|

|

|

|

|||||

|

|

Both IonQ, Inc. IONQ and Microsoft Corporation MSFT are making waves in the emerging field of quantum computing, each from very different positions. IonQ is a pure-play quantum computing pioneer, focused solely on developing cutting-edge quantum computers and networks. Microsoft is a tech giant weaving quantum technology into its massive Azure cloud platform.

What they have in common is a commitment to “quantum cloud” services – offering access to quantum computing via the cloud – and both have drawn investors’ attention recently. IonQ’s stock has surged on breakthroughs and strategic deals, while Microsoft continues to post strong cloud-driven results and invest in quantum R&D. The question is how these two quantum-exposed stocks stack up as investments.

Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

IonQ has positioned itself as a leader in trapped-ion quantum computing, achieving significant technical milestones. In first-quarter 2025, the company secured its first commercial sale, a $22 million deal with EPB, a utility in Tennessee, to deploy its Forte Enterprise quantum computer and quantum network. This marked the debut of both quantum computing and networking in a real-world application, solidifying IonQ’s technological edge. The company’s substantial intellectual property portfolio, with nearly 900 patents spanning quantum computing, communication, and sensing, further strengthens its position as a pioneer in the emerging quantum tech sector.

IonQ is aggressively expanding its reach through strategic partnerships and acquisitions. It has inked new partnerships in Asia (like in Japan and South Korea) to broaden its global presence. The company recently acquired or invested in key quantum networking players, including controlling interests in ID Quantique (a leader in quantum encryption) and Qubitekk, which positions IonQ at the forefront of quantum communication infrastructure. These moves vastly expand IonQ’s total addressable market into areas like quantum-safe networking and secure satellite communications.

IonQ is also building out a full-stack quantum ecosystem. Its systems are accessible via major clouds (Amazon’s AWS Braket and Azure Quantum), and it’s advancing enabling technologies like photonic interconnects for scaling quantum processors. Notably, the U.S. government has recognized IonQ’s capabilities – the company was selected by DARPA for a national quantum benchmarking initiative, underscoring its credibility in pushing quantum performance standards.

For 2025, IonQ forecasts revenue between $75 million and $95 million – roughly 97% growth at the midpoint, thanks to new contracts and its broadened product lineup. Such growth, if realized, would far outpace the broader tech industry and reflect the considerable demand for IonQ’s quantum solutions.

Despite its promise, IonQ faces substantial challenges. The company remains deeply unprofitable, as it continues to invest heavily in R&D and talent. In first-quarter 2025, IonQ’s net loss was $32.3 million (narrower than a year ago due to some one-time gains), and its adjusted EBITDA loss actually widened as operating expenses jumped 38% year over year. This heavy cost structure means profitability is still a distant goal.

The quantum computing sector is highly competitive, with major tech companies like International Business Machines Corporation IBM, Alphabet’s Google, and Microsoft investing billions to push the technology forward. At the same time, emerging players such as Baidu, Amazon, and Rigetti Computing RGTI are also vying for a stake in this fast-evolving market. Among IonQ’s closest competitors in the trapped-ion space is Quantinuum, a Honeywell-backed joint venture, known for its high fidelity and commercial readiness. Rigetti provides a full-stack superconducting platform but is still in the early stages of commercialization with modest revenue. D-Wave Quantum QBTS specializes in quantum annealing, focusing on optimization problems with systems boasting over 1,200 qubits. Google’s Quantum AI division leads in superconducting qubit development, setting benchmarks for scalability and quantum supremacy. Together, these companies define the competitive and rapidly shifting landscape that IonQ must navigate.

Microsoft needs little introduction – it is one of the world’s most valuable companies, with a dominant position in enterprise software and cloud computing. This scale and stability are key strengths for investors considering Microsoft as a “quantum cloud” play. Unlike IonQ, Microsoft benefits from significant profitability and a broad economic moat across multiple tech sectors. Its Azure cloud platform is pivotal to its quantum strategy, providing access to a range of quantum hardware and software tools through Azure Quantum. This positions Microsoft as a central hub for quantum innovation, partnering with various hardware approaches, including ion-trap systems like IonQ’s and superconducting qubits.

In early 2025, Microsoft unveiled its Majorana 1 quantum processing chip, a breakthrough in topological qubit research, signaling progress toward scalable, fault-tolerant quantum computers. With $80 billion in cash reserves (as of the fiscal third quarter of 2025-end), Microsoft has the financial strength to continue investing in quantum initiatives without impacting its core business.

Microsoft’s quantum strategy integrates internal innovation with strategic partnerships, such as its collaboration with Atom Computing and DARPA’s support for its topological qubit work. Azure is also rolling out quantum services, including Azure Quantum Elements for industries like chemistry and drug discovery. With its cloud dominance and AI growth, Microsoft is primed to capitalize on quantum advancements, offering quantum computing-as-a-service when the technology matures.

Microsoft’s quantum ambitions face several challenges. While exciting, quantum computing currently represents a tiny fraction of Microsoft’s about $70 billion quarterly revenue, meaning breakthroughs in Azure Quantum won’t significantly impact its financials in the near term.

For investors seeking pure quantum exposure, Microsoft stock might dilute the theme due to its broader business drivers. Additionally, Microsoft's quantum hardware progress lags behind competitors like IBM, which has built over 100 qubit superconducting processors, while companies like IonQ and Quantinuum are advancing with current-generation machines. Microsoft’s bet on topological qubits, though promising, remains in the research phase, with its Majorana 1 chip still a prototype.

The quantum field is also crowded with well-funded players like Google, Amazon, and IBM, intensifying competition.

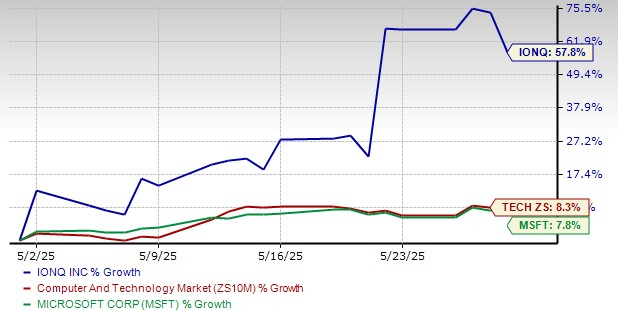

IonQ has recently garnered attention with a significant 57.8% surge in its stock price over the past month, despite a modest 3.4% year-to-date (YTD) gain. This uptick reflects growing investor confidence in its quantum computing advancements. Meanwhile, Microsoft continues to solidify its position in the tech industry, with an 8.8% YTD stock increase and a 7.8% rise over the past month.

Microsoft has been pacing the broader tech rally, whereas IonQ’s surge was an outlier. Microsoft’s less dramatic stock moves reflect its large-cap stability. The Zacks Computer and Technology sector has gained 8.3% in the past month but declined 1.7% YTD.

Valuation remains a key concern for IonQ. The company’s forward 12-month price-to-sales ratio stands at a lofty 91.76, well above the sector average of 6.22. While this figure has fluctuated significantly over the past two years, ranging from 20.55 to 229.06, it reflects the high expectations embedded in the current share price.

Though IonQ’s stock is trading 21.1% below its 52-week high, it has surged 594.5% from its 52-week low, illustrating the speculative nature of its price movement. With limited revenue and substantial losses, IonQ’s premium valuation is heavily dependent on its ability to execute its strategy and secure a leading position in the emerging quantum market before its competitors.

Meanwhile, Microsoft’s valuation has also become very stretched compared to the sector, but much lower than that of IonQ. Microsoft trades at about 10.99X, far below IONQ but above the sector.

For IONQ, the Zacks Consensus Estimate for 2025 loss per share has narrowed over the past 30 days, as you can see below, depicting analysts’ optimism. The estimated figure indicates a much narrower loss than the year-ago reported loss of $1.56. The Zacks Consensus Estimate for 2025 revenues implies year-over-year growth of 97.3%.

On the other hand, for MSFT stock, the earnings per share (EPS) estimate has increased over the past 30 days. The consensus mark for fiscal 2025 revenues and EPS indicates 13.7% and 13% growth, respectively.

For IONQ Stock

For MSFT Stock

IonQ and Microsoft each represent compelling but distinct plays in the quantum cloud space. IonQ, as a pure-play quantum computing company, is a high-risk, high-reward investment with impressive growth prospects, highlighted by its strong patent portfolio, strategic partnerships, and significant revenue expansion forecast. However, its heavy losses and speculative valuation make it a more volatile option.

In contrast, Microsoft offers a more stable investment with a dominant presence in the cloud and AI sectors, backed by a robust financial position. While its quantum ambitions are exciting, they currently constitute a small portion of its overall business, limiting the immediate impact on its financials. Given the current market dynamics, IonQ’s Zacks Rank #2 (Buy) and its aggressive growth trajectory give it an edge for investors seeking higher risk and return potential, whereas Microsoft’s diversified business and Zacks Rank of 3 (Hold) position it as a more conservative investment. In conclusion, for those willing to tolerate volatility in exchange for the chance of significant gains, IonQ is the stock with greater upside potential right now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 9 hours |

Marketplaces Are the Next Frontier in Publisher Deals With AI Companies

MSFT

The Wall Street Journal

|

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite