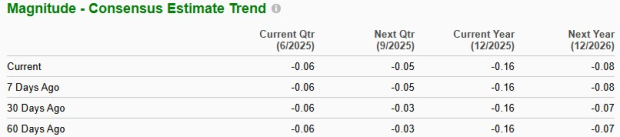

Although analysts have remained muted for SOUN’s earnings potential over the past 60 days, they are growing increasingly bearish for VERI’s prospects. Over the past 60 days, the Zacks Consensus Estimate for VERI’s 2025 loss per share has widened, as you can see below.

The contrast in growth rates is notable — for 2025, the analysts expect Veritone’s revenues to decline 0.7% to $106.3 million, whereas SoundHound is aiming to roughly double its revenue this year to $162.8 million (up 92.2%). This slower revenue growth trajectory, coupled with ongoing losses, makes investors cautious in the short term for VERI stock.

For SOUN Stock

For VERI Stock

Although both stocks currently carry a Zacks Rank #3 (Hold), the fundamental question lies in which stock offers better upside potential at this moment. Both SoundHound and Veritone stocks are down YTD. The former rebounded in the past month and the latter has continued to slide. The difference lies in their forward trajectories. SoundHound offers a compelling growth story - its revenues are skyrocketing, and it boasts a solid balance sheet with ample cash and zero debt to fund expansion. While its stock isn’t cheap and volatility will persist, SoundHound’s expanding partnerships and aggressive execution give it an edge in the race to monetize AI voice technology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In contrast, Veritone is essentially in rebuild mode – it’s smaller, saddled with debt, and trying to re-accelerate growth after a strategic reset. Veritone’s focus on enterprise and government AI solutions could pay off over time, and its low valuation means any good news might ignite the stock. However, the company’s fundamentals (declining revenue and ongoing losses) suggest that a sustained turnaround could take time, and there is considerable risk if it cannot achieve profitability before its cash runs low.

After closely examining both companies, SoundHound appears to have better upside potential at this moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours |

Dow Jones Futures: Trump Tariffs Spark Stock Market Sell-Off; Apple, Nvidia, Tesla Are Key Movers

AAPL

Investor's Business Daily

|

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite