|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Gold prices have been witnessing a northward journey in recent months, benefiting the stocks associated with yellow metal mining. On May 5, the spot gold price touched $3,415.57/ounce and it thereafter it stayed around $3,300/ounce. Stock prices of several gold miners have jumped year to date.

The surge in gold price was driven by investor concerns over the U.S. government's escalating debt, weak demand for long-term treasury bonds and a declining dollar. The northward journey of the yellow metal is likely to continue as the World Gold Council said that the gold mining industry is suffering from a scarcity of the yellow metal deposits.

On the demand side, several central banks of emerging economies are continuously buying the yellow metal. Moreover, the use of gold in energy, healthcare and technology is rising. Therefore, an eventual demand-supply imbalance is likely to drive gold prices.

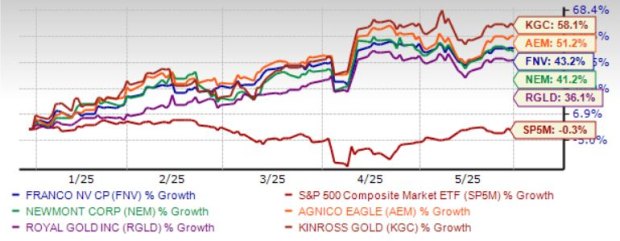

At this stage, it should be fruitful to invest in gold mining stocks with a favorable Zacks Rank. Five such stocks are: Franco-Nevada Corp. FNV, Newmont Corp. NEM, Kinross Gold Corp. KGC, Royal Gold Inc. RGLD and Agnico Eagle Mines Ltd. AEM. Each of our picks currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Central banks across the world are in the process of cutting interest rates in order to spur economic growth. A low market interest rate is beneficial for non-income-bearing bullions like gold. Moreover, a weak U.S. dollar has increased demand for dollar-denominated bullions like gold.

The prolonged geopolitical conflicts between Russia and Ukraine the intensified war between Israel and Hezbollah, and political unrest in some major South-east Asian countries are concerns for the global political atmosphere. In this situation, the price of gold should remain buoyant as the yellow metal is known as a safe-haven investment.

Market participants are optimistic about the gold mining industry’s prospects. Giant investment bankers like Goldman Sachs and JP Morgan have forecasted that gold prices could climb to $4,000/ounce by 2026, suggesting continued bullish momentum.

The chart below shows the price performance of our five picks year to date.

Franco-Nevada is well-poised to deliver strong earnings growth aided by increased contributions from its streaming agreements. Contribution from buyouts and a healthy portfolio of royalty and streaming agreements will aid the growth of FNV. Even though the company has been facing lower output due to the production halt in Cobre Panama, it is likely to be offset by FNV’s continued focus on cost management.

FNV has a debt-free balance sheet and uses its free cash flow to expand the portfolio and pay out dividends. Gold prices have been on an uptrend in 2025, aided by geopolitical reasons, and the potential for monetary policy easing. This rise in gold price will also boost the results of FNV in the coming quarters.

Franco-Nevada has an expected revenue and earnings growth rate of 31.5% and 29.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.7% over the last seven days.

Newmont is making notable progress with its growth projects. NEM is likely to gain from several projects, including the Tanami expansion. The acquisition of Newcrest also created an industry-leading portfolio providing opportunities for significant synergies. NEM also remains focused on improving operational efficiency and returning value to its shareholders.

Newmont has received full funds approval for its Ahafo North project, which has reached the execution stage. Commercial production for the project is expected to commence in second-half 2025. NEM remains committed to Ghana, investing $950 million to $1,050 million in development capital for Ahafo North.

Newmont has an expected revenue and earnings growth rate of 2% and 20.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.2% over the last seven days.

Kinross Gold has a strong production profile and boasts a promising pipeline of exploration and development projects. These projects are expected to boost production and cash flow and deliver significant value. KGC is focusing on organic growth through its Tasiast mine, where the Phase One expansion boosted production capacity, and the Tasiast 24K expansion further increased throughput and production.

KGC’s Manh Choh project at Fort Knox is expected to extend operations and benefit from higher gold prices. The Great Bear project in Ontario also offers a promising long-term opportunity with substantial gold resources. Higher gold prices should also boost KGC’s profitability and drive cash flow generation.

Kinross Gold has an expected revenue and earnings growth rate of 15.3% and 63.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.8% over the last seven days.

Royal Gold has been benefiting from its solid streaming agreements. RGLD maintains a strong balance sheet, which is likely to drive growth in the upcoming quarters. This rise in metal prices, like gold and silver, will boost RGLD’s results in the coming quarters. Even though RGLD is facing higher interest costs, it will be offset by the tailwinds.

RGLD is focused on allocating its strong cash flow to dividends, debt reduction and new businesses. In 2024, RGLD repaid $250 million of debt, effectively eliminating its total debt. This provides the company with the scope to strengthen its portfolio.

Royal Gold has an expected revenue and earnings growth rate of 24.1% and 35.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.4% over the last 30 days.

Agnico Eagle Mines is focused on executing projects that are expected to provide additional growth in production and cash flows. AEM is advancing its key value drivers and pipeline projects. The Kittila expansion promises cost savings, while acquisitions like Hope Bay and the merger with Kirkland Lake Gold strengthen AEM’s market position.

Merger with Kirkland Lake Gold established the new Agnico Eagle as the industry's highest-quality senior gold producer. Higher gold prices are also expected to drive AEM’s margins. Strategic diversification mitigates risks, supported by prudent debt management and maintaining financial flexibility.

Agnico Eagle Mines has an expected revenue and earnings growth rate of 23% and 42.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7.3% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 10 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite