|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

As GameStop Corp. GME prepares to unveil its first-quarter fiscal 2025 earnings results on June 10 after market close, investors face an important decision: Should they buy the stock now or hold their current positions?

With earnings expectations and market conditions in mind, it is crucial to evaluate key factors influencing GameStop’s performance and whether the stock offers an attractive entry point ahead of its earnings report.

GameStop is in the midst of a strategic transformation, pivoting toward a more digital-focused business model. By placing greater emphasis on e-commerce and digital gaming, the company is working to align itself with shifting consumer behaviors and the evolving retail landscape.

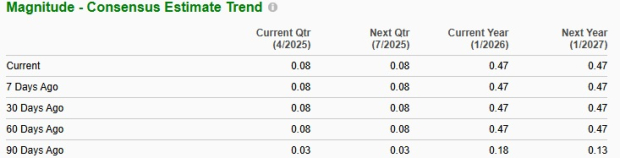

The Zacks Consensus Estimate for first-quarter revenues stands at $750 million, which indicates a decrease of 16% from the prior-year reported figure. On the earnings front, the consensus estimate has been unchanged at 8 cents per share over the past 30 days, implying a 166.7% year-over-year upsurge.

GameStop has a trailing four-quarter earnings surprise of 137.8%, on average. In the last reported quarter, this Grapevine, TX-based company surpassed the Zacks Consensus Estimate by a margin of 233.3%. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

GameStop Corp. price-consensus-eps-surprise-chart | GameStop Corp. Quote

As investors prepare for GameStop's first-quarter results, a question looms regarding earnings beat or miss. Our proven model does not conclusively predict an earnings beat for GameStop this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that is not the case here.

GameStop has a Zacks Rank #3 (Hold) and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

GME’s fiscal first-quarter results are likely to reflect the dual nature of its ongoing transformation alongside persistent challenges in its legacy business. The company has been growing its presence in categories like collectibles, which offer higher margins and are less sensitive to industry cycles. This move helps reduce reliance on gaming hardware and software. In parallel, GameStop has continued to invest in its logistics capabilities and customer experience while exploring digital ventures, including NFTs and blockchain-based projects.

GameStop has also demonstrated a clear shift toward operational discipline by streamlining its cost structure, optimizing its store footprint and focusing on profitability. The company made decisive progress in its international restructuring efforts, pursuing the sale of its operations in France and Canada to allocate resources to its core, higher-return operations. These factors are expected to have had favorable impacts on the bottom line.

On the challenging side, the fiscal first-quarter results are likely to reflect continued declines in legacy revenue segments, particularly in Hardware & Accessories, and Software. These categories have been under pressure due to shifting consumer behavior favoring digital downloads, cloud-based gaming and subscription services. GME's dependence on physical products in a rapidly digitizing industry remains a vulnerability, and this is likely to have weighed on the top line.

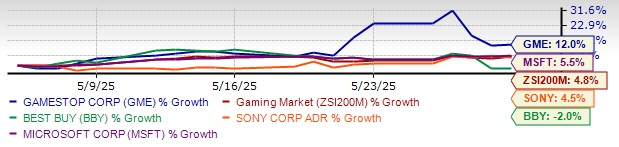

GameStop has witnessed an impressive increase in its stock price over the past month. Closing last Friday’s trading session at $29.80, the stock has rallied 12%, outpacing the industry’s rise of 4.8%.

GME has outperformed its competitors, including Best Buy Co., Inc. BBY, Microsoft Corporation MSFT and Sony Group Corporation SONY. Shares of Microsoft and Sony have risen 5.5% and 4.5%, respectively, while shares of Best Buy have declined 2% over the same period.

From a valuation standpoint, GME currently trades at a premium relative to its industry peers. The company’s forward 12-month price-to-sales (P/S) ratio is 4.10, higher than the industry average of 3.22 and the sector’s average of 2.14. The stock is also trading above its median P/S level of 2.92, observed over the past year. This elevated multiple underscores the market's continued willingness to pay a premium for the stock, likely driven more by sentiment than fundamentals.

GameStop is trading at a premium to Best Buy (with a forward 12-month P/E ratio of 0.34) and Sony (1.87) but at a discount to Microsoft (11.02).

GME Valuation vs. Industry

GME’s focus on streamlining costs, embracing a digital-first strategy, and expanding into higher-margin areas like collectibles signals a move toward greater sustainability. While its premium valuation may raise caution, the evolving business model and potential for long-term growth suggest an upside. Current investors may consider holding their positions, while prospective investors may wait for post-earnings clarity or a more favorable entry point.

Given GameStop’s ongoing transformation and operational improvements, the stock presents an intriguing but speculative opportunity ahead of its Q1 earnings results. While initiatives in collectibles, digital ventures and cost optimization signal progress toward long-term stability, the company’s core business remains vulnerable to industry shifts and digital disruption.

The recent rally suggests heightened investor enthusiasm, but with valuation already running ahead of fundamentals and no clear earnings beat predicted, a cautious stance may be warranted.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite