|

|

|

|

|||||

|

|

In a market increasingly dominated by artificial intelligence giants, two under-the-radar companies — Innodata Inc. INOD and SoundHound AI SOUN — are carving out lucrative niches in the AI ecosystem. While SoundHound is racing ahead in conversational intelligence, offering voice AI solutions, Innodata has established itself as a foundational player in data engineering and AI model assurance. Both companies are posting stellar top-line growth, partnering with major industry players, and pursuing ambitious roadmaps. Yet, they offer vastly different risk-reward profiles.

In this comparison, we break down the strengths and weaknesses of each stock to determine which one could present greater upside potential as we move into the latter half of 2025.

Innodata is a powerful, behind-the-scenes enabler of generative AI infrastructure. The company specializes in large language models (LLMs) data preparation, model fine-tuning and safety evaluations, serving a client roster that includes five of the “Magnificent Seven” tech giants — namely Microsoft Corp. MSFT, Alphabet Inc. GOOGL and Amazon.com Inc. AMZN. This customer base is particularly valuable, given that Amazon, Alphabet, Meta and Microsoft alone are expected to invest billions in generative AI infrastructure in 2025.

In 2024, Innodata reported a near doubling of revenues to $170.5 million and an impressive 250% surge in adjusted EBITDA to $34.6 million. In the first quarter of 2025, momentum has been even stronger, with revenues up 120% year over year to $58.3 million, and adjusted EBITDA increasing 236% and hitting $12.7 million, or 22% of revenues — highlighting scalable operating leverage. The company’s adjusted gross margin of 43% also exceeded its long-term target of 40%, demonstrating scalable and profitable execution as it ramps up delivery to both new and existing customers.

A major move is the launch of its Generative AI Test & Evaluation Platform in partnership with Nvidia (NVDA). This platform addresses enterprise concerns around AI safety, bias and transparency and has already seen adoption by companies like MasterClass. As global AI regulation and scrutiny increase, Innodata is positioning itself at the forefront of model validation and assurance.

The firm’s financials are robust, with $56.6 million in cash and no debt, giving it the flexibility to invest in talent and technology without endangering its balance sheet.

However, one of the main risks for Innodata is customer concentration. In 2024, 48% of total revenues came from a single customer. While management is actively expanding relationships with other Big Tech players — having secured $8 million in new deals in the first quarter and eyeing another $30 million in potential contracts — this dependency remains a critical vulnerability should contract renewals falter or client priorities change.

Still, the company’s revenue growth target of 40%+ for 2025 and its consistent margin expansion suggest a scalable, high-moat business model that’s becoming integral to enterprise AI infrastructure.

SoundHound AI has positioned itself as a fast-growing player in the voice AI space, with its emphasis on conversational AI platforms driving rapid revenue expansion. The company delivered a record 151% year-over-year revenue increase in the first quarter of 2025, reaching $29.1 million. This surge is driven by a flurry of acquisitions and partnerships that have expanded SoundHound’s reach into fast food ordering (e.g., White Castle, Applebee’s), automotive voice assistants and broader enterprise use cases.

SoundHound has significantly expanded its scale and customer reach through acquisitions like SYNQ3, which is a restaurant voice ordering provider; Allset, which is an online ordering platform; and Amelia, which is an AI dialogue company. The acquisitions are expected to contribute significantly to revenues, with Amelia alone to add $45 million in recurring revenues in 2025. This feeds into SoundHound’s guidance of $157-$177 million in full-year 2025 revenues, implying 85-109% growth over the 2024 levels.

What stands out is SoundHound’s diversified customer base, with no single customer accounting for more than 10% of revenues. This marks a significant improvement over past levels, enhances overall risk management and highlights the company’s expanded serviceable markets. Its multilingual AI model, Polaris, and strategic collaborations with NVIDIA, Tencent, Perplexity AI and others bolster its competitive moat in a space where Big Tech incumbents like Amazon and Alphabet are formidable competitors. Financially, SoundHound is capitalized to fuel growth, with $246 million in cash and no debt.

However, it remains unprofitable, with the first quarter showing a $22.2 million adjusted EBITDA loss, an increase from the $15.4 million loss reported a year earlier. Margins have also come under pressure, primarily due to the cost of acquisitions and scaling, with GAAP gross margins falling from 59.7% to 36.5% year over year, reflecting continued investment in growth and R&D. Moreover, major players such as Amazon (Alexa), Alphabet (Assistant), Apple (Siri), and others continue to pour substantial investments into voice AI technologies.

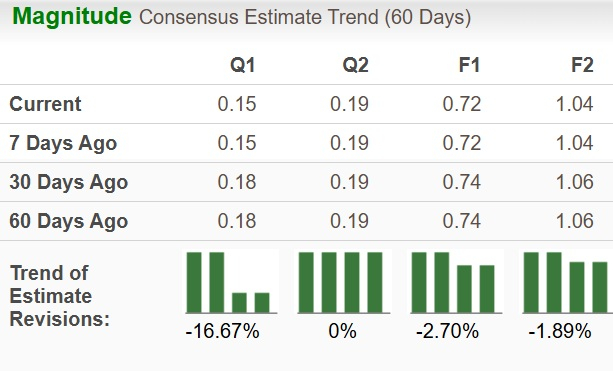

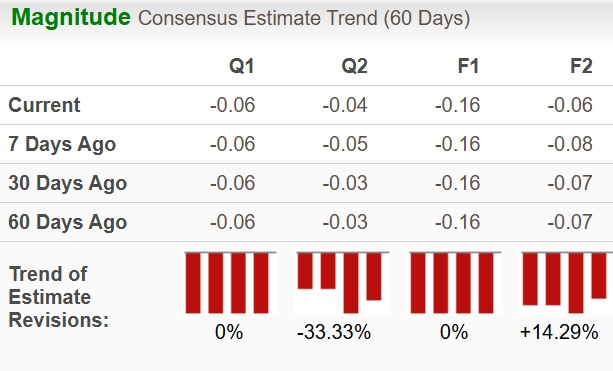

While analysts have largely held steady on SOUN’s earnings outlook over the past 30 days, sentiment toward INOD has turned notably more bearish during the same period. Over the past 30 days, the Zacks Consensus Estimate for INOD’s EPS has been revised two cents downward.

With respect to growth rates, we note that, for INOD, the Zacks Consensus Estimate for 2025 sales and EPS implies a year-over-year increase of 41.76% and a decline of 19.10%, respectively. For SOUN, the Zacks Consensus Estimate for 2025 sales implies year-over-year growth of 91.07%, while the EPS projections suggest an improvement from a loss of $1.04 per share in the prior year to a loss of 16 cents per share in 2025. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

INOD Stock

SOUN Stock

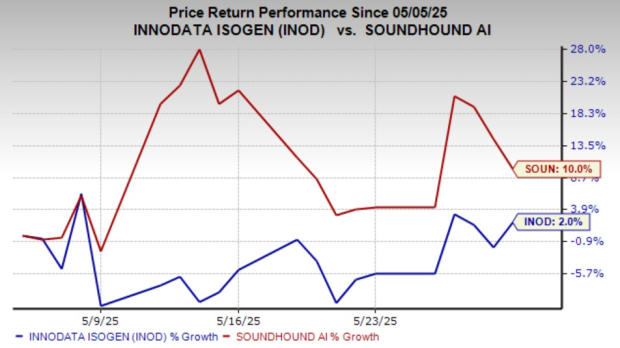

So far this year, Innodata has fallen 0.1%, while SoundHound has dropped 49% in the same time frame. However, the stocks are moving at different paces in the short term, with SoundHound bouncing back 10% in the past month, while Innodata increased only 2% over the same period. The recent rise in SOUN stock reflects growing investor optimism as the market begins to embrace the company’s growth narrative.

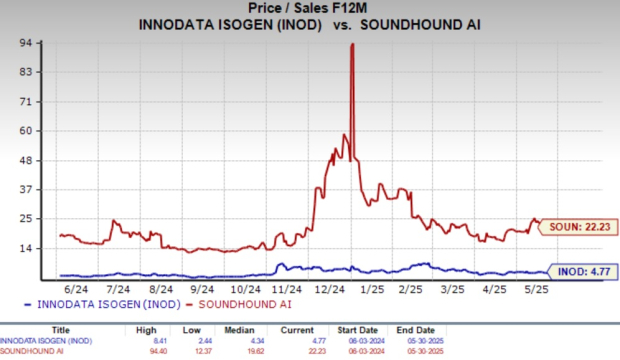

INOD is trading at a forward 12-month price-to-sales (P/S) multiple of 4.77X, which is slightly above its one-year median of 4.34X. SOUN does seem pricey, with its forward 12-month P/S multiple sitting at 22.23X, well above its one-year median of 19.62X.

Both Innodata and SoundHound have a Zacks Rank #3 (Hold), which makes choosing one stock a difficult task. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

SoundHound is a solid growth story, riding the wave of voice AI adoption across consumer and industrial sectors. Its aggressive expansion strategy, strong partnerships and rapidly growing revenues make it a compelling bet on the future of conversational AI. However, the company’s mounting losses, falling margins and stiff competition from tech giants temper the near-term investment case.

Meanwhile, Innodata operates more quietly — but no less impactfully — in the engine room of the AI revolution. With strong profitability metrics, mission-critical services and deep integration with Big Tech, INOD offers a more balanced growth profile. Though its customer concentration is a red flag, the company is actively addressing this through new contracts and platform offerings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 min | |

| 32 min |

Land Grab for Data Centers Is One More Obstacle to Much-Needed Housing

GOOGL MSFT

The Wall Street Journal

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

AMZN

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite